In a surprise announcement, Samsung Electronics revealed that its Q3 2024 earnings are expected to be 10% lower than previously estimated due to a delay in the AI chip business from a major customer. Analysts predict that this trend will continue in the current quarter and Samsung's late response to new technological advancements could jeopardize its market share. However, Vice Chairman Young Hyun Jun remains optimistic and promises to use this challenge as an opportunity to enhance the company's long-term technological competitiveness.

Samsung Electronics Faces Slowdown in AI Chip Business

Background

Samsung Electronics, a global technology leader, has been facing increasing competition in recent years from other tech giants such as Apple and Huawei. In order to maintain its market share, Samsung has invested heavily in artificial intelligence (AI) and other emerging technologies.

Current Situation

In a surprise announcement, Samsung Electronics revealed that its Q3 2024 earnings are expected to be 10% lower than previously estimated due to a delay in the AI chip business from a major customer. Analysts predict that this trend will continue in the current quarter and Samsung's late response to new technological advancements could jeopardize its market share.

Vice Chairman's Response

Despite the setback, Vice Chairman Young Hyun Jun remains optimistic and promises to use this challenge as an opportunity to enhance the company's long-term technological competitiveness. Samsung is reportedly planning to invest more in R&D and accelerate its development of new AI chips.

Top 5 FAQs

1. What caused the delay in the AI chip business? The delay was reportedly caused by a major customer (who is speculated to be Amazon) pushing back its launch of a new product due to technical issues.

2. How will the delay impact Samsung's earnings? Analysts predict that Samsung's Q3 2024 earnings will be 10% lower than previously estimated and that the trend may continue into the current quarter.

3. What steps is Samsung taking to address the situation? Samsung is planning to invest more in R&D and accelerate its development of new AI chips to enhance its technological competitiveness.

4. How is Samsung's market share likely to be affected? Analysts predict that Samsung's late response to new technological advancements could jeopardize its market share. However, Vice Chairman Jun remains optimistic that the company can regain its position.

5. What is the long-term outlook for Samsung Electronics? Despite the current setback, Samsung Electronics is still a global technology leader with a strong foundation in innovation. Analysts are optimistic that the company can recover from this challenge and continue to grow in the long term.

In a continued pattern, four days in a row now, domestic airlines have been facing bomb threats to their flights. Recently, two Vistara and two IndiGo flights received such threats. Following the protocol, the authorities were immediately informed, and all passengers were safely disembarked as the aircraft underwent extensive security checks. IndiGo did not disclose any further details and is cooperating with relevant authorities.

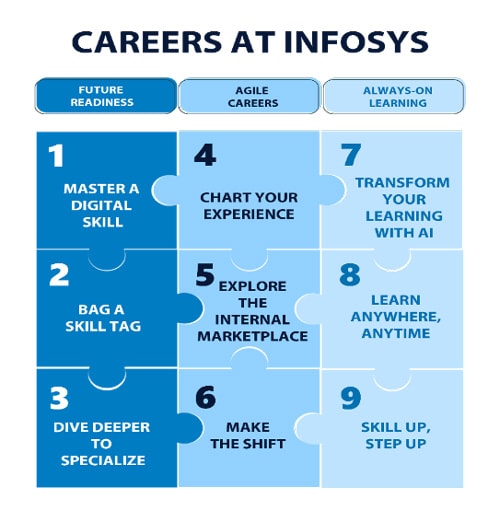

Infosys, one of India's largest IT companies, reported a 4.7 per cent rise in net profit in the September quarter. Despite a tough global economic environment, the company added about 2,500 employees in the quarter, reversing a six-quarter hiring downturn. This is an important development for Infosys, which has been struggling to retain employees in recent years. The company's strong financial performance and increase in employee strength signals growth and stability for the IT giant, making it a market leader in the tech industry.

On October 17, 2024, Wipro announced a 21% increase in net profit for the September quarter and a bonus share issue in proportion of 1:1, marking the company's first bonus share issuance since 2019. This is the 14th time Wipro has issued bonus shares, solidifying its position as the most frequent issuer of bonus shares among Nifty and Non-Nifty constituents. Shareholders can expect to receive their bonus shares on December 15, 2024.

Recent quarter earnings reports are causing major fluctuations in the stock market, with some companies experiencing sharp increases and others facing significant drops. TCS, the IT giant, saw its shares plummet by 2% after a disappointing Q2 earnings announcement, while Bajaj Auto announced a hike in deferred tax provision leading to their stock taking a hit. In contrast, HCL Tech and Infosys, leading IT companies, saw their stocks soar after strong earnings. Other companies, such as Bajaj Finserv, Asian Paints, and Bajaj Housing Finance, also experienced dips after reporting their earnings. Even the auto sector was not immune, with Maruti and Bandhan Bank experiencing both surges and drops respectively in their stock prices following their earnings announcements.

On day 2 of the first Test between India and New Zealand, the Indian team faced a shocking start as they lost 3 crucial wickets within a span of 3 overs. Both the Indian captain Rohit Sharma and star player Virat Kohli were dismissed early, putting India in a difficult position. New Zealand player Devon Conway showed his excellence on the field by taking a stunning one-handed catch, contributing to the downfall of Sarfaraz Khan. This has given New Zealand a strong advantage over India in the early stages of the Test match.

Waaree Energies Ltd. is aiming for a significant increase in their margins by becoming a fully integrated manufacturing company by 2027. With a focus on cost management and their own cell capacities coming into play, the parent entity of Waaree Renewable Technologies Ltd. is confident that margins will expand, potentially up to 300 basis points. The upcoming IPO for Waaree Energies will help finance their expansion plans in Odisha and meet the demand for solar cells in the Indian market.

Indians across the Hindu religion will celebrate Valmiki Jayanti on October 17, 2024, as they mark the birth anniversary of Maharishi Valmiki. Known as the Adi Kavi, or the first poet of Sanskrit literature, Valmiki authored the epic Ramayana, a collection of 24,000 verses and 7 cantos. The day, also known as Pargat Diwas, is celebrated traditionally on the full moon day of Ashwin in the Hindu calendar, and is commonly referred to as Panchanga. Share in the festivities with Valmiki Jayanti Wishes, quotes, greetings, and photos to commemorate the occasion.

In a much-awaited announcement, Reliance Industries may declare the record date for their bonus share issuance, doubling the shares of every shareholder. This would mark the largest bonus issue in the stock market and is being considered a Diwali gift for investors. The decision may be taken on October 14, along with the company's quarterly and half-yearly results. This is the sixth bonus issue for Reliance since their IPO, reflecting their commitment to providing continuous benefits to their shareholders.

United Airlines has seen a 70.4% increase in stock value over the past 12 months, with its fourth quarter already showing a 20% increase. This comes after the airline announced a successful third-quarter earnings report and a $1.5 billion stock buyback program. Options traders and analysts are responding positively to the news, with a surge in trading and multiple price target hikes. The stock's short interest has also increased, further contributing to the positive momentum.