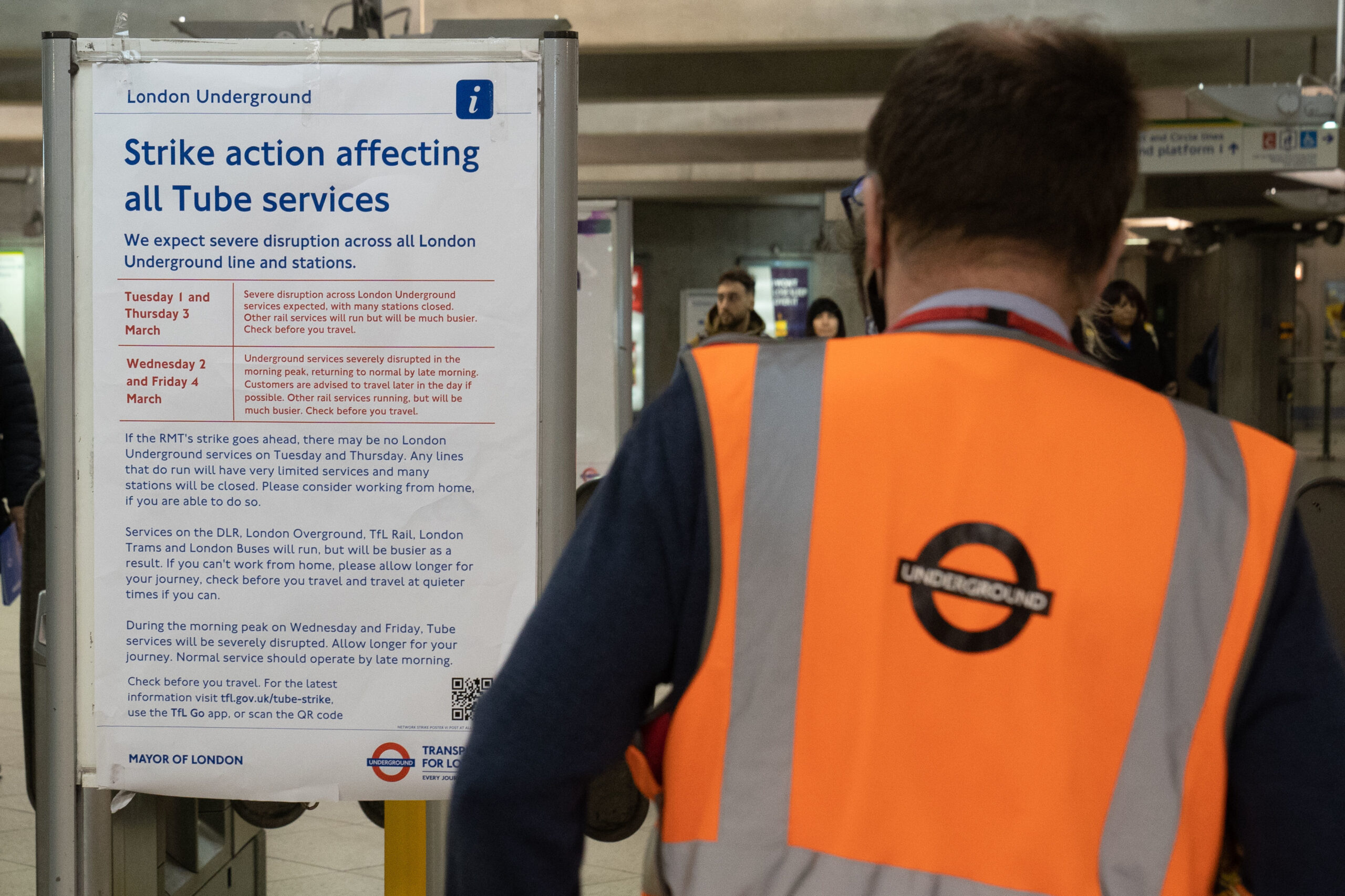

London commuters can breathe a sigh of relief as the RMT union has called off its strike, which was set to cause 10 days of travel chaos. However, Tube drivers belonging to the Aslef union are still planning to strike next week. While the RMT claims to have received a improved pay offer, Transport for London and City Hall deny this. The future of the strikes now depends on the decision of Aslef.

Tube Strike Update: RMT Calls Off Action, Aslef Still Poised to Strike

London commuters can now breathe a sigh of relief as the Rail, Maritime and Transport (RMT) union has called off its planned 10-day strike on the Tube. However, members of the Associated Society of Locomotive Engineers and Firemen (Aslef) are still set to strike for one day next week.

Background:

The strikes stem from long-running disputes over pay, pensions, and working conditions. The RMT has been demanding a pay increase of 7%, while Aslef has been seeking a 5% rise. The unions have also expressed concerns about changes to the Tube's pension scheme and the potential loss of jobs.

Developments:

Top 5 FAQs and Answers:

1. Why are the Tube strikes happening? A: The strikes are the result of disputes over pay, pensions, and working conditions.

2. Which unions are involved in the strike? A: The RMT and Aslef unions are both involved in the strike.

3. What is the RMT's demand? A: The RMT is demanding a 7% pay increase.

4. What is Aslef's demand? A: Aslef is demanding a 5% pay increase.

5. What will happen if the Aslef strike goes ahead? A: If the Aslef strike goes ahead, there will be severe disruption to Tube services on August 3.

Conclusion:

The future of the Tube strikes now depends on the decision of Aslef. If the union goes ahead with its strike, it could cause significant disruption to commuters in London. TfL has advised passengers to check its website for the latest travel updates during the strike period.

In an effort to accelerate industrial development in Tamil Nadu, Chief Minister M K Stalin has spearheaded the 'TN Rising' Investors Conclave, resulting in the signing of 91 Memorandums of Understanding (MoUs) worth Rs 36,660.35 crore. This initiative has not only attracted significant investments but also created 56,766 job opportunities across the state. With a strong focus on upgrading the state's economy, Tamil Nadu continues to attract investments through its investment promotion and industrial expansion efforts, with the aim of becoming a USD 1 trillion economy by 2030.

Kolkata Metro authorities have announced the introduction of two new direct train services between Jai Hind Bimanbandar and Shahid Khudiram stations from December 15. This initiative is expected to benefit passengers traveling to and from Dum Dum airport, as well as those commuting to different parts of the city. With these experimental services, passengers will be able to travel seamlessly and conveniently from the airport to places such as Esplanade, Kalighat, and Mahanayak Uttam Kumar without changing trains.

A powerful storm in southern Brazil caused a 24-metre replica of the Statue of Liberty outside a Havan megastore in Guaíba to collapse onto a parking lot. Despite the intense winds, the incident resulted in no injuries or damage thanks to quick actions by store staff and proper safety protocols. The storm, which affected other cities in Rio Grande do Sul, warned residents through cell broadcast alerts and prompted responses from Defesa Civil.

The BHIM app is currently running exclusive cashback deals for users, with opportunities to earn back up to Rs 750 on various transactions. These include cashback on food and travel expenses, linking a Rupay credit card to the app, and using it for fuel and utility bill payments. This offer is only available until March 31, 2024, so users should take advantage while they can.

After a roller coaster week, the Indian equity benchmark indices, Sensex and Nifty, opened in the negative territory on Monday due to weak global cues, persistent foreign institutional outflows, and renewed selling pressure. This comes after the Sensex and Nifty ended the previous trading session at 85,267.66 and 26,046.95, respectively. In the early trade, ICICI Bank, Asian Paints, Hindustan Unilever, and Axis Bank were among the top gainers, while Trent, NTPC, Mahindra & Mahindra, Eternal, and Bajaj Finserv were the laggards. The broader indices also opened in the red, with 1,680 stocks in the Nifty pack trading in the green and 936 in the red, while 90 remained unchanged.

Rubics Group has made a major move into Mumbai's high-end real estate market by announcing their bold debut with the sponsorship of Lionel Messi's G.O.A.T. India Tour 2025. The renowned Rubics Group has entered into the market with their new venture, Rubics Realty, which will bring world-class properties to Mumbai. This collaboration with Messi, arguably one of the greatest football players of all time, is expected to bring a whole new level of excitement and luxury to the Indian real estate market.

The Springfield News-Sun, a trusted local news source, offers a variety of tools to help readers stay informed and engaged with their community. The online subscriber portal allows for easy account management, including options to start a delivery hold and view and pay bills. Additionally, dedicated customer service staff are available to help with any questions or issues. Invest in local journalism and stay connected with the Springfield News-Sun.

The renowned Rubics Group is making strides in the luxury real estate market with the launch of their new brand, Rubics Realty, in Mumbai. This move coincides with their sponsorship of the highly anticipated G.O.A.T. India Tour 2025, featuring superstar Lionel Messi. According to Rubics Group's Managing Director Suhan Shetty, this partnership reflects their ambition to redefine premium property markets and offer clients a sophisticated lifestyle upgrade. Fans can look forward to meeting Messi and reliving memorable moments from his legendary career during the tour.

A recent investigation launched by the Securities and Exchange Board of India (SEBI) has sparked concerns for investors of Quant Mutual Fund. The company's significant increase in AUM has caught the attention of authorities, leading to suspicion of front-running practices. If proven, this could result in reduced returns for investors and potential redemptions, highlighting the importance of fair trade practices in the financial industry.

As part of its 2025 impact report, cycling brand Rapha has announced ambitious targets to increase its use of sustainable materials and reduce emissions across its operations and supply chain by 2030. This includes a commitment to using 80% recycled polyester in its garments and offering a trade-in program for its clothing. While cycling may produce few emissions, Rapha's actions aim to address the environmental impact of the entire supply chain in the industry.