After years of gaining widespread attention for its reports that caused significant financial losses for Indian billionaire Gautam Adani and his companies, US-based Hindenburg Research has announced its closure. The firm's founder Nate Anderson shared the news with family, friends, and the Hindenburg team, stating that the decision to shut down had been made back in late 2020. This announcement comes at the same time as a call from a Republican Congressman for document preservation, coinciding with the firm's closure.

Hindenburg Research Closes After Exposing Adani Group Fraud

US-based Hindenburg Research, known for its explosive reports that caused significant financial losses for Indian billionaire Gautam Adani and his companies, has announced its closure. The firm's founder, Nate Anderson, revealed the decision to shut down in a statement shared with family, friends, and the Hindenburg team.

Background

Hindenburg Research gained widespread attention in January 2023 with its report on the Adani Group, alleging fraudulent accounting practices and stock manipulation. The report sent shockwaves through the Indian economy, leading to a massive sell-off in Adani shares and wiping out billions of dollars of investor wealth.

Adani Group initially dismissed the allegations but later admitted to accounting errors and withdrew its proposed stock offering. The Securities and Exchange Board of India (SEBI) and the National Stock Exchange of India (NSE) are currently investigating the matter.

Closure Announcement

Anderson's announcement that Hindenburg Research is closing comes at a time when a Republican Congressman has called for document preservation related to the firm. The closure has sparked speculation about potential legal challenges or regulatory actions against Hindenburg.

Top 5 FAQs

1. Why is Hindenburg Research closing? Anderson stated that the decision to shut down was made in late 2020, before the Adani report was published. He cited personal reasons and a desire to pursue other interests.

2. Is Hindenburg Research being investigated? There is no official investigation into Hindenburg Research at this time. However, the firm's closure has raised questions about potential regulatory or legal actions.

3. What will happen to the Adani investigation? SEBI and NSE are continuing their investigations into the Adani Group. These investigations are ongoing, and it is unclear how Hindenburg's closure will affect their progress.

4. Who is Nate Anderson? Nate Anderson is the founder and portfolio manager of Hindenburg Research. He has a background in finance and has been involved in several high-profile investigations.

5. What is Hindenburg Research's track record? Hindenburg Research has a history of publishing reports that have led to significant financial losses for targeted companies. The firm has been criticized for its aggressive tactics, but its track record has also led to calls for greater corporate transparency.

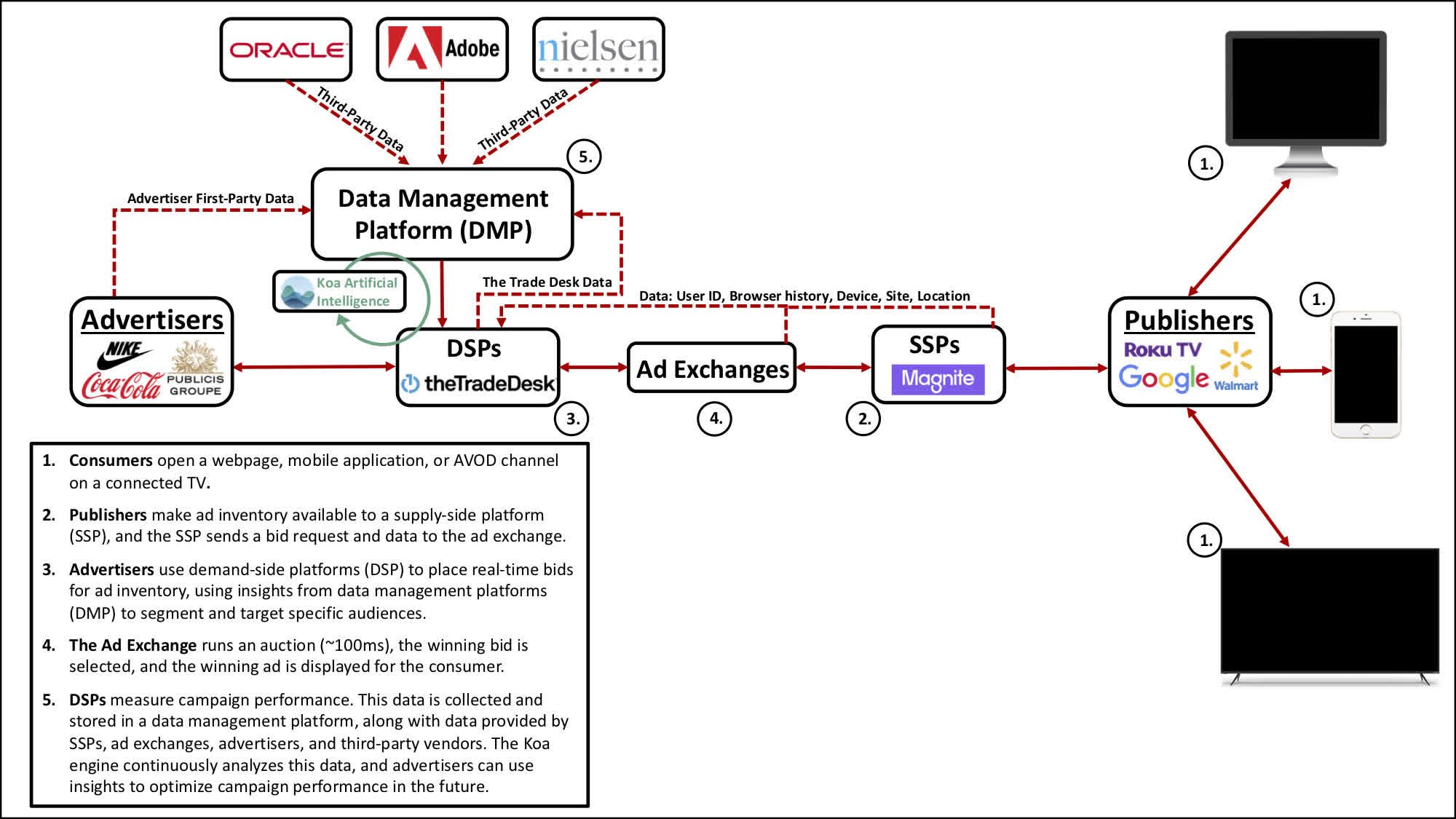

Trade Desk, a well-known advertising technology company, has announced its acquisition of Sincera, a New York-based digital advertising firm. This move will allow Trade Desk to further enhance its technology and services in the digital advertising space. With Sincera's CEO reporting directly to Trade Desk's CEO, the company aims to continue its growth and innovation in the industry. Financial details of the deal were not disclosed, but the acquisition is expected to be completed in the first quarter of 2025.

A recent analysis has shown that the price of Ripple's XRP could potentially increase by 550% by December 2024. This is attributed to the current market conditions and the expectation of positive regulatory changes. At the same time, RCO Finance (RCOF), a lesser-known altcoin, is gaining attention with projections of a whopping 8,400% rally within the next month. Despite the ongoing legal battles, XRP has remained strong and was trading at around $0.69 in late October 2024.

In a letter, founder of Hindenburg Research, Nate Anderson, has announced the disbandment of the research firm after the completion of their ongoing pipeline of ideas. Anderson stated that there is no specific reason for this decision, but rather a realization that his intense focus on the company has come at the cost of missing out on other aspects of life. The team's work has led to the charging of nearly 100 individuals, including billionaires, and has had a significant impact on the stock market, with the Adani group seeing a major decline in market capitalization following Hindenburg's report. However, the Supreme Court has since given a clean chit to the Adani group, stating that the report could not be relied upon without verification.

The US research firm Hindenburg Research, known for short-selling, is disbanding after completing its pipeline of ideas. Its founder Nate Anderson said the decision comes days before the Biden Administration's term ends as he wants to focus on his personal life and believes his organization is now simply a chapter in his life. The investigative firm published reports against Adani, leading to a Republican congressman to ask the Department of Justice to preserve related documents. Anderson plans to invest in low-stress investments and ensure his team lands in their desired roles.

Following criticism from Ripple executives over the SEC's refusal to postpone its appeal filing, the XRP price surged 11% in the last 24 hours to trade at $2.7998. The surge comes amidst an ongoing legal battle between the blockchain company and the SEC, with the impending resignation of SEC Chair Gary Gensler on Jan. 20. Ripple's chief legal officer, Stuart Alderoty, labeled the decision a "waste of time and taxpayer dollars" but expressed confidence in their position on appeal. The company's stance on the matter remains strong despite the change in leadership at the SEC.

The tech world was abuzz as Salesforce CEO Marc Benioff shared a heartwarming and inspiring story about his late friend and mentor, Steve Jobs. During a recent interview at TechCrunch Disrupt, Benioff disclosed the last gift Jobs ever gave him - a book about self realization by Yogananda. The poignant gesture serves as a reminder of Jobs' belief in the power of intuition and looking within to achieve true success.

JPMorgan predicts that an XRP ETF could attract billions in investments based on the success of Bitcoin and Ethereum ETFs. Ripple President Monica Long has also mentioned increasing adoption of XRP in traditional finance, with multiple firms actively filing for XRP ETFs. However, the approval process for an XRP ETF remains uncertain due to ongoing legal battles with the SEC. Analysts predict that if approved, the XRP price could reach $3.66, with some expecting it to break through key resistance levels.

Four-sentence summary: Ripple's XRP is up 5% after positive news surrounding its ecosystem and a prediction of significant inflows if an XRP ETF gains approval from the SEC. The token has also seen $8.06 million in futures liquidations in the past 24 hours, with long liquidations outweighing short liquidations. As XRP approaches key resistance levels, investors are anticipating a rally to new all-time highs, supported by bullish technical indicators.

Jai Corp's shares experienced a staggering 20 percent lower circuit, leading to doubts about whether the proposed capital reduction will be approved at Urban Infrastructure Holdings' upcoming extraordinary general meeting (EGM). As investors wait for the EGM and its outcome, discussions surrounding the potential impact on both companies continue to mount. With the market closely monitoring the situation, all eyes are on whether Jai Corp's shares will continue on their downward trend or make a rebound.