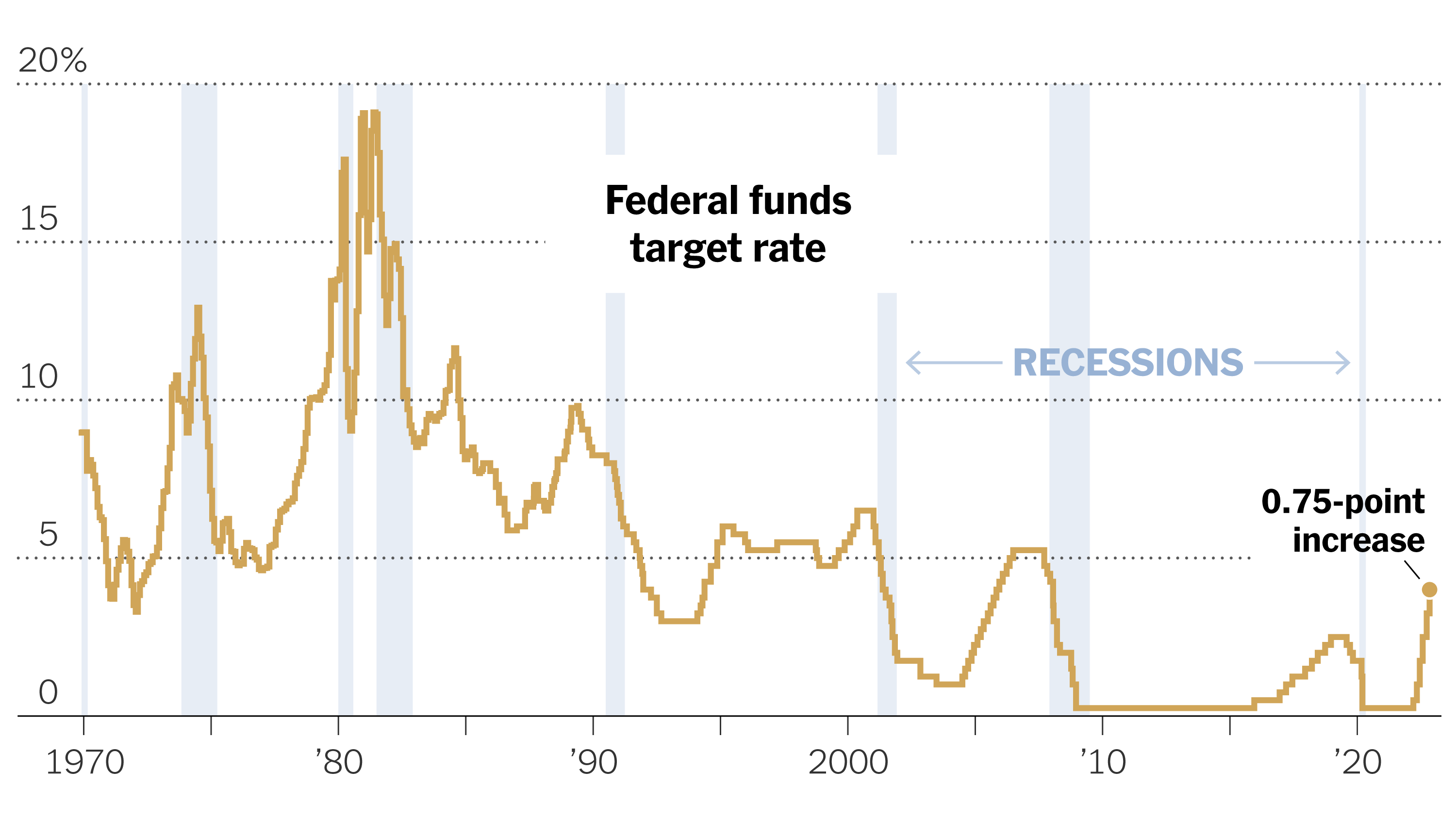

The Federal Reserve has cut the federal funds rate by 0.25% and released the latest FOMC forecasts, showing expectations for fewer and slower interest rate cuts through 2027. Despite a solid labor market, the Fed has the flexibility to cut rates gradually given moderate inflation. The dot plot of median Fed member forecasts reveals a modest increase in interest rate projections for 2025, 2026, and 2027, with real GDP growth remaining positive and unemployment expected to improve slightly.

The Federal Open Market Committee announced its decision to keep interest rates unchanged at its most recent meeting, citing a lack of progress towards the central bank's 2% inflation goal. Despite initial expectations for multiple interest rate cuts this year, the FOMC has maintained the benchmark federal funds rate since 2023. With inflation still hovering above its target rate, the Fed will continue to reduce its holdings of securities. Economists expect the Fed to adopt a more hawkish stance in the future, driven by concerns about rising inflationary pressures and the potential impact on the economy.

The US dollar dropped after the results of the FOMC meeting showed a continued outlook for interest rate cuts, causing a stock rally and reducing demand for the dollar. In the same meeting, the FOMC also raised their GDP and inflation forecasts for 2024. Meanwhile, the euro rebounded from a 2-1/2 week low after the ECB President stated they cannot commit to further rate cuts after the expected cut in June.

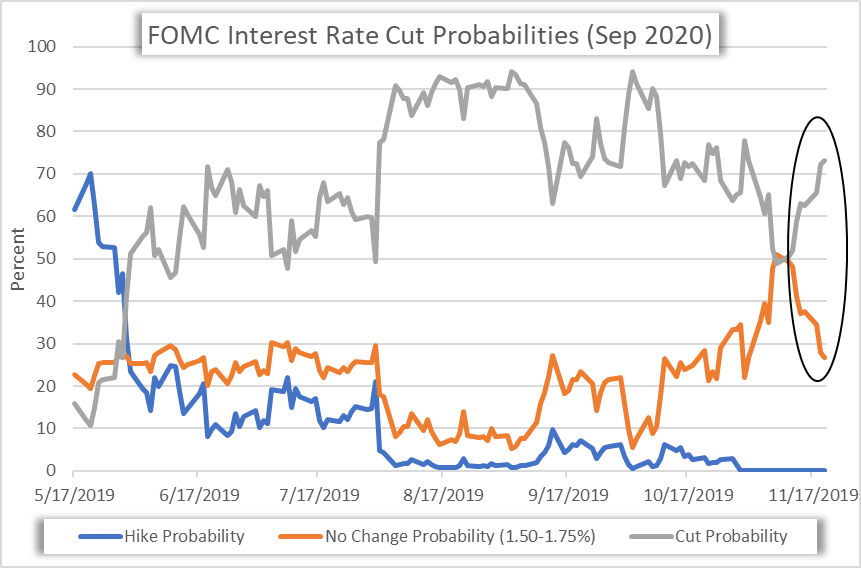

As the Federal Open Market Committee (FOMC) meeting approaches, Wall Street economists are closely analyzing projections and determining market expectations for the expected rate cuts. While initial projections showed enthusiasm for significant cuts in 2024, recent data and events have caused investors to revise these expectations. The highly anticipated meeting this week will provide crucial insight into the Fed's plans for cutting interest rates, with all eyes on Chair Jerome Powell's remarks.

In the recent FOMC meeting, the Federal Reserve decided to keep the federal funds rate unchanged, but made it clear through their messaging that interest rate cuts are on the horizon. Although no concrete policy changes were announced, the Fed's use of open-mouth operations signaled a shift towards a more accommodative stance. The removal of language related to further rate hikes from the official statement solidified the fact that the Fed's focus is now on assessing incoming data for future adjustments.