The Indian Union Cabinet has approved an assured 50 per cent pension for government employees who joined service under the National Pension System (NPS). The decision was made in order to bridge the gap between the earlier defined benefit pension scheme and the contribution-based NPS. The newly announced Unified Pension Scheme (UPS) will provide government employees with 50 per cent of their average basic pay as pension for at least 25 years of service, and proportionately for a shorter period. This move is expected to benefit over 23 lakh government employees and will go into effect from the next financial year.

Government Announces Assured Pension Scheme for NPS Employees

The Indian Union Cabinet has approved a significant move to provide an assured 50% pension to government employees who joined service under the National Pension System (NPS). This decision aims to address the disparity between the earlier defined benefit pension scheme and the contribution-based NPS.

Background:

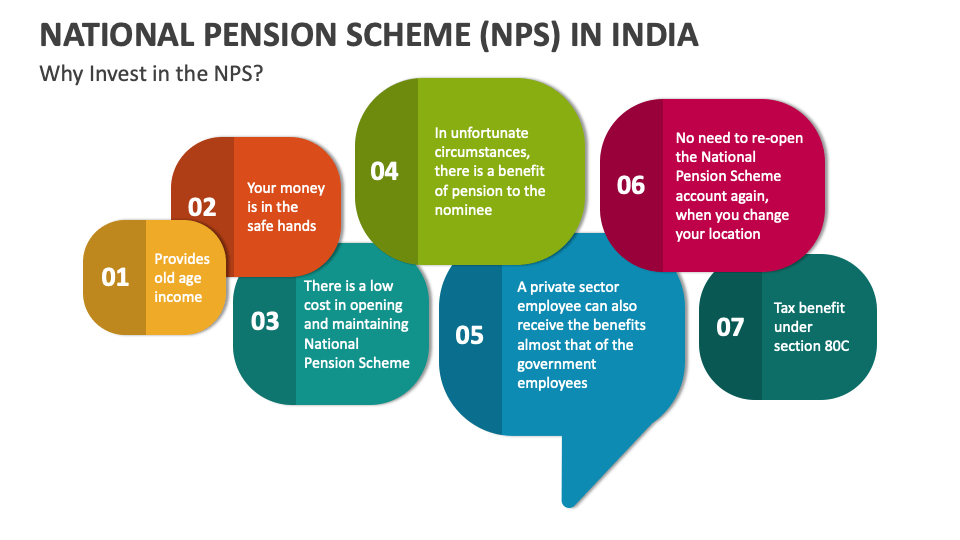

The NPS was introduced in 2004 as a contributory pension scheme for government employees who joined service on or after January 1, 2004. The scheme requires employees to contribute 10% of their monthly basic pay to their individual pension accounts. Upon retirement, the accumulated corpus is invested in an annuity plan, which provides a monthly pension for life.

However, there have been concerns among NPS employees that their pension may not be sufficient due to unpredictable market returns. This has led to demands for an assured minimum pension.

The Unified Pension Scheme (UPS):

To bridge this gap, the government has announced the UPS, which will provide a guaranteed 50% of the average basic pay as pension for at least 25 years of service. The pension will be proportionate for a shorter period of service.

Benefits of the UPS:

Top 5 FAQs and Answers:

1. Who is eligible for the UPS?

2. How long will I receive the pension under the UPS?

3. What happens if the accumulated corpus in the NPS account is less than the guaranteed pension?

4. Will the UPS affect my existing NPS account?

5. When will the UPS come into effect?

The three-day Startup Mahakumbh, inaugurated by Commerce and Industry Minister Piyush Goyal, is set to bring together 3,000 startups, over 1,000 investors, and 10,000 delegates from 50 countries. With a focus on fostering collaboration and innovation, this event will lay the groundwork for the future success of entrepreneurs. The second edition, set to take place in 2025, will feature participation from tribal entrepreneurs and showcase the growth of the Indian startup ecosystem.

In a surprise move, billionaire entrepreneur Elon Musk's artificial intelligence company xAI has acquired the popular social media platform, X, in a multi-billion dollar deal. With X's massive reach and data spanning two decades, xAI's advanced AI capabilities are set to get a big boost. However, the acquisition raises concerns about potential layoffs and the company's lack of accountability as a private entity. Only time will tell how this strategic move will impact the future of both xAI and X.

President Trump announced new tariffs on major trading partners, including India and China, during a speech at the White House on April 2. These "reciprocal tariffs" match the duties these countries have imposed on US goods, with India set to face a 26% tariff and China set at 34%. The tariffs will go into effect on April 9 at 12:01 am local time, sparking concerns for industries such as automobiles, with companies like Volkswagen already taking action to mitigate the impact.

Enter this month's competition for a chance to win one of two fantastic Motorola Edge 50 Pro handsets worth £600 each. With its sleek design, impressive camera system and fast charging capabilities, this phone is not to be missed. Plus, each winner will receive a limited-edition F1 engraved case to complete the package. All you have to do is answer a simple question on motorola.co.uk.

According to the Comptroller and Auditor General of India's report, state-owned telecom company BSNL incurred a loss of Rs 1,757.76 crore due to financial lapses in its Master Service Agreement with Reliance Jio Infocomm Ltd (RJIL). These lapses include BSNL's failure to enforce contractual terms, leading to revenue shortages and loss of potential interest. The report also highlights additional losses incurred by BSNL due to inefficient planning and procurement, resulting in unnecessary expenditure and non-realization of tax credits.

The National Company Law Tribunal has intervened in the ongoing dispute between Aakash Education Services Limited and Byju's, directing a status quo on the former's shareholding. This move came after the Resolution Professional of Byju's filed a plea in court. As one of India's leading ed-tech companies, Byju's has been aggressive in its acquisition of competitors such as Aakash Institute, and this development adds to the ongoing legal battles in the business world.

FOX News Network, LLC has announced exclusive offers for members of the military and first responders on their streaming platform, FOX Nation. The offers include discounted rates and additional benefits for those who serve in these roles. To learn more and take advantage of these offers, interested individuals can contact the designated help centers or visit the FAQ page on the FOX News website. With this initiative, FOX News continues to show their support for those who serve and protect their communities.

The Brihanmumbai Municipal Corporation (BMC) exceeded expectations by collecting Rs 6,172 crore in property tax in the financial year 2024-25. This marks a 30% increase compared to the previous year and is the highest ever collection for India's largest civic body. BMC officials attribute the success to consistent follow-ups, enhanced recovery measures, and citizen compliance. Despite facing financial strain, tax rates in Mumbai have remained unchanged since 2015, leading the BMC to explore other revenue sources.

Following a long wait, the Staff Selection Commission (SSC) has finally declared the final results of the Combined Graduate Level Examination (CGL) 2024,which was held on 12.03.2025. Out of 1267 candidates whose results were withheld, the SSC has released the scores for 219 candidates on its official website. The remaining results are still pending for further scrutiny, and candidates can check their scorecards by logging into the website using their registration number and password.

In a major move to revive the struggling telecom company Vodafone Idea (Vi), the Indian government has decided to convert an additional Rs 36,950 crore of the company's dues into equity, bringing the government's total stake in the company to nearly 49%. This follows a previous infusion of Rs 6,133 crore in equity in February 2023. With this takeover, the government becomes the single-largest shareholder in Vi and will continue to have operational control of the company. However, this decision has raised concerns about potential losses for taxpayers, as the government will have to acquire these shares at a premium of more than 47%.