The Reserve Bank of India has announced a holiday schedule for banks in May 2024, with customers advised to be prepared for up to 14 non-working days. These closures are due to a combination of religious holidays, state elections and weekends. Regional bank holidays may also be affected by the ongoing Lok Sabha elections. Customers in Maharashtra, Tamil Nadu, Assam, Andhra Pradesh, Telangana, Manipur, Kerala, Karnataka, West Bengal, Goa, and Bihar will be affected due to these closures.

Reserve Bank of India Announces Holiday Schedule for Labour Day 2024 in Karnataka

The Reserve Bank of India (RBI) has declared a holiday schedule for commercial banks in Karnataka for Labour Day 2024. Here's an overview of the upcoming non-working days:

Background

The RBI periodically announces holiday schedules for banks across India to ensure the smooth functioning of the banking system while observing important national and regional holidays. These non-working days typically include weekends, festivals, and religious observances.

2024 Labour Day Holiday in Karnataka

Impact on Bank Services

Banks in Karnataka will remain closed on Labour Day. This means that normal banking transactions, such as cash withdrawals, deposits, and check clearing, will not be available. However, online banking services, including mobile banking and internet banking, are expected to continue functioning normally.

Other Closures and Impact

In addition to the Labour Day holiday, banks in Karnataka may also observe additional closures due to other holidays. The RBI's holiday schedule includes the following non-working days:

FAQs

1. Are all banks in Karnataka affected? Yes, all commercial banks in Karnataka will observe Labour Day as a holiday.

2. Will online banking services be available? Yes, online banking, mobile banking, and internet banking are expected to be accessible.

3. Can I still withdraw cash from ATMs? Yes, ATMs are expected to remain operational on Labour Day.

4. What if I have a scheduled loan repayment on Labour Day? Loan repayments due on Labour Day will be automatically extended to the next business day.

5. Will bank branches be open on the weekend following Labour Day? Bank branches will typically be closed on weekends, including the weekend following Labour Day.

The Federation of Indian Chambers of Commerce & Industry (FICCI) and government departments have launched the second edition of the Startup MahaKumbh, which aims to empower Indian startups with 30 crore in funding, industry mentorship, and networking opportunities. The challenge focuses on 11 sectors and is open to all DPIIT recognized startups. The top startups in each sector will receive funding and mentorship, while all selected startups will receive valuable support and guidance from TiE chapters. The challenge has the backing of top industry leaders and aims to nurture the next generation of innovative entrepreneurs in India.

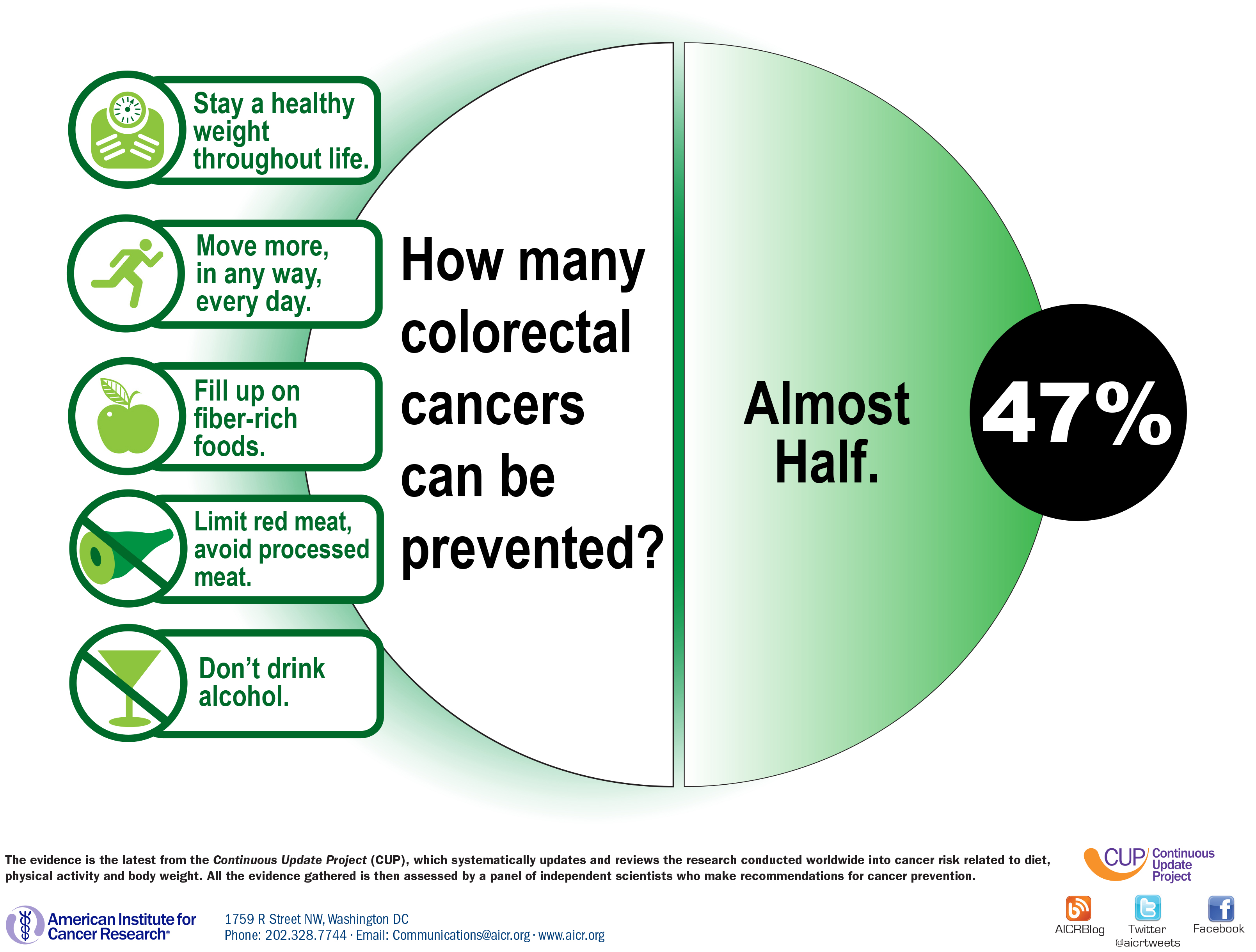

Colorectal cancer is one of the most common types of cancer, and research shows that changes in diet can play a crucial role in its prevention and treatment. At Memorial Sloan Kettering Cancer Center, experts are investigating the connection between nutrition and colorectal cancer, with evidence suggesting that a diet high in fiber, whole grains, fruits, and vegetables can reduce the risk of colorectal cancer. Additionally, personalized nutrition plans are being developed to improve outcomes for patients with this condition. With the understanding that excess body fat can also contribute to cancer, the research further highlights the importance of maintaining a healthy weight through proper dietary choices.

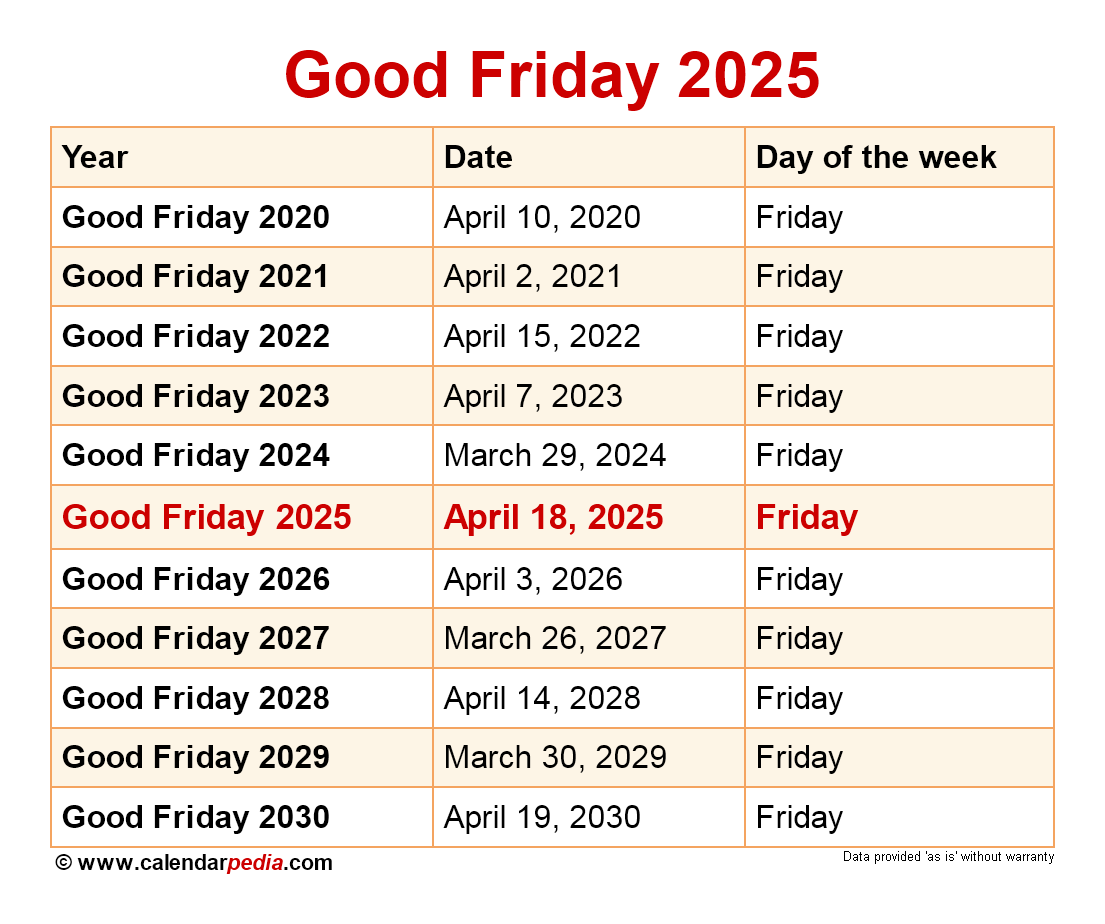

As most of the states in India observe Good Friday as a gazetted holiday, banks, government organizations, public institutions, and schools remain closed. However, according to the holiday calendar shared by the Reserve Bank of India, banks in some states like Tripura, Assam, Rajasthan, and others will remain open. This is good news for those who need to conduct banking transactions as digital channels such as mobile banking apps, internet banking, and UPI are available 24X7. Additionally, ATMs will also function normally, making it convenient for customers. The article also shares the upcoming holidays in April 2025, which do not include the regular weekly offs.

The Indian government plans to launch a new GPS-based toll collection system, the GNSS, which will replace the current FASTag system. The new system will use satellite tracking to calculate toll fees based on the distance travelled by a vehicle, eliminating the need for toll booths and manual transactions. The rollout was initially scheduled for April 1, but has faced delays, with the government now aiming to implement it within the next 15 days. The new system is expected to improve efficiency, reduce waiting times, and prevent technical glitches and fraud.

In a speech at the Economic Club of Chicago, Federal Reserve Chair Jerome Powell highlighted the challenges facing the US economy as trade policy concerns and uncertainty pose threats to growth and inflation. He emphasized the importance of the Federal Reserve's ongoing efforts to achieve a delicate balance in its policy decisions.

The Securities and Exchange Board of India (SEBI) has taken action against Gensol Engineering and its promoters, the Jaggi brothers, after receiving a complaint in June 2024 alleging fraudulent activities. The regulator has barred the promoters from holding any directorial or managerial positions in the company and has ordered an audit of its accounts. This decision will also have a negative impact on the Jaggi's other venture, the electric ride-hailing service BluSmart, as they are co-founders of the company. The funding crisis for BluSmart is likely to worsen as finding new investors becomes increasingly difficult with cases against the Jaggi brothers.

Gensol Engineering Ltd, a renewable energy company, has faced a steep decline in its shares after being hit with a ban by the Securities and Exchange Board of India (Sebi). The regulator has accused Gensol and its promoters of diverting funds raised for electric vehicle procurement into personal expenses and transactions with related entities. This has led to a loss of trust among investors and raises concerns about potential fraudulent activities within the company.

After discovering Tuoi Tre News through social media, Ray Kuschert quickly became a regular reader and eventually a contributor for almost a decade. In celebration of Tuoi Tre News' newly revamped website, Kuschert shares his emotional journey with the newspaper and how it has led to friendships, cultural connections, and opportunities to share his experiences of living in Vietnam with the world.

WestJet, one of Canada's leading low-cost airlines, has announced a new program called "Vacation Flex" that allows its guests to showcase their vacation photos on digital billboards and bus stops across the country. This initiative aims to give everyday Canadians and upcoming social media influencers an opportunity to gain more exposure and potentially go viral. With this creative program, WestJet once again proves their commitment to providing unique and affordable travel experiences for their guests.

Øystein Kalleklev, the CEO and driving force behind the success of Flex LNG, has resigned after 7.5 years with the company. The company's board has appointed Marius Foss as interim CEO, who has been instrumental in the company's commercial strategy since joining in 2018. While Kalleklev's departure is regretted, the board and Kalleklev himself have expressed gratitude for his leadership and are confident in Foss' ability to continue driving shareholder value.