On its debut in the stock market, Vishal Mega Mart's shares saw a premium of up to 43.5%, following strong demand for its IPO. With a stellar listing, experts predict the stock to see further gains in the long run, advising investors to hold onto it for potential 100% gains in the next 2-3 years. Prior to its listing, the company had raised Rs 2,400 crore from anchor investors, adding to the positive sentiment surrounding the stock. Keep an eye on all the latest stock market updates and news on Zeebiz.com.

Vishal Mega Mart: A Retail Giant Soaring in the Stock Market

Introduction

Vishal Mega Mart, a leading hypermarket chain in India, has witnessed a remarkable surge in its stock price following its recent initial public offering (IPO). The company's strong fundamentals and positive market sentiment have driven its shares to new heights, making it an attractive investment opportunity.

IPO and Stellar Listing

Vishal Mega Mart's IPO, which opened on August 23, 2022, received an overwhelming response from investors, oversubscribing by 11 times. The company raised a total of Rs 2,400 crore from anchor investors, further boosting the positive sentiment surrounding the stock.

On its debut in the stock market on August 29, 2022, Vishal Mega Mart's shares saw a premium of up to 43.5%. The stellar listing was a testament to the company's strong financials and growth potential.

Growth Prospects and Stock Performance

Vishal Mega Mart operates a wide network of hypermarkets in Tier II and Tier III cities, catering to a vast base of value-conscious consumers. The company's focus on offering a wide range of products at competitive prices has been a key driver of its growth.

Experts predict that Vishal Mega Mart's stock has the potential to gain further in the long run. The company's strong market position, expansion plans, and favorable industry dynamics are expected to support its continued growth.

FAQs

Q1: What is Vishal Mega Mart's current stock price? A: As of October 5, 2022, Vishal Mega Mart's stock price is trading around Rs 583 per share on the Bombay Stock Exchange (BSE).

Q2: How much did Vishal Mega Mart raise in its IPO? A: The company raised a total of Rs 2,400 crore from its IPO.

Q3: What is the target price for Vishal Mega Mart's stock? A: Analysts have set a target price of around Rs 800 per share for Vishal Mega Mart's stock in the next 2-3 years.

Q4: Is Vishal Mega Mart a good investment? A: Experts believe that Vishal Mega Mart's stock offers a good investment opportunity due to its strong fundamentals, growth prospects, and positive market sentiment.

Q5: What are the key factors driving Vishal Mega Mart's growth? A: Key factors driving Vishal Mega Mart's growth include its focus on value-conscious consumers, wide range of products, competitive prices, and expansion plans.

Hansaraam Bhati, a 43-year-old passenger aboard the Mumbai ferry that capsized on Wednesday, remains missing as his family struggles to accept that he may have drowned. Despite his skills as a swimmer and wearing a lifejacket, Bhati’s fate is still unknown as authorities continue to search for him and other missing passengers. The family is also blaming the Indian Navy for the accident, which occurred when a Navy boat hit the ferry carrying passengers from the Gateway of India to Elephanta Island. With the death toll at 13 and possible rising, the investigation into the cause of the collision is ongoing.

The IPO of Mamata Machinery Ltd, a manufacturer of packaging machinery from Gujarat, opened to a stellar reception, with the offering's price band set between Rs 230 and Rs 243 per share. Within the first hour of bidding, the IPO was subscribed over three times, and by the end of the first day, it had received bids for 16.49 times the total shares on offer. Retail investors can apply for a minimum lot size of 61 shares with a minimum investment of Rs 14,823, while small and big non-institutional investors can invest in a minimum lot size of 14 and 68 lots respectively.

Korean automaker Kia has introduced its latest model, the compact SUV Syros, in the Indian market. The company aims to increase its sales to 3 lakh units with the launch of Syros, which boasts a new design and advanced features such as level-2 ADAS and 17 autonomous safety packages. Kia is also considering an electric variant of the model. With Syros, the company hopes to tap into the growing demand for compact SUVs in India, while also maintaining its position as a leader in the market.

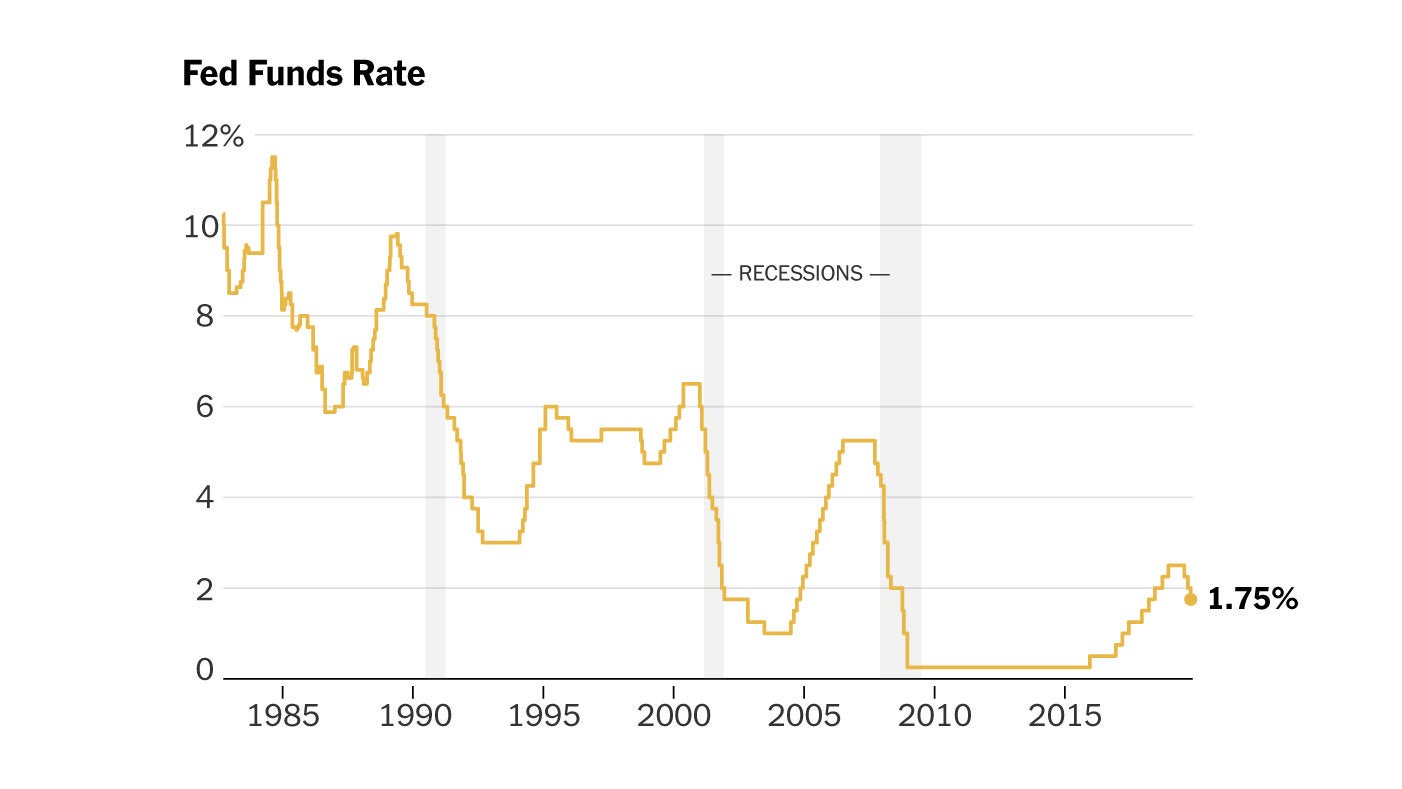

The US Federal Reserve announced a decision to cut key interest rates by 25 basis points, marking the third rate cut in three months. This move comes as the Fed attempts to keep the US economy strong and maintain a low unemployment rate. Despite the slight dip in US markets after the announcement, the Fed remains hopeful about the economy and has forecasted an increase in inflation for 2025.

The Federal Reserve has cut the federal funds rate by 0.25% and released the latest FOMC forecasts, showing expectations for fewer and slower interest rate cuts through 2027. Despite a solid labor market, the Fed has the flexibility to cut rates gradually given moderate inflation. The dot plot of median Fed member forecasts reveals a modest increase in interest rate projections for 2025, 2026, and 2027, with real GDP growth remaining positive and unemployment expected to improve slightly.

During the December meeting, Federal Reserve Chairman Jerome Powell announced a cut to the federal funds rate range and discussed the potential impact of tariffs on inflation in a post-meeting press conference. He emphasized that there are still many unknown factors regarding the scale and duration of tariffs and that it is premature to draw any conclusions. Powell also mentioned the need to consider both inflation and the labor market when making policy decisions, especially in light of potential changes.

Finance Minister Nirmala Sitharaman announced that properties worth Rs 22,280 crore have been restored to pay off the debts of wanted individuals such as Vijay Mallya, Mehul Choksi, and Nirav Modi. This includes Rs 1,052 crore from Modi and Rs 2,565 crore from Choksi. The Finance Minister's statement comes after questions were raised about the Enforcement Directorate's low conviction rate in cases under the Prevention of Money Laundering Act. Congress leader Randeep Surjewala has accused the ruling party of using agencies like the ED to target opposition leaders.

As the Indian stock market continues to rally, a number of companies are taking advantage by launching their Initial Public Offerings (IPOs). Among them are Mamata Machinery, who has opened its IPO with a price band of Rs 230-243. Other companies such as Transrail Lighting, Concord Enviro, ACME Solar, Mobikwik, Niva Bupa, Senores Pharma, Sterlite Power, and Zinka Logistics have also announced their IPOs with various price bands. These IPOs are expected to bring in a significant amount of capital, with some companies like ACME Solar raising Rs 2,900 crore through their IPO. Investors are eagerly watching these developments and expecting a positive outcome.

MobiKwik, a digital payment platform, made a remarkable stock market debut on Wednesday with a premium of 58.51% over its issue price. The company's growing adoption of digital payments and recent shift to profitability has boosted market confidence. However, analysts suggest investors should book profits given the high listing gains, while those holding should set a stop loss at Rs 400. MobiKwik has capitalized on the fintech sector's significant growth and offers flagship products such as MobiKwik ZIP, providing flexibility and easy repayment options for consumers.