The Securities and Exchange Board of India (Sebi) has implemented a new rule for credit of bonus shares in demat accounts of investors, to be in force from October 01, 2024. NBCC's bonus share issue's record date is Monday, October 07, 2024, with the Ex Bonus Date also on the same day. However, since all stocks in India now follow T+1 settlement cycle, only those investors who have bought NBCC shares latest by Friday, October 04, 2024 will be eligible for the bonus issue. Stay updated and follow News24 for the latest news and updates on the NBCC bonus share issue.

The shares of NBCC (India) Limited have seen an impressive surge of 292.47% in the past year and 144% in 2024. The company's market capitalization also hit a record high of Rs 35,982 crore. The announcement of the proposal for bonus shares and recent order wins in the healthcare and construction sectors have further boosted investor confidence in the company's growth potential. Technical indicators for NBCC's stock suggest a positive trend with the company's share price trading above its key moving averages and an RSI indicating neither overbought nor oversold levels. This development puts NBCC in a strong position for future growth and expansion.

The Indian stock market indexes, Sensex and Nifty, remained steady on Wednesday amidst a mixed response from global markets. Stocks such as Tata Steel and ICICI Bank faced losses while companies like IndusInd Bank and Infosys showed growth. Meanwhile, the state-owned construction company, NBCC India, saw a surge of over 6% in its shares. Midcap and smallcap indices reached new highs, but sectors like banks and metals faced losses while media and IT companies saw buying trends. Market experts predict a consolidation phase with low volatility and a slight upward bias in the near future.

Shares of NBCC (India) Ltd saw a significant surge on Wednesday, with a rise of 10%, following the announcement that the company's board will be meeting to discuss a proposal for bonus shares. The company's stock has been performing well, with a 292.47% increase in the last year and a 144% increase so far in 2024. With recent orders and contracts, NBCC is continuing to expand and provide value added services.

After nearly 4 years, NBCC (India) has announced that its board will meet to consider a proposal for bonus shares. This news has lead to an increase in the company's share price, with strong buying pushing it towards its all-time high. This potential bonus issue will be the first for NBCC since 2017, when it declared a 1:2 bonus issue for shareholders.

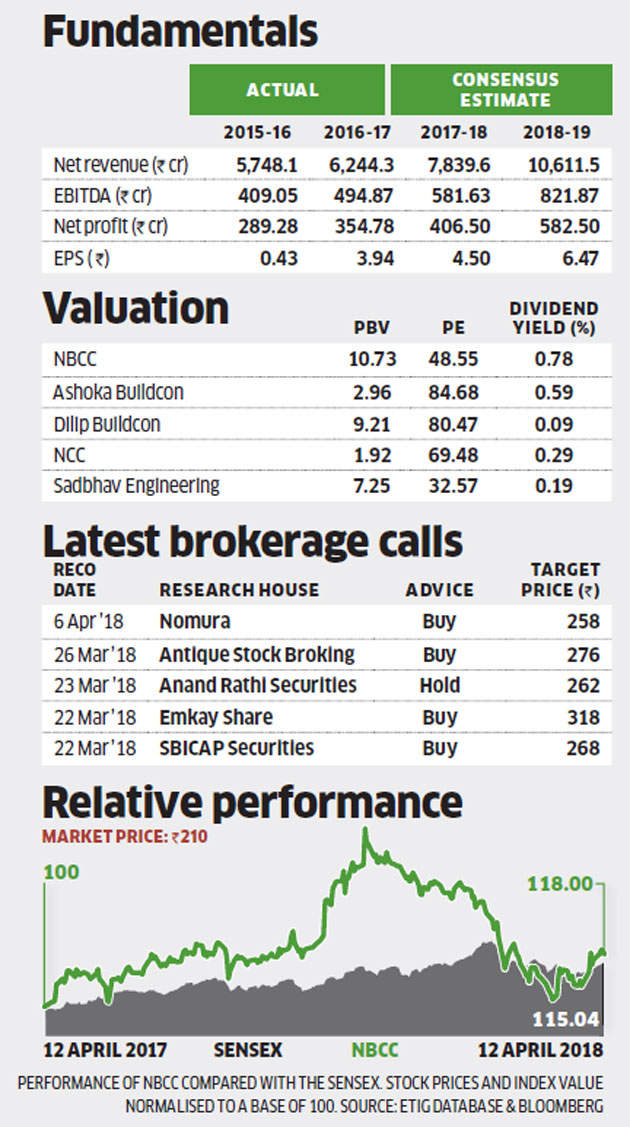

NBCC, a government infrastructure and housing projects company, saw a 30% increase in share price with the news of bagging a Rs 180 crore order from SAIL. This recent order is worth 0.45 times the company's current market capitalisation, leading to a fresh 52-week high for NBCC shares. The positive news led to a surge in global markets as well, with the Sensex and Nifty expected to open with higher numbers. However, residents of NBCC Green View housing complex may have to vacate their flats by March 2022, causing concern for some.

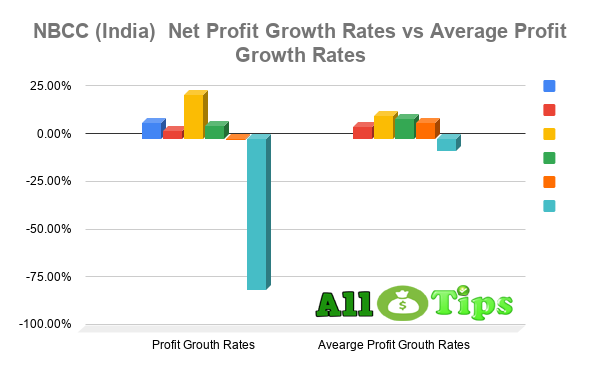

The government-owned construction company, NBCC (India) Ltd, has reported a net profit of Rs 1.14 billion for the fiscal year 2020-21. With its main industry being miscellaneous, NBCC (India) Ltd has announced ASA & Associates LLP as its approved auditor. While P K Gupta serves as the chairman, Deepti Gambhir takes on the role of company secretary. The company's data sources and disclaimer information have been sourced from reputable partners.