The recent uproar surrounding the shutdown of Hindenburg Research displays a misunderstanding of the purpose of short selling. Instead of addressing the flaws in certain companies, society has shifted the focus to the practice itself. This reflects a larger issue of how financial news is consumed and the media's role in shaping public perception. The real issue lies in the weaknesses exposed by these reports, not in the reports themselves. Hindenburg's past successful research, such as their report on the Adani Group, indicates the importance of short selling in uncovering governance failures and unjust valuations.

The Hindenburg Research Debacle: Uncovering the Misconceptions Surrounding Short Selling

In recent weeks, the financial world has been rocked by the controversy surrounding Hindenburg Research, a short-selling firm with a track record of exposing corporate malfeasance and inflated valuations. The shutdown of Hindenburg by the Securities and Exchange Commission (SEC) has sparked a debate about the nature and purpose of short selling.

Background: What is Hindenburg Research?

Hindenburg Research is an investment research firm founded in 2017. The firm's primary focus is investigating companies it believes are engaging in fraudulent or unethical practices. Hindenburg publishes detailed reports on its findings, which often lead to significant drops in the stock prices of the targeted companies.

The Controversial Shutdown

In March 2023, the SEC announced that it had suspended Hindenburg Research for violating certain disclosure requirements. The SEC alleged that Hindenburg had failed to disclose its own financial interests in the companies it targeted for short selling. The suspension stirred up a storm of controversy, with many questioning the SEC's motives and the potential impact on corporate accountability.

The Misunderstanding of Short Selling

The uproar surrounding Hindenburg has highlighted a fundamental misunderstanding of the purpose of short selling. Short selling is a legitimate investment strategy that involves borrowing shares of a company and selling them in the hope of buying them back later at a lower price. By betting against a company, short sellers put pressure on its management to address any underlying problems.

The Real Issue: Corporate Misconduct

The focus on Hindenburg's actions has diverted attention from the real issue at hand: the weaknesses and fraudulent practices exposed by the firm's reports. Hindenburg's past successes, such as its investigations into the Adani Group and Nikola Corporation, have exposed governance failures and unjust valuations that would have otherwise gone unnoticed.

Top 5 FAQs Regarding Hindenburg Research and Short Selling

1. What is the purpose of short selling? Short selling is a strategy used to profit from a company's decline in stock price. Short sellers borrow shares of a company and sell them, hoping to buy them back at a lower price and return them to the lender for a profit.

2. Why was Hindenburg Research suspended by the SEC? The SEC alleged that Hindenburg failed to disclose its own financial interests in the companies it targeted for short selling, violating certain disclosure requirements.

3. Is short selling ethical? Yes, short selling is generally considered ethical when done in a responsible manner. It can help expose corporate misconduct, put pressure on companies to address problems, and promote transparency in the financial markets.

4. What are the benefits of short selling? Short selling can provide insights into corporate governance, reveal fraudulent practices, and help investors make informed decisions. It also increases market efficiency by reducing inflated valuations and promoting price discovery.

5. What are the risks of short selling? Short selling carries the risk that the stock price will increase, resulting in losses. Short sellers can also be accused of manipulating the market or spreading false information, which can lead to regulatory challenges and reputational damage.

The Indian auto industry has been buzzing with news of major developments from two giants, Tata Motors and Eicher. Tata Motors' subsidiaries have partnered with Saraswat Bank for electric fleet financing and have seen a 1% increase in global wholesales in the third quarter of fiscal year 2025, while also urging government incentives for electric fleets. Meanwhile, Eicher has launched their new electric Pro X range for small commercial vehicles and has formed a partnership with TIVOLT Electric Vehicles and Tata Power for EV charging infrastructure. Lohia Auto has also announced their entry into the EV market with their brand 'Youdha.'

As Republic Day approaches, Indian e-commerce platforms Flipkart and Amazon launch their annual sales with attractive discounts. One of the most sought-after deals during this sale is the 14% discount on the iPhone 14 series, with the 128GB model now available for just Rs 50,999, down from its original price of Rs 59,900. This sale also includes additional bank and exchange offers, making the iPhone 14 an even more affordable option for buyers. While Flipkart offers discounts of up to Rs 10,000 on the iPhone 16 and iPhone 16 Plus, Amazon may still have competitive deals with its specific bank offers or gift cards.

Alexa McCulley, an industrial engineer at MARSHALLTOWN Company, tackles daily challenges and problem-solving opportunities in her role at the company's production plant. McCulley's passion for industrial engineering began early in high school and has led her to excel in optimizing production processes and ensuring quality control. Her diverse responsibilities include creating a safe work environment and continuously seeking ways to improve efficiency. With her dedication and expertise, McCulley is a vital part of the company's success.

Honda has finally revealed the prices for the Activa E, its first electric scooter in India, at the 2025 Bharat Mobility Global Expo. There will be two variants available, the base model priced at Rs 1.17 lakh and the higher-end RoadSync Duo at Rs 1.52 lakh. The electric scooter comes with swappable batteries and a claimed range of 102km, but drawbacks include limited storage space and the need to rely on Honda's battery-swapping network for charging. Honda plans to expand its network of battery-swapping stations in major cities.

Reliance Industries, led by Mukesh Ambani, announced its Q3 results for 2024 with a 7.38% increase in consolidated net profit and a 7.8% jump in consolidated EBITDA as compared to the previous year. The company also reported outstanding debt of ₹3,50,453 Crore and cash and cash equivalents of ₹2,34,988 Crore. Its telecom arm, Jio Platforms, witnessed a 19.2% YoY rise in revenue and a total subscriber base of 48.2 Crore as of December 2024. The company's strong performance reflects its continued growth and stable financial position in the market.

Hindenburg Research, a US-based short seller and financial research firm, announced its disbanding following its recent allegations of stock manipulation and accounting fraud against the Adani Group. The organisation, founded in 2017, specialized in uncovering unconventional information and had a track record of leading to civil and criminal charges against individuals, including billionaires and oligarchs. The Adani Group, which has been the target of these allegations, has denied all claims and currently facing legal trouble in an alleged bribery case in the US.

Today, Madhya Pradesh Chief Minister Mohan Yadav will launch the seventh Regional Industry Conclave in Shahdol district aimed at promoting economic and industrial growth in all parts of the state. The conclave will see participation of over 4,000 attendees, including more than 2,000 industrialists. It is expected to result in investment proposals worth Rs 20,000 crore and create 2,600 job opportunities. These efforts align with the state government's previous success in attracting investments of over Rs 3.75 lakh crore in six similar industrial conclaves.

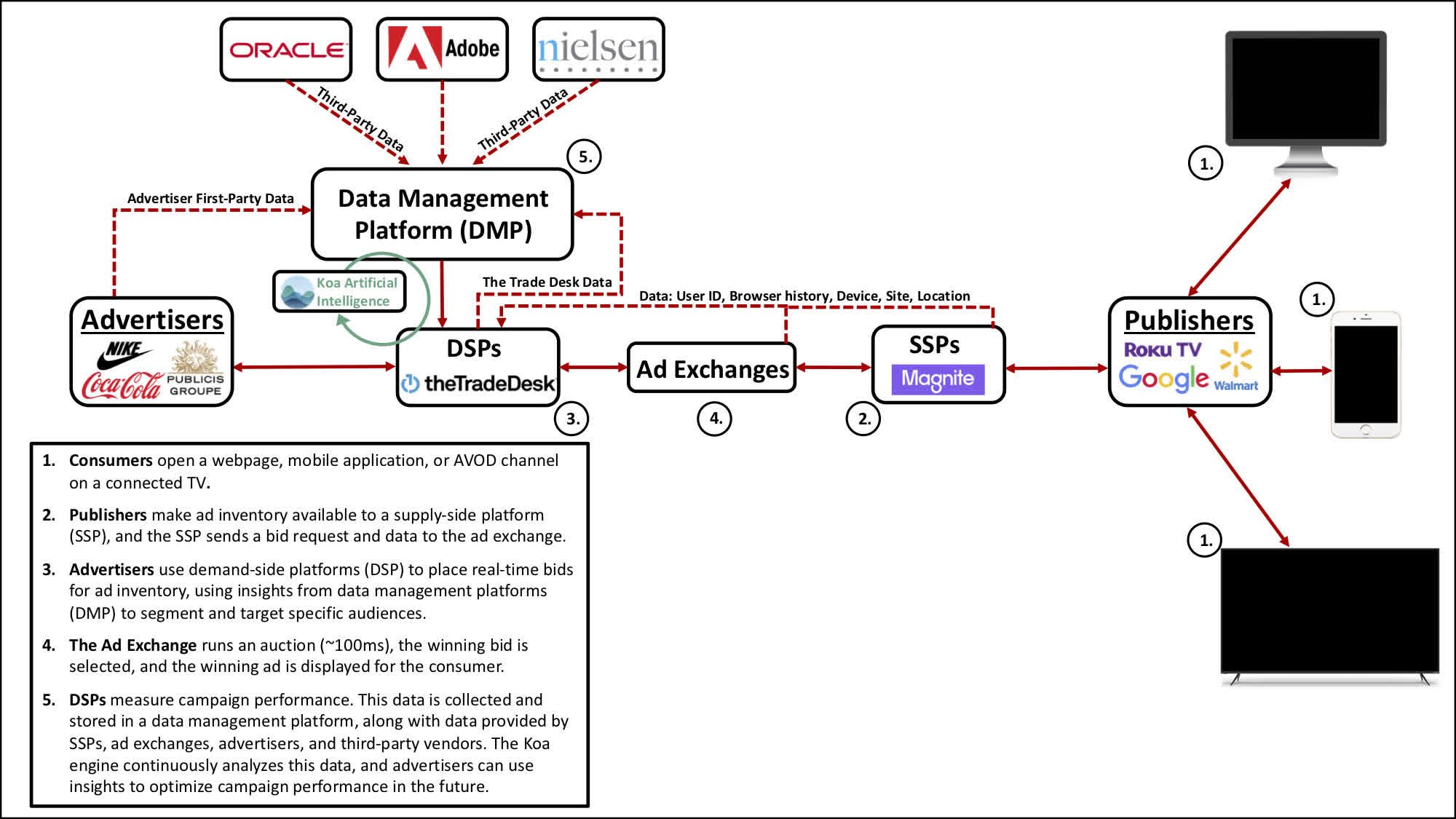

Trade Desk, a well-known advertising technology company, has announced its acquisition of Sincera, a New York-based digital advertising firm. This move will allow Trade Desk to further enhance its technology and services in the digital advertising space. With Sincera's CEO reporting directly to Trade Desk's CEO, the company aims to continue its growth and innovation in the industry. Financial details of the deal were not disclosed, but the acquisition is expected to be completed in the first quarter of 2025.

A recent analysis has shown that the price of Ripple's XRP could potentially increase by 550% by December 2024. This is attributed to the current market conditions and the expectation of positive regulatory changes. At the same time, RCO Finance (RCOF), a lesser-known altcoin, is gaining attention with projections of a whopping 8,400% rally within the next month. Despite the ongoing legal battles, XRP has remained strong and was trading at around $0.69 in late October 2024.