The stock market experienced a spike in futures on Thursday after Tesla reported better-than-expected profits and a promising outlook for electric vehicle sales. Nasdaq 100 futures rose by 0.8% and S&P 500 futures saw a 0.4% increase, while Dow Jones Industrial Average futures struggled to keep up with a minor decline of 0.2%. This surge in the tech-heavy Nasdaq index was largely attributed to Tesla's impressive earnings performance and market reaction. In light of this, other tech giants such as Amazon and Meta also saw a boost in premarket trading. However, not all companies were met with positive news, as Boeing stocks saw a 3% dip after a rejected pay deal from workers. This news, combined with a possible delay in interest rate cuts from the Federal Reserve, sets the stage for a volatile trading day on Wall Street.

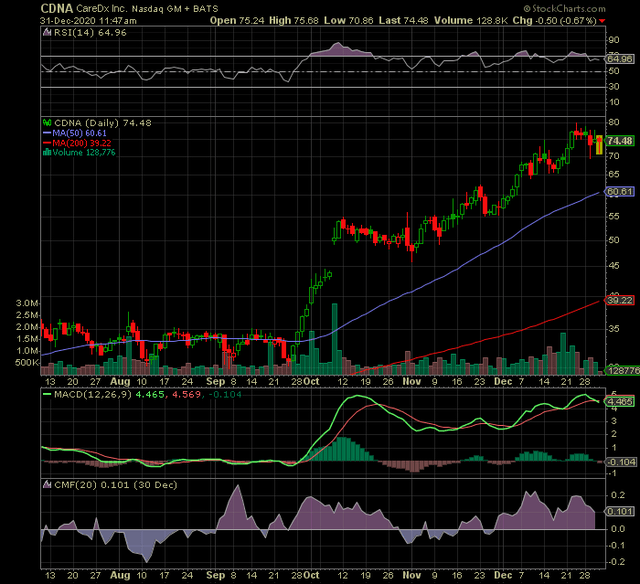

As a leader in the healthcare industry, CareDx (NASDAQ: CDNA) offers pro members the opportunity to stay ahead of the market with early news alerts. With a stock price of $30.16, CareDx has a consensus price target of $26.29 and no upcoming dividends. Other companies in CareDx's space, such as Gyre Therapeutics (NASDAQ: GYRE), Centessa Pharmaceuticals (NASDAQ: CNTA), Syndax Pharmaceuticals (NASDAQ: SNDX), Arcutis Biotherapeutics (NASDAQ: ARQT), and Day One Biopharmaceutical (NASDAQ: DAWN), can also benefit from CareDx's innovations. Stay ahead of the game by investing in CareDx with the support of our list of the best stock brokerages.

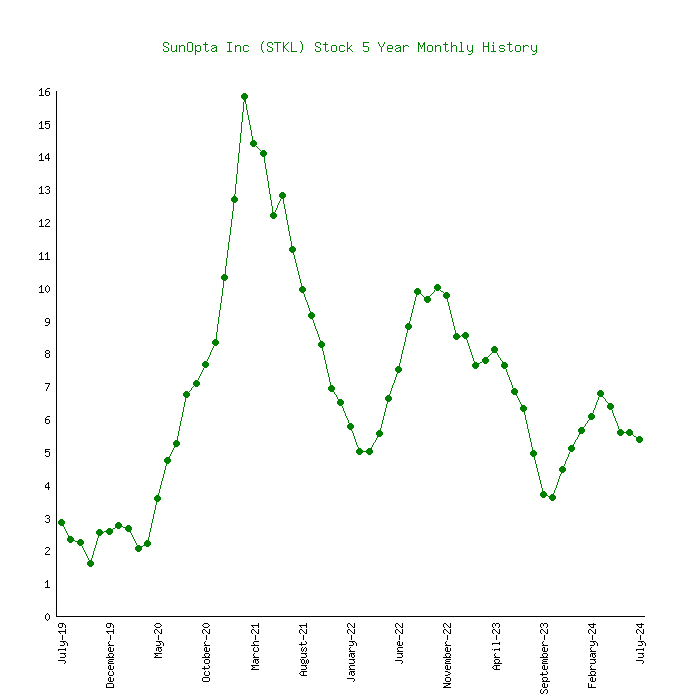

SunOpta (NASDAQ: STKL) continues to see positive growth as its stock price hits $5.9 and has a consensus price target of $10.33. With no competitors in the market, SunOpta is expected to see even more success in the future. Investors can purchase shares of SunOpta through any online brokerage, making it a desirable stock to invest in. The company's Q3 earnings are scheduled for Wednesday, November 6, 2024, and there are no upcoming dividends or splits.

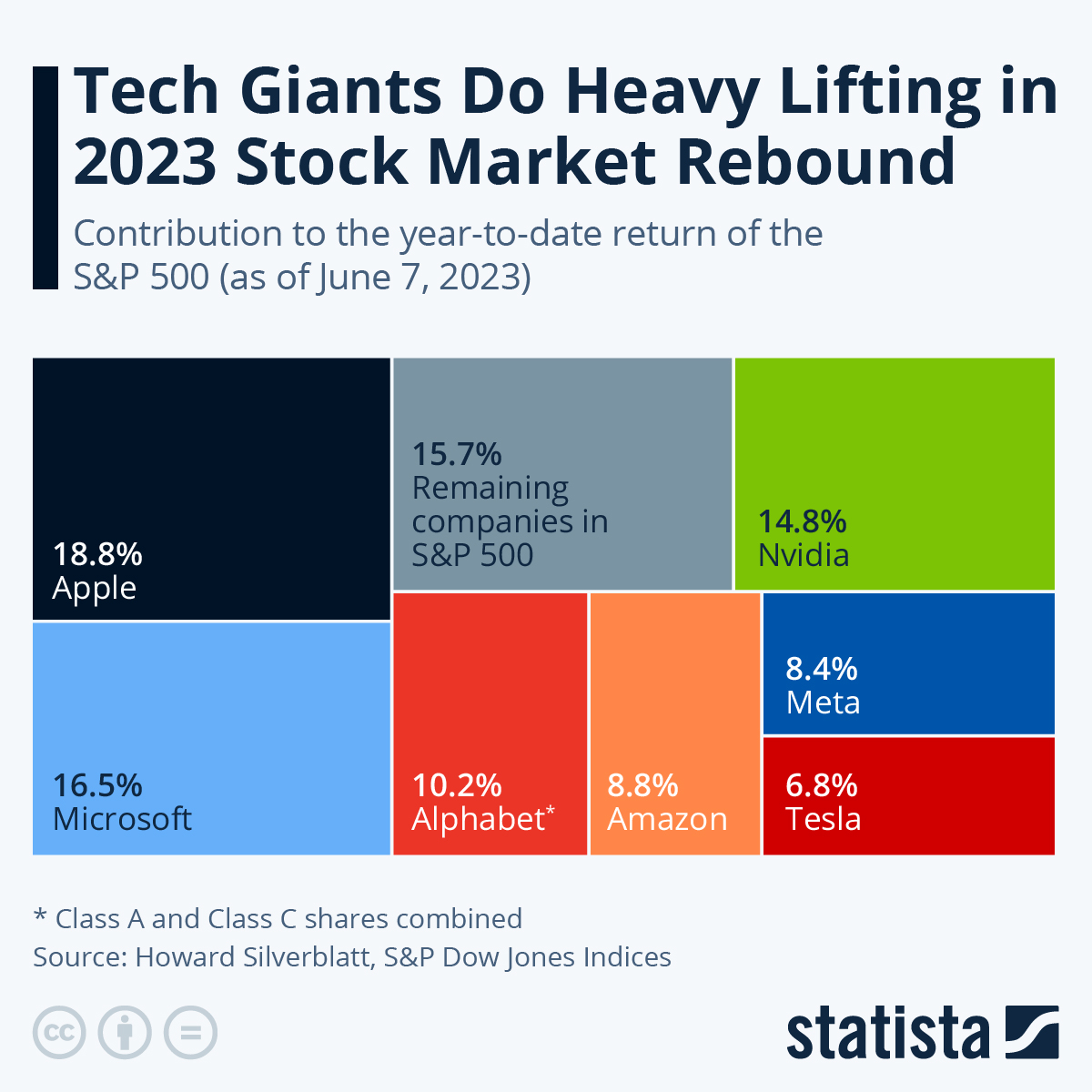

As tech giants Apple and Amazon report their quarterly earnings, the stock market experiences a sharp drop in reaction. Intel's decision to suspend its dividend further adds to the decline of stocks, with the Dow Jones Industrial Average falling nearly 500 points. This news raises questions about the impact of economic developments on the performance of major tech companies, and whether the so-called "good news" for the economy is now seen as bad news for the stock market. Investors are keeping a close eye on these developments as they navigate through uncertain times in the market.

Investors are feeling the effects of a Big Tech-induced stock downturn as doubts about AI profitability loom. This has translated to steep losses for the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 futures. The European market has also taken a hit, while concerns about the US economy and potential Fed rate cuts are starting to emerge. Meanwhile, a mixed bag of corporate earnings, including a profit miss from Ford and investor worries about a conservation campaign at Chipotle, are contributing to the market's uncertainty. As traders brace for key data releases, the fate of the market hangs in the balance.

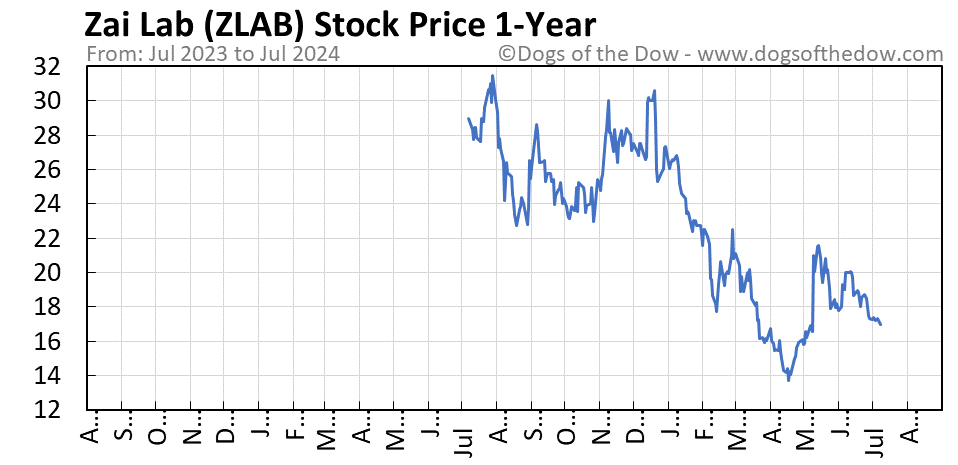

After a recent surge in its stock price, Zai Lab (NASDAQ: ZLAB) is drawing the attention of investors. The company, which focuses on biopharmaceuticals, has been outperforming others in its space, such as Syndax Pharmaceuticals (NASDAQ:SNDX) and Day One Biopharmaceuticals (NASDAQ:DAWN). Despite a lack of analysis on the stock, its Q2 earnings are expected to be strong, potentially driving the price even higher.

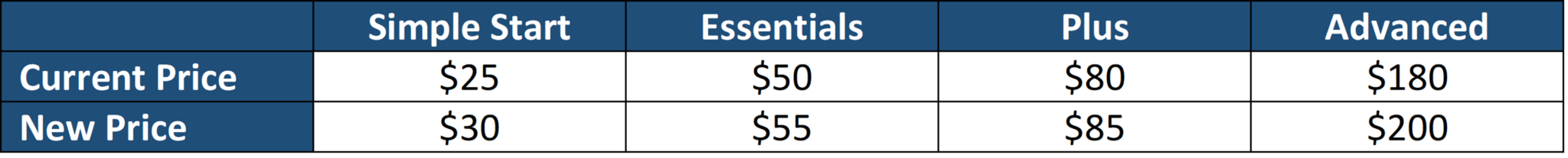

Jefferies analysts reacted positively to the news of Intuit's (INTU) decision to increase prices for its QuickBooks products in fiscal 2025, with a potential for higher revenue guidance in the future. The price hikes are expected to boost revenue growth for the company's Small Business segment, which has shown consistent growth in the past three quarters. Jefferies believes Intuit is well-positioned for continued growth, thanks to its resilient tax and small business segments, growing Live expert offerings, and strong financials.

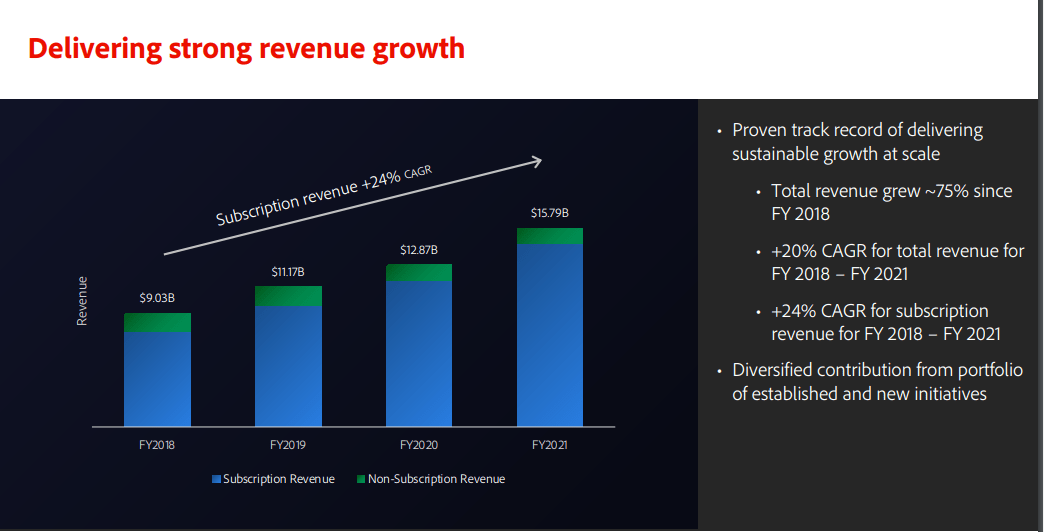

Adobe (NASDAQ: ADBE) has been making headlines in the stock market with its impressive growth and strong competition in the technology space. The company, along with other big players like SAP and Intuit, has been consistently providing positive returns for its investors. A confirmed quarterly cash dividend and an upcoming third quarter earnings report further solidifies Adobe's position as a top performer in the market.

Encore Wire, a leading wire and cable manufacturer, has issued a dividend to its shareholders from its excess cash. Unlike most companies that pay dividends quarterly, Encore Wire has announced that its dividends may also be paid on a monthly, annual, or irregular basis. The next dividend payout for Encore Wire will be on July 19, 2024 and investors must be shareholders by July 5, 2024 to receive it. With a current yield of 0.03%, Encore Wire's dividend announcement on May 15, 2024 is eagerly awaited by investors.

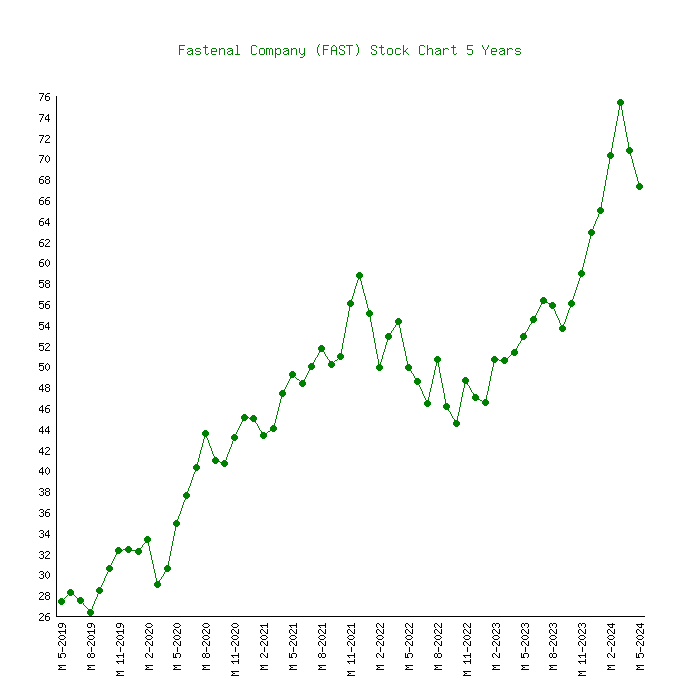

Proving to be a lucrative investment option, Fastenal's stock price continues to rise with recent analyst reports predicting a 7.49% upside in the next 12 months. With a limited time deal offering Pro users exclusive news, scanners, and chat power, this is the perfect opportunity for investors to win more in the market. Other players in the space include Rush Enterprises, Core & Main, H&E Equipment Services, and United Rentals. As the latest price for Fastenal (NASDAQ: FAST) sits at $64.19, it's clear that this is a must-have stock for any savvy business investor.