Jammu and Kashmir's Chief Minister Omar Abdullah presents the first budget of the union territory after six years, calling it a roadmap for economic growth and a true reflection of its people's aspirations. The CM also credits Prime Minister Narendra Modi, Home Minister Amit Shah, and Finance Minister Nirmala Sitharaman for their support in various sectors. In his budget speech, CM Abdullah emphasizes the resilience and determination of the region and pledges to transform it into a modern, progressive, and economically vibrant one.

In a significant move by the Chhattisgarh government, petrol prices have been reduced by one rupee, benefiting the people of the state. Finance Minister O P Choudhary emphasized that the budget is focused on knowledge welfare and aims to bring progress through a speed strategy. The budget also includes plans to adopt the National Education Policy, establish Chhattisgarh Institutes of Technology, and develop infrastructure. However, opposition leader Bhupesh Baghel criticized the budget for not addressing issues such as farmer welfare and unemployment.

In his budget presentation, Chhattisgarh's Finance Minister OP Chaudhary announced a budget of Rs 1.65 lakh crore for the upcoming financial year, with a focus on accelerating economic growth and modernization. The budget, based on the theme of 'GATI', aims to achieve the state's medium-term goals by 2030 and its long-term vision of a developed Chhattisgarh by 2047. It includes initiatives such as the Chief Minister Mobile Tower Scheme and the establishment of a NIFT, as well as schemes to support women's empowerment, rural housing, and agricultural prosperity. Additionally, there will be no new taxes imposed and revenue is expected to increase by 11% without increasing the burden on citizens.

March 3 is observed as World Wildlife Day every year to bring attention to the importance of protecting endangered species. This year's theme, 'Wildlife Conservation Finance: Investing in People and Planet', highlights the need for sustainable measures to protect our diverse wildlife. The United Nations General Assembly declared this day in 2013, coinciding with the signing of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). This international agreement, with 185 parties, aims to regulate and control the trade of endangered species to ensure their survival. Three appendices list the species under different categories based on their level of protection needed, with stricter rules for Appendix I species such as the Indian star tortoise.

Bihar's Finance Minister Samrat Choudhary presented a budget of Rs 3.15 lakh crore in the state Assembly, with a significant increase from the previous year. The budget prioritizes the education sector with an allocation of Rs 60,954 crore, along with a boost for healthcare and the home department. In line with the government's focus on women's empowerment, the budget also includes initiatives such as a women's marketplace, pink toilets, and pink buses. The government will also provide job opportunities and housing facilities for women, including women constables near police stations.

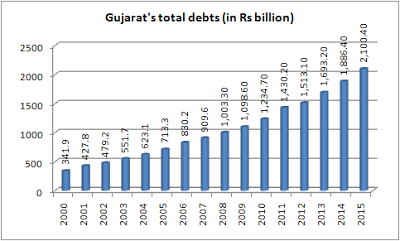

In a written reply to Congress MLAs, Gujarat's Finance Minister Kanubhai Desai stated that the state's public debt stands at over Rs 3.77 lakh crore, with over Rs 48,000 crore paid as interest in the past two years alone. The government has borrowed from financial institutions, market loans, and the central government, drawing criticism from opposition Congress for burdening the people of the state.

Finance Minister Nirmala Sitharaman presents a paperless budget on a tablet, it's her record 8th budget. The budget, which is politically driven according to former finance minister P Chidambaram, includes meetings with entertainment icons for the WAVES Summit and a call for global AI governance at the Paris Summit by PM Modi. Additionally, PM Modi reveals his vision for a Deregulation Commission, aimed at reducing bureaucracy and promoting economic growth in India. The budget also includes an economic outlook for India, presented in the Economic Survey 2024-25.

Pakistani Finance and Revenue Minister, Muhammad Aurangzeb, has been invited by his Saudi counterpart to attend the two-day Emerging Markets Conference-2025, which aims to foster discussions on building resilience and sustainable economic growth. The high-profile gathering includes IMF's managing director and finance ministers from Egypt, Brazil, and Turkiye. Senator Aurangzeb will also participate in a high-level panel discussion and this conference is set to become an annual platform for shaping global economic discourse and cooperation.

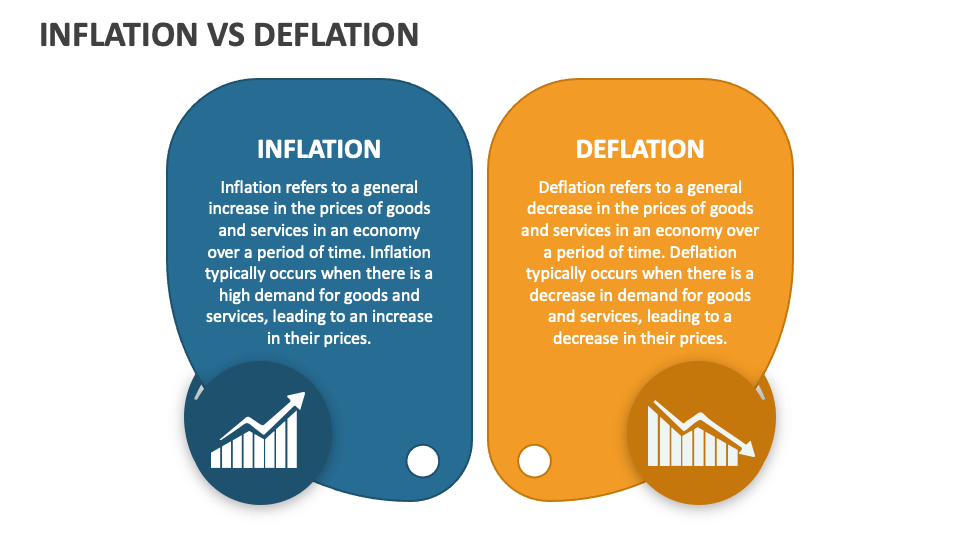

A recent study by the Research Institute of Economy, Trade and Industry sheds light on the burden of inflation tax and its effect on intergenerational imbalances. Contrary to previous studies, this research found that inflation or deflation can greatly impact the burden faced by both current and future generations. Additionally, the study suggests that implementing economic growth strategies alone will not be enough to eliminate these imbalances, and calls for concurrent reform in public finance and social security systems. These findings have significant implications for policy makers and economists.

The wait is almost over as Finance Minister Nirmala Sitharaman gets ready to present the Union Budget at 11 am today. This highly anticipated event will see several major announcements that are expected to have a significant impact on the country's economy. To fully grasp the details of the budget, it is important to understand key terms such as GDP, nominal GDP, real GDP, and capital receipts. These terms include important aspects such as economic growth, inflation, and the government's borrowing requirements, which can help individuals make sense of the budget speech. So, let's delve into the world of economics and get ready for the Union Budget 2025.