Vodafone Idea's stocks have seen a 35.40% increase in just five trading days following the news that the government is considering waiving AGR dues for the company. However, analysts are cautious about a potential dip in the company's subscriber base and the impact on their finances. Despite ongoing concerns, some are cautiously optimistic about the stock's medium- to short-term prospects with the recent capital infusion and network strengthening initiatives. Technically, the stock is currently trading below key moving averages but with high trading volumes and a significant m-cap.

Vodafone Idea Shares Surge on AGR Relief Hopes

Vodafone Idea's (VI) shares have soared by 35.40% in the past five trading days, spurred by news that the Indian government is considering waiving Adjusted Gross Revenue (AGR) dues for the company.

Background

AGR is a levy imposed on telecom operators based on their revenue. In 2019, the Supreme Court ruled that non-telecom revenues should also be included in calculating AGR, resulting in massive liabilities for VI and other operators.

VI's financial situation had been precarious due to these dues, estimated at over Rs 50,000 crore. The company had been struggling to raise funds and its subscriber base had been declining.

Government Relief

In a significant development, Union Finance Minister Nirmala Sitharaman announced that the government was considering options to waive or defer AGR dues for VI. This news ignited hopes of a financial lifeline for the company.

Analysts' Caution

While the AGR relief is positive, analysts are cautiously optimistic about VI's future. They note that the company still faces challenges such as:

Technical Analysis

Technically, VI shares are currently trading below their key moving averages. However, the stock has seen high trading volumes and its market capitalization remains significant. This suggests that there may be potential for further upside in the short to medium term.

Top 5 FAQs

What is AGR? AGR is a levy imposed on telecom operators based on their revenue, including non-telecom sources.

Why did VI's shares surge? VI's shares surged due to news that the government is considering waiving or deferring AGR dues for the company.

Is VI's financial situation improving? The potential AGR relief could improve VI's financial situation, but the company still faces other challenges.

What are the challenges facing VI? VI faces challenges such as declining subscriber base, financial constraints, and competition from rivals.

What is the technical outlook for VI shares? VI shares are currently trading below their key moving averages, but have seen high trading volumes and a significant market capitalization, suggesting potential for future upside.

After a tumultuous year filled with concerns about national security and Chinese ties, the social media app TikTok, owned by Chinese company ByteDance, was temporarily shut down when it disappeared from app stores and left millions of users unable to access the app on Saturday. Though the Trump administration's push for a sale of TikTok before the Sunday deadline, set to take place just before Joe Biden's presidency, has been unsuccessful, Trump has suggested a potential solution: a joint venture between TikTok and an American company, with the US owning 50% of the company. With a 90-day extension of the deadline potentially on the horizon, it appears that the fight over TikTok is far from over.

The First Lady has caused a stir in the cryptocurrency world with the release of her own memecoin, $MELANIA, which surpassed the value of her husband's Trump Coin by an astounding 8,694.61%. The launch comes just days after Trump Coin's initial surge, which has now been overshadowed by $MELANIA's meteoric rise. This move further solidifies the couple's influence beyond the political realm, as they capitalize on the booming crypto market.

As President Donald Trump's newly launched $TRUMP memecoin continues to gain attention in the cryptocurrency world, his wife Melania Trump has followed suit by launching her own token, $MELANIA. Valued at a reported several billion dollars, $MELANIA differs in structure from $TRUMP and has already seen a surge in market price and volume. While $TRUMP has also seen success, achieving a market cap of $9.9 billion, $MELANIA's launch has added another fascinating element to the Trump cryptocurrency saga.

Phoenix Supported Housing CIC, along with former and current directors Kimberley Bethell and Davinder Singh Chall, were prosecuted by a council after allegedly failing to provide promised support to a vulnerable tenant. The tenant fell into debt and was illegally evicted due to the company's actions. Bethell and Chall were each sentenced to suspended prison time and ordered to pay the tenant £1,500 each. The company was fined and ordered to pay legal costs. The judge described the defendants' behavior as "thoroughly wicked" and they were urged to be ashamed of themselves.

Swiss pharmaceutical company Novartis has filed a lawsuit against President Joe Biden's administration over a disagreement regarding the 340B Drug Discount Program. The company claims that the U.S. Health Resources and Services Administration interpreted a federal law wrongly, preventing Novartis from changing payment terms for participating hospitals. This move by Novartis could have significant repercussions on the negotiation process for the company's popular heart drug, Entresto, and its pricing under Medicare. Stay updated on market-moving news with TheFly and check out top-performing stocks on TipRanks.

After facing a series of issues on a recent bus trip with VRL Travels, BHPian ghodlur shares the details with other automotive enthusiasts. From delays to unmaintained buses, the experience raises questions about the cost of prioritizing price over quality. With a return trip planned, the BHPian turns to social media for advice on whether to stick with this budget option or opt for a carpooling app instead. Indian car enthusiasts discuss their experiences and suggest ways to stay updated on the automotive scene.

The popular social media app, TikTok, was set to be banned in the US due to national security concerns, impacting 170 million American users and over 7 million small businesses. However, President-elect Donald Trump has announced that he will work with the app's parent company ByteDance to protect national security and allow for a 50% ownership by American companies. This unexpected turn of events has relieved many TikTok users and avoided a potential strain on US-China relations.

In just 18 months, 26-year-old Jeet Shah, a LD Engineering College graduate, amassed a fortune through his digital marketing training business and YouTube channel. After initially balancing his studies with food delivery gigs, the pandemic forced him to pivot to digital marketing, which he excelled at. Now, he uses his expertise to empower individuals and businesses while also inspiring others through his journey.

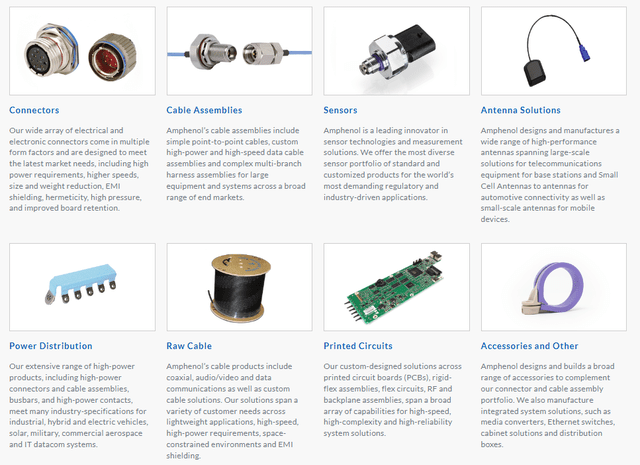

The stock market can be intimidating for investors of any age and experience, but finding winning stocks can be made easier with the help of Zacks Style Scores. For growth-oriented investors, Amphenol (APH) is a promising choice with a solid Zacks Rank, Growth Style Score of B, and VGM Score of B. With expected increases in earnings and sales, as well as strong cash flow growth, APH should be on the radar for investors looking for sustainable growth in the long term.