The Reserve Bank of India (RBI) has decided to maintain the repo rate at 6.5 per cent, highlighting its cautious stance amidst economic uncertainties. This decision comes as the central bank continues to face challenges in keeping inflation within its target range. Experts believe that the RBI's focus on price stability over immediate rate cuts is necessary given the current economic climate and global factors. This stable interest rate environment is also perceived as beneficial for long-term investments in the real estate market.

Repo Rate: A Critical Tool for Monetary Policy

Background:

The repo rate is a crucial monetary policy tool used by central banks to influence the cost of borrowing and economic activity. It refers to the interest rate at which commercial banks can borrow short-term funds from the central bank, typically overnight or for a term of up to 14 days.

Recent Announcement:

On February 8, 2023, the Reserve Bank of India (RBI) decided to maintain the repo rate at 6.5%, its highest level since April 2019. This decision was made amidst global economic uncertainties and challenges in controlling inflation.

RBI's Cautious Stance:

The RBI's decision to hold the repo rate steady reflects a cautious approach aimed at balancing economic growth with price stability. While inflation remains elevated above the central bank's target of 4%, the RBI recognizes the need to support economic recovery post-pandemic.

Benefits of a Stable Repo Rate:

Maintaining a stable repo rate can create a favorable environment for long-term investments, particularly in the real estate market. Consistent interest rates reduce uncertainty and encourage investors to commit to property purchases.

Top 5 FAQs and Answers:

1. What is the impact of a repo rate hike on consumers?

A repo rate hike can lead to increased interest rates on loans and mortgages, resulting in higher borrowing costs for consumers.

2. How does the repo rate affect inflation?

By increasing the cost of borrowing, the RBI aims to curb spending and reduce inflation.

3. Why has the RBI maintained the repo rate despite high inflation?

The RBI is balancing its inflation-fighting mandate with the need to support economic growth. Raising the repo rate too quickly could stifle economic activity.

4. What are the economic uncertainties that the RBI is considering?

The global economic outlook, geopolitical tensions, and supply chain disruptions are among the uncertainties that the RBI is monitoring.

5. What is the RBI's long-term inflation target?

The RBI's long-term inflation target is to maintain inflation within a range of 2%-6%.

Conclusion:

The RBI's decision to maintain the repo rate at 6.5% highlights its cautious approach in navigating economic uncertainties and controlling inflation. While the current interest rate environment may affect consumer borrowing costs, it also provides a degree of stability for long-term investments and supports economic recovery. The RBI will continue to monitor economic developments and adjust its monetary policy stance as necessary to achieve its mandate of price stability and sustainable economic growth.

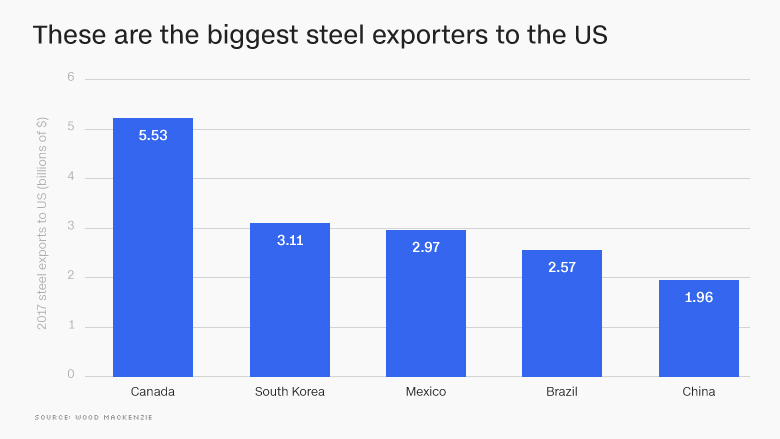

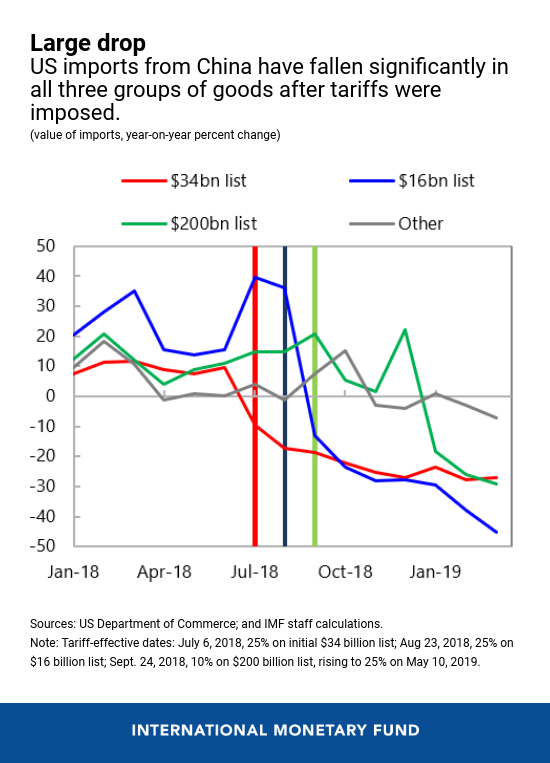

Canada has announced that it will challenge the new 25% tariffs imposed by US President Donald Trump through international legal channels. In response, Canada has also introduced its own tariffs on American products, affecting 17% of all US imports. The move is seen as a violation of trade agreements between the two countries and has raised concerns about the impact on global economic growth and inflation. Meanwhile, Nirmala Sitharaman has presented the second Budget for the BJP government, with a focus on reviving the Indian economy through healthcare, infrastructure, and privatization, though critics argue these measures should have been implemented earlier.

Samvardhana Motherson International has approved the sale of its joint venture company, Marelli Motherson Auto Suspension, to Gabriel India for Rs 60 crore. The joint venture, established in 2014 to manufacture suspension components for vehicles in India, will be transferred to Gabriel India along with fixed assets, inventory, and employees. The Indian auto component maker, which contributed 0.3% of Samvardhana Motherson's revenue in FY24, stated that the sale is aligned with their long-term strategy and will not affect their other businesses. The acquisition will expand Gabriel India's product portfolio and manufacturing capacity, positioning them for further growth in the market.

Mumbai's Ranji Trophy team receives a major boost as India T20 captain Suryakumar Yadav and all-rounder Shivam Dube make themselves available for the quarter-final against Haryana. Despite Yadav's series of low scores in the ongoing T20Is against England, his presence will greatly benefit the team. The MCA has confirmed that the two players have informed them of their availability and the selection committee will soon meet to pick the squad. Both players have been busy with national duty but have previously played for Mumbai in the Vijay Hazare Trophy and Syed Mushtaq Ali Trophy. The quarter-finals are set to begin on February 8.

US stocks took a hit on Friday as the White House announced tariffs on goods from Mexico, Canada, and China, reigniting fears of a trade war with the nation's closest trading partners. The S&P 500 and the Dow Jones Industrial Average both fell into the red, while the tech-heavy Nasdaq Composite reversed earlier gains. The news overshadowed positive updates earlier in the day from Apple's solid earnings and a matched inflation reading. The looming tariff deadline has sparked concerns about the impact on the US economy and uncertainty over potential inflamed inflation has put Federal Reserve Chair Jerome Powell in a wait-and-see position.

The benchmark indices in India, Sensex and Nifty, surged thanks to a strong performance by Vedanta, whose impressive Q3 results led to investor sentiment. However, the Economic Survey 2025 highlights potential risks to Indian markets, with high valuations and excessive optimism in the US stock market. All eyes are now on the upcoming Budget for further cues, as the Indian market is sensitive to fluctuations in the US market.

As part of the Budget for 2025-26, Finance Minister Nirmala Sitharaman announced that contributions of up to Rs 50,000 per year towards the NPS Vatsalya scheme, a children's welfare scheme, will be eligible for tax exemption. This move aims to make the scheme more appealing, with the tax benefits also available to regular NPS accounts. The number of enrolments in the scheme is expected to increase with this announcement, providing a secure and prosperous financial future for minors.

The recently released Union Budget for 2025 has sparked positive reactions from various stakeholders in the MSME sector. The budget includes measures such as increased credit guarantee cover and customised credit cards for small businesses, which are seen as crucial steps in promoting financial inclusion and aiding India's position as a global manufacturing hub. However, experts emphasize the importance of simplifying access to these schemes and ensuring efficient disbursement of funds. The budget also focuses on building export competitiveness through digital trade networks and strong buyer-supplier ecosystems.

The Finance Minister, in her Budget 2025 speech, announced significant changes in taxation including a nil tax slab limit of Rs 12 lakh, increased from Rs 7 lakh, and an extended time limit of 4 years to file an updated income tax return. The threshold for TDS deduction on rent has also been raised from Rs 2.4 lakhs to Rs 6 lakhs while the exemption limit for TCS on remittances has been increased from Rs 7 lakhs to Rs 10 lakhs. Additionally, TCS on sale of goods will be omitted to ease compliance difficulties.

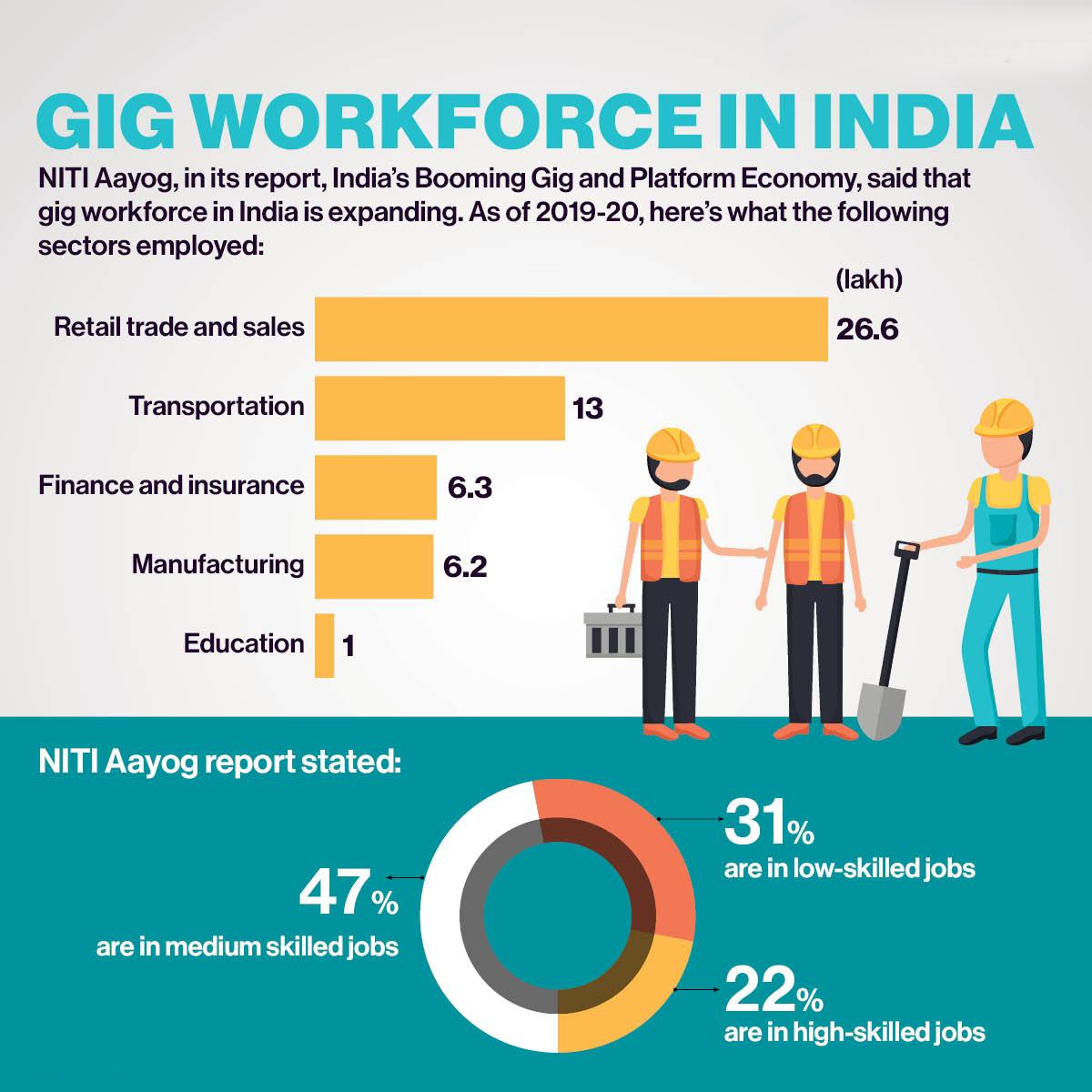

The finance minister announced plans to provide social security and health benefits to gig workers under the government's flagship schemes, including the e-Shram portal which will create a national database. However, unions representing gig workers in Pune expressed dissatisfaction with the budget, questioning why existing health insurance schemes are not being extended to gig workers, and raising concerns about working conditions and lack of a grievance redressal mechanism. While some welcome the government's recognition of gig workers, others argue that the budget does not go far enough in regulating the relationship between workers and companies.

BTTV, a leading business news network, has launched a new market show titled 'Daily Calls' that aims to provide viewers with valuable insights and clarity through live sessions with expert analysts. The show, available on BT TV and Reels, is a must-watch for anyone looking for guidance on investing and portfolio building. With this new addition, BTTV continues to be a go-to source for all things business.