RBI Governor Shaktikanta Das will make an announcement on Friday morning regarding the next round of monetary policies, with expectations that the interest rate will remain at 6.5%. The central bank is likely to maintain its current stance on withdrawing accommodation, based on an SBI research paper that predicts a potential rate cut in the third quarter of the fiscal year. The decision will have significant impacts on the real estate sector, with experts noting that keeping the repo rate steady will support housing market affordability and overall economic growth.

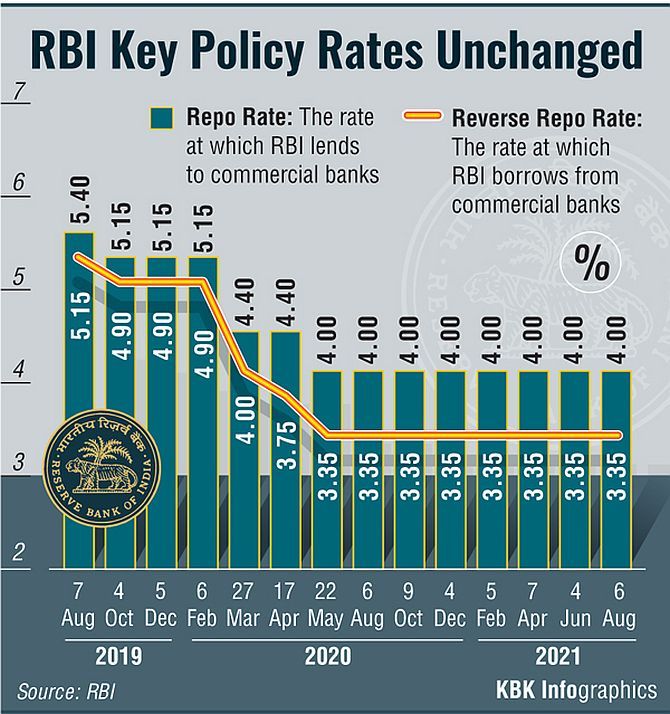

The RBI's Monetary Policy Committee has announced its decision to maintain the repo rate at 6.5%, for the seventh consecutive time. This means that for those whose loans are linked to the external benchmark, their EMIs will remain unchanged. The RBI Governor, Shaktikanta Das, has emphasized the importance of continuing to control inflation in order to ensure stable economic growth and has projected an inflation rate of 4.5% for the fiscal year 2025. Economists predict that there may be a series of rate cuts in the near future, possibly beginning in October of 2024, with a potential change in stance.

The Reserve Bank of India, in its first monetary policy statement of the current financial year, has decided to maintain a status quo on the policy repo rate at 6.5 per cent. This is the seventh consecutive meeting that the Monetary Policy Committee has kept the rates unchanged, citing ongoing concerns about inflation remaining above the target of 4 per cent. The recent forecast of above-normal temperatures by the India Meteorological Department has added to the concerns about rising prices of vegetables and other perishable items, requiring close monitoring. However, Governor Shaktikanta Das remains optimistic about the outlook for agriculture, rural activity, and private consumption.

In its latest monetary policy review, the Reserve Bank of India (RBI) has decided to keep the key policy rate unchanged for the seventh consecutive time, in order to maintain stability in the economy and control inflation. However, RBI Governor Shaktikanta Das announced a new scheme for investment and trading in Sovereign Green Bonds in the International Financial Services Centre (IFSC), as well as the launch of a mobile app to widen the reach of its Retail Direct Scheme. The RBI will also continue its disinflationary policy to ensure a stable growth path for the economy.

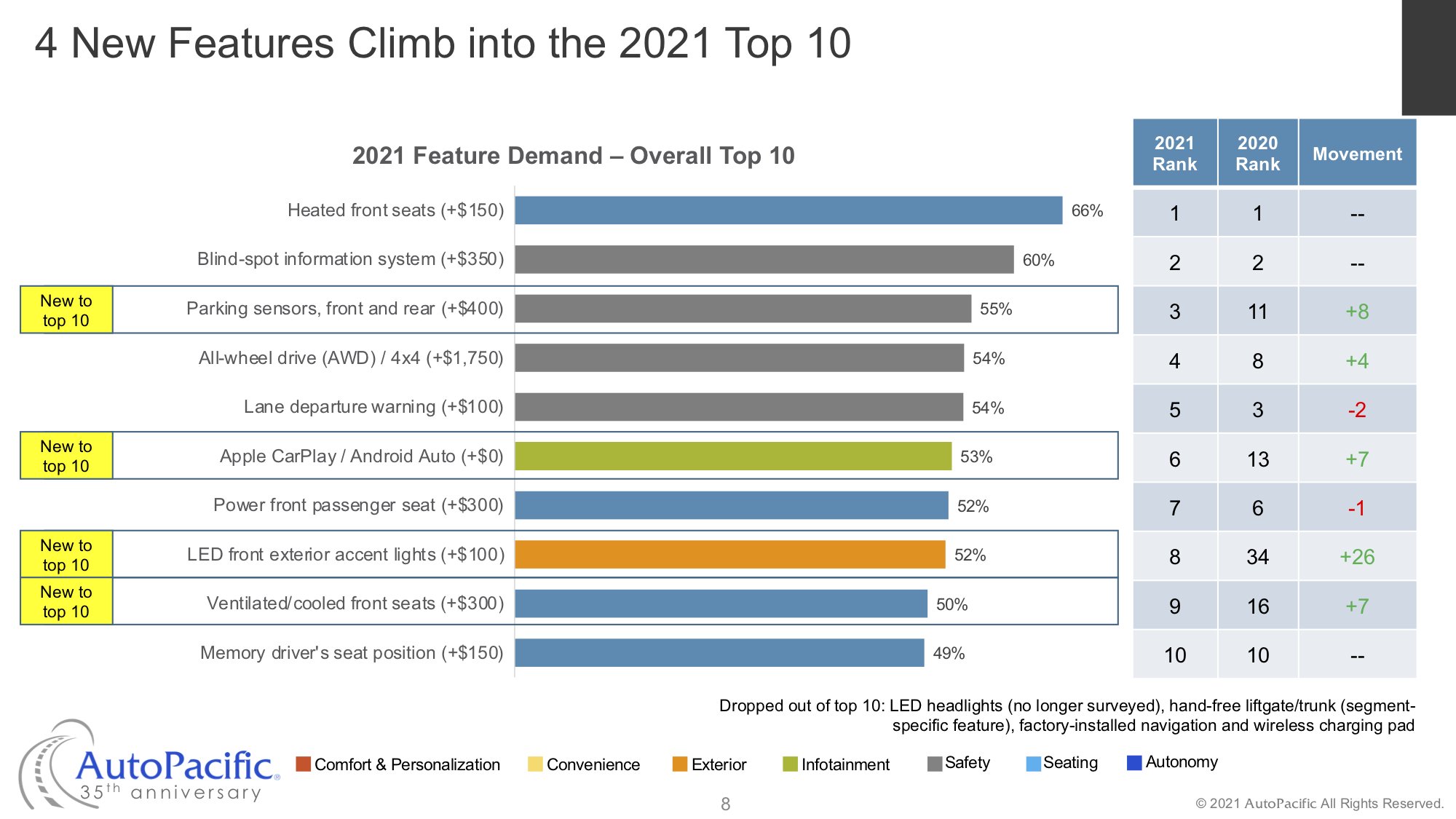

In response to economic and technological changes, Maruti is implementing a major restructuring that may have implications for the entire auto industry. As part of this restructuring, the company is creating two new divisions focused on electric and premium vehicles, indicating a shift towards these markets. While the changes may cause some volatility in the short term, investors remain confident in Maruti's long-term prospects.

The meeting of the Reserve Bank of India's Monetary Policy Committee, which started on Wednesday, will conclude today (Friday) with RBI Governor Shaktikanta Das announcing the latest monetary policy statement. The announcement, which is expected at 10 am, will cover decisions on key policy rates and a discussion on the current economic situation. The governor will also hold a press conference at 12 pm to address channel partners and provide further insights on the committee's decision.

The Reserve Bank of India (RBI) has decided to keep the policy repo rate unchanged at 6.5% in its Monetary Policy Committee (MPC) meeting, as expected by markets and policy-watchers. The RBI Governor, Shaktikanta Das, announced that the decision was made by a 5 to 1 majority and that the central bank will remain focused on withdrawing accommodation to align inflation with the target. The RBI has projected consumer price index (CPI)-based retail inflation for the next financial year at 4.5%, while the Indian economy is expected to grow by 7% in the same period.