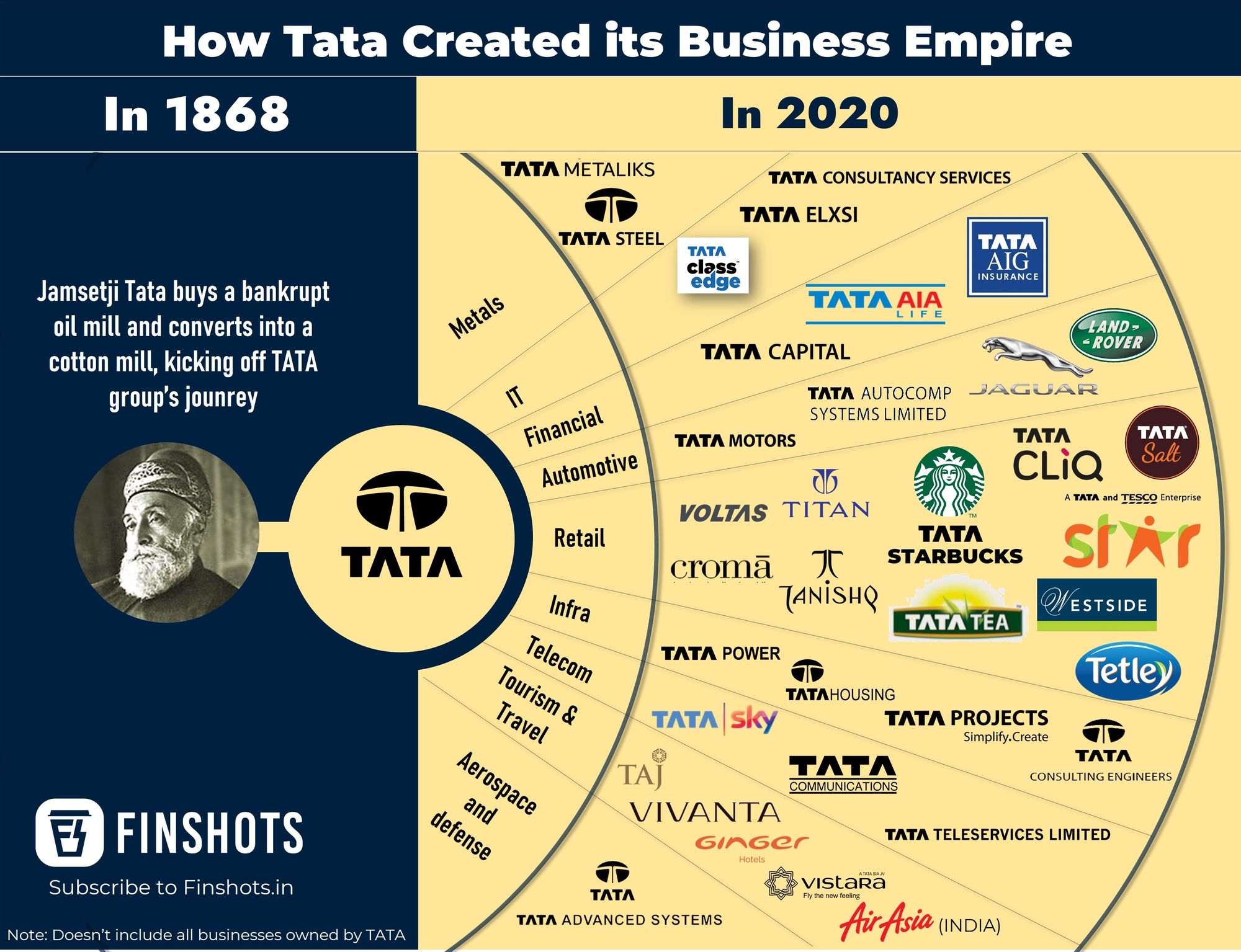

A recent report from S&P Global Ratings has put Tata Group firms on credit watch following the deteriorating financial health of some subsidiaries. This comes as a blow to the group's image as a pioneer in Indian business. At the same time, HRERA emphasizes the importance of financial discipline in the success of real estate projects, highlighting the challenges faced in the industry.

Tata Group's Financial Challenges and Implications for India's Real Estate Industry

Background

The Tata Group, one of India's largest and most respected conglomerates, has recently faced financial challenges due to the deteriorating performance of some of its subsidiaries. This has led to a credit watch by S&P Global Ratings, casting a shadow over the group's otherwise strong reputation.

Shapoorji Pallonji Group's Involvement

The Shapoorji Pallonji Group, a prominent construction and engineering conglomerate, held a significant stake in Tata Sons, the holding company of the Tata Group, until 2016. Following a lengthy legal battle, the group sold its shares in Tata Sons to the Tata Trusts, ending its involvement in the conglomerate.

Current Situation

S&P Global Ratings recently placed several Tata Group firms on credit watch negative, citing concerns about the deteriorating financial health of some subsidiaries. This has impacted the group's overall credit profile and raised questions about its future financial stability.

Implications for Real Estate

The financial challenges faced by the Tata Group have also highlighted the importance of financial discipline in the success of real estate projects. The Housing and Real Estate Regulatory Authority (HRERA) has emphasized the need for developers to maintain sound financial practices to ensure the timely completion of projects and protect homebuyers' interests.

Top 5 FAQs and Answers

1. Why has the Tata Group been placed on credit watch? Answer: S&P Global Ratings has placed the Tata Group on credit watch negative due to concerns about the deteriorating financial health of some of its subsidiaries.

2. Which Tata Group firms have been impacted? Answer: Tata Motors, Tata Power, Tata Steel, and Tata Chemicals have been placed on credit watch negative.

3. What are the potential consequences for the Tata Group? Answer: If the Tata Group fails to address the financial challenges facing its subsidiaries, it could face a downgrade in its credit rating, which could increase its borrowing costs and impact its overall financial stability.

4. How does the Shapoorji Pallonji Group's exit from Tata Sons impact this situation? Answer: The Shapoorji Pallonji Group's exit from Tata Sons in 2016 has no direct impact on the current financial challenges faced by the Tata Group.

5. What are the implications of the Tata Group's financial challenges for the real estate industry? Answer: The Tata Group's financial challenges highlight the importance of financial discipline in real estate development and emphasize the need for developers to prioritize financial stability to ensure the timely completion of projects and protect homebuyers' interests.

FOX News Network, LLC has announced exclusive offers for members of the military and first responders on their streaming platform, FOX Nation. The offers include discounted rates and additional benefits for those who serve in these roles. To learn more and take advantage of these offers, interested individuals can contact the designated help centers or visit the FAQ page on the FOX News website. With this initiative, FOX News continues to show their support for those who serve and protect their communities.

The Brihanmumbai Municipal Corporation (BMC) exceeded expectations by collecting Rs 6,172 crore in property tax in the financial year 2024-25. This marks a 30% increase compared to the previous year and is the highest ever collection for India's largest civic body. BMC officials attribute the success to consistent follow-ups, enhanced recovery measures, and citizen compliance. Despite facing financial strain, tax rates in Mumbai have remained unchanged since 2015, leading the BMC to explore other revenue sources.

Following a long wait, the Staff Selection Commission (SSC) has finally declared the final results of the Combined Graduate Level Examination (CGL) 2024,which was held on 12.03.2025. Out of 1267 candidates whose results were withheld, the SSC has released the scores for 219 candidates on its official website. The remaining results are still pending for further scrutiny, and candidates can check their scorecards by logging into the website using their registration number and password.

In a major move to revive the struggling telecom company Vodafone Idea (Vi), the Indian government has decided to convert an additional Rs 36,950 crore of the company's dues into equity, bringing the government's total stake in the company to nearly 49%. This follows a previous infusion of Rs 6,133 crore in equity in February 2023. With this takeover, the government becomes the single-largest shareholder in Vi and will continue to have operational control of the company. However, this decision has raised concerns about potential losses for taxpayers, as the government will have to acquire these shares at a premium of more than 47%.

The debut of Mubarak Coin on Binance, the world's largest crypto exchange, was met with unexpected results as the token crashed by 40% in just 24 hours. This sudden drop has sparked intense discussions among investors, with some seeing it as a normal correction and others fearing a larger shakeout. The token's listing on Binance was expected to boost its price, but instead, it triggered a sell-off by whales (large investors) taking profits, leading to panic selling. Some traders who hoped to ride the wave for huge profits in the futures market were left disappointed as insiders allegedly dumped large amounts of the crypto, further causing price declines. Technical indicators suggest that the selling pressure is likely to continue.

Fox News Network, LLC has announced new offers for both military members and first responders. These discounts will be available on their streaming service, Fox Nation, and can be accessed by contacting the online representatives or through the FAQ section on the network's website. This move comes amid the company's efforts to expand its audience and cater to different demographics.

In a major move to consolidate his influence, billionaire entrepreneur Elon Musk's AI venture xAI has acquired X, formerly known as Twitter, for a whopping $33 billion. This merger is expected to streamline the development of Musk's AI model, Grok, by combining xAI's advanced AI capabilities with X's massive reach. The all-stock transaction values xAI at $80 billion, solidifying Musk's diverse portfolio which already includes Tesla and SpaceX. Stay tuned for updates on how this acquisition will impact the future of AI and technology.

Audit firm S D Mehta & Co has revealed that there is no data available for any block deals in Shangar Decor Ltd, a miscellaneous industry company with registered headquarters in Ahmedabad, India. The main management team, including chairman Samirbhai Rasiklal Shah and company secretary Shubhangi Chaurasia, may face challenges as a result. The information has been sourced from reliable corporate and stock market data providers, but users are advised to seek professional advice before making any investment decisions.

With the price of gold constantly fluctuating, many investors are turning to Gold ETFs as a more convenient and cost-effective way to invest in the precious metal. In this article, we explore the top 5 Gold ETFs with the highest annualised returns in the past 10 years and analyze their performance since their debut in the market. Find out how a one-time investment of Rs 1,25,000 in each fund has fared over a 10-year period, with an expense ratio as low as 0.41 per cent.

Mother Dairy, one of India's leading dairy brands, aims to reach a revenue of Rs 20,000 crore by FY27 through the launch of new products and expansion into new markets. Its latest offering, a "pro" range of dairy products enriched with protein, aims to bridge the gap between Indian's protein intake and their daily requirements. The company plans to invest in expanding capacities and reducing dependence on Delhi-NCR in order to achieve its ambitious revenue target.