The recently released Union Budget for 2025 has sparked positive reactions from various stakeholders in the MSME sector. The budget includes measures such as increased credit guarantee cover and customised credit cards for small businesses, which are seen as crucial steps in promoting financial inclusion and aiding India's position as a global manufacturing hub. However, experts emphasize the importance of simplifying access to these schemes and ensuring efficient disbursement of funds. The budget also focuses on building export competitiveness through digital trade networks and strong buyer-supplier ecosystems.

Finance Minister Nirmala Sitharaman announced key measures for the MSME (micro, small, and medium enterprises) sector in the Union Budget 2025. The investment limit for MSME classification will be increased to 2.5 times and the turnover limit will be doubled, leading to growth and innovation in the sector. The government will also provide a credit guarantee cover up to Rs 10 crore and introduce customized credit cards for micro enterprises. This focus on the MSME sector, which contributes 36% of India's manufacturing and employs 7.5 crore people, is expected to boost the country's economy and create more job opportunities for the youth.

Finance Minister Nirmala Sitharaman announced several significant changes for the micro, small, and medium enterprises (MSMEs) sector in the Union Budget 2025 presentation. This includes customised credit cards with a limit of Rs 5 lakh, increased credit guarantee cover and a term loan of up to Rs 20 crore for well-run export-oriented MSMEs. This move aims to boost manufacturing in the country and improve credit access for MSMEs. To stay updated on the latest business news and stock market updates, check out Zee Business and subscribe to their YouTube channel.

In a district-level employment and loan fair, Uttar Pradesh Chief Minister Yogi Adityanath distributed appointment letters to 5,000 youths and loans worth Rs 30 crore to selected beneficiaries and MSME entrepreneurs. He also provided 1,000 tablets and smartphones to the younger generation, as part of the Swami Vivekananda Yuva Sashaktikaran Yojana. This event marked a crucial step towards tackling unemployment in the western UP region and empowering the youth to contribute to the local economy.

Finance Minister Nirmala Sitharaman presented the much-awaited Budget 2021, announcing the construction of all-weather roads and highways and the allocation of Rs. 1.18 lakh crore for infrastructure development. The development of these roads will not only boost the economy but also benefit the MSME sector by providing better connectivity and easier transportation of goods. This makes this budget a game-changer for the MSME industry, which has been severely impacted by the COVID-19 pandemic.

Prime Minister Narendra Modi's BJP party has won its first seat in the ongoing Lok Sabha elections after opposition candidate Nilesh Kumbhani's nomination was rejected and other candidates withdrew from the fray. Mukesh Dalal of the BJP was declared elected from Surat after candidates from smaller parties and Congress withdrew on the last day of withdrawal. The Congress has accused the BJP of "match-fixing" in an attempt to win over the anger of MSME owners and the business community in Surat.

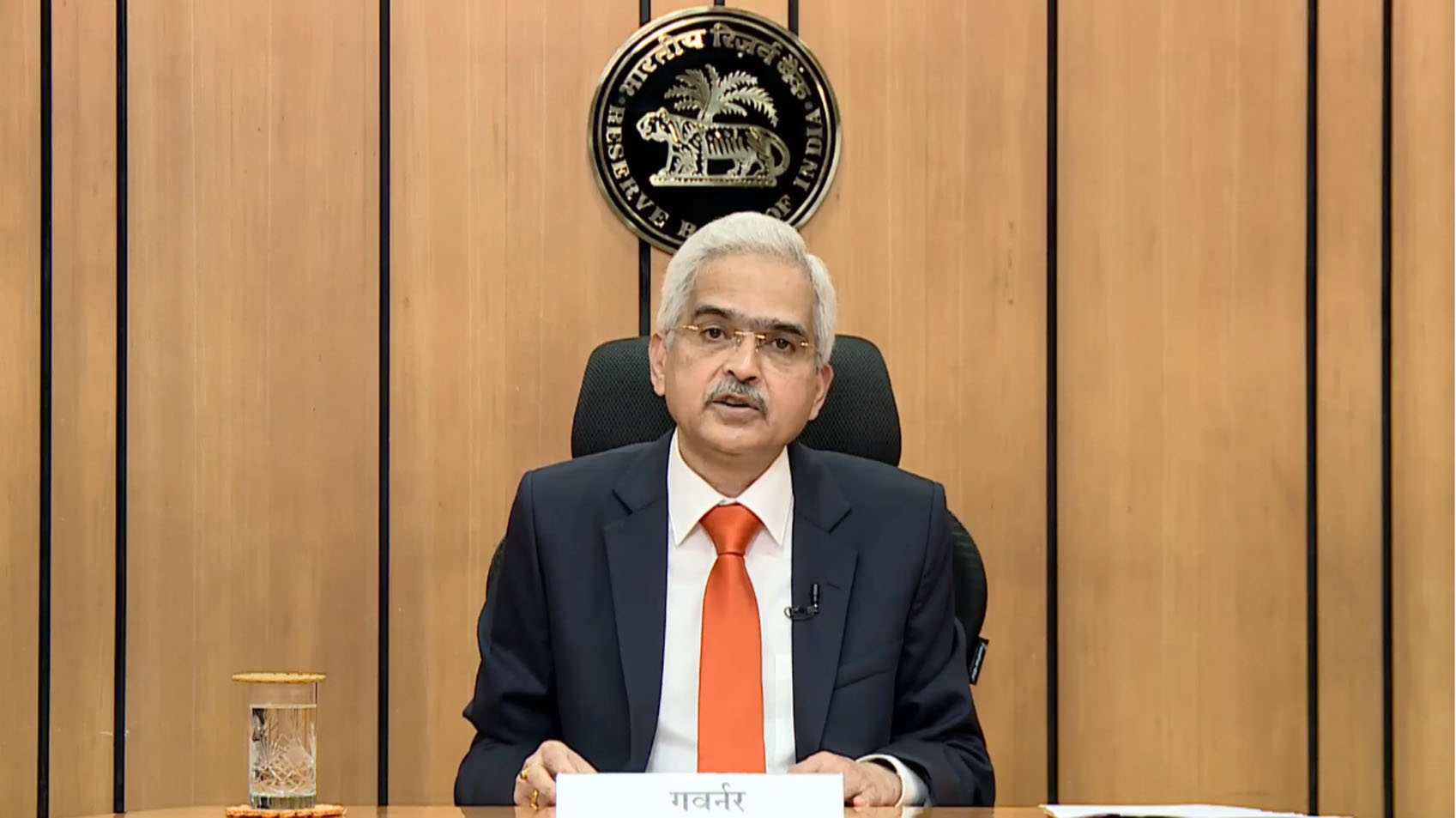

The RBI's Monetary Policy Committee (MPC) maintained the repo rate at 6.50 percent for the sixth consecutive time in the last policy meeting of fiscal 2023-2024. RBI Governor Shaktikanta Das also announced plans to enable resident entities to hedge gold prices in the International Financial Services Centre (IFSC). This was the first MPC meeting after the interim Budget 2024 and the governor stated that the MPC predicts a GDP growth rate of 7 percent in FY25. ZeeBiz.com breaks down the key takeaways of the MPC meeting, including the decision to mandate all regulated entities to provide a 'Key Fact Statement' to borrowers for all retail and MSME loans.

The India SME Forum has launched an ambitious initiative to train and facilitate 200,000 first-time MSME exporters by providing them with knowledge and resources on exporting potential, international regulations, and trade finance. This initiative is in partnership with UPS and ICICI Bank and is aimed at promoting import substitution and navigating the international market landscape for MSMEs. The launch event, held at a regional summit in Bengaluru, featured expert talks and networking opportunities for over 200 MSMEs and aspiring exporters.

MSME Secretary Subhas Chandra Lal Das shared the government's plans to boost the productivity and efficiency of MSMEs during a conference in Gandhinagar on Friday. The focus is on helping micro units become medium-sized enterprises in order to drive overall economic growth.