KFin Technologies, a leading asset management firm, has joined BlackRock's Aladdin Provider network in order to enhance its operating model and offer more efficient and standardized services to clients. This collaboration has resulted in a 6% increase in share prices. KFin Technologies' stock has been on a rise for the past six months and its relative strength index stands at 65.7. Additionally, the IPO for KFin Technologies had a successful market debut, indicating a positive outlook for the company's future.

KFin Technologies Soars: Collaboration with BlackRock Boosts Share Prices

Background

KFin Technologies, a leading provider of asset management solutions, has been making waves in the industry. Founded in 1987 as Kesar Financial Services, the company has evolved into a global player, servicing over 250 million investor accounts in 24 markets.

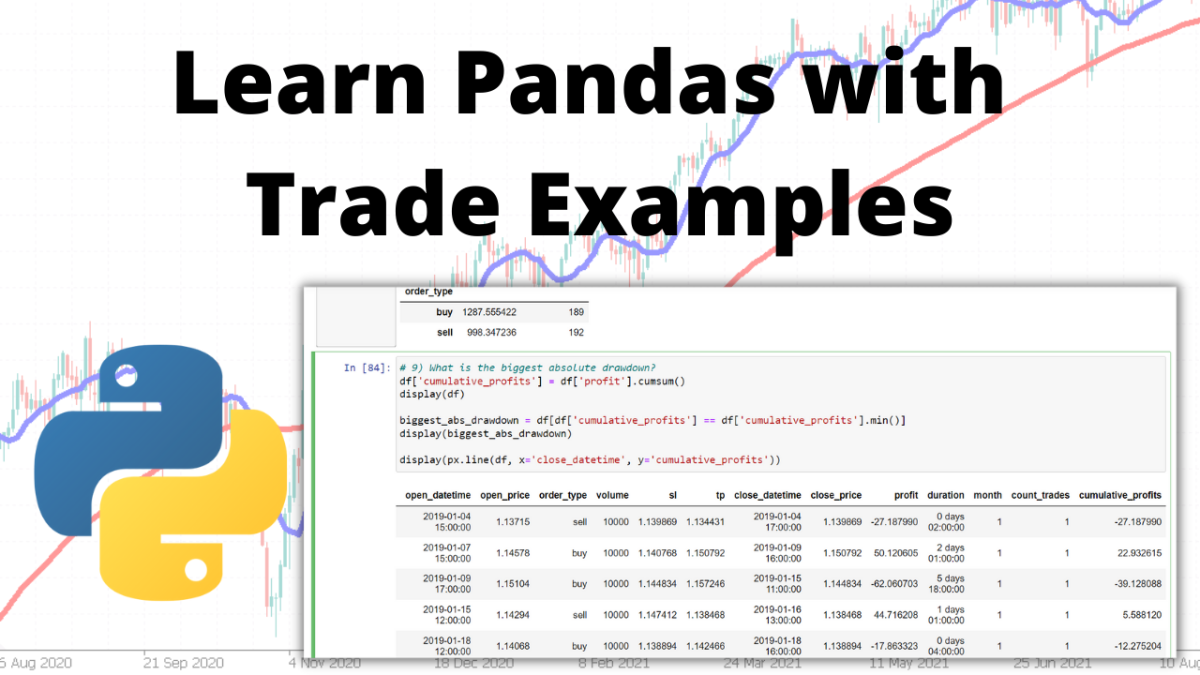

BlackRock Collaboration

In a recent strategic move, KFin Technologies joined BlackRock's Aladdin Provider network. Aladdin is a comprehensive platform that provides portfolio management, risk analytics, and data services. By integrating with Aladdin, KFin aims to enhance its operating model, reduce costs, and offer more efficient and standardized services to clients.

This collaboration has had a significant impact on KFin's share prices, which have increased by 6%. The company's stock has been on a steady rise for the past six months, reflecting the positive market sentiment surrounding the partnership.

IPO Debut

In July 2022, KFin Technologies made a successful market debut on the National Stock Exchange of India. The IPO was oversubscribed by over 50 times, underscoring the strong investor interest in the company. The funds raised through the IPO will be used to expand KFin's operations and invest in technology advancements.

Top 5 FAQs

1. What is the significance of KFin's collaboration with BlackRock?

This partnership provides KFin access to Aladdin, a leading platform for portfolio management and risk analytics. It will allow KFin to streamline its operations, reduce costs, and offer more efficient services to clients.

2. How has the BlackRock collaboration impacted KFin's share prices?

The collaboration has led to a 6% increase in KFin's share prices, signaling the market's positive outlook on the partnership.

3. What was the performance of KFin's IPO?

KFin's IPO was oversubscribed by over 50 times, indicating strong investor demand for the company's shares.

4. What is the outlook for KFin Technologies?

KFin's collaboration with BlackRock, successful IPO, and strong track record position it well for continued growth in the asset management industry.

5. What are the drivers behind KFin's recent stock price rise?

The collaboration with BlackRock, positive market sentiment, and the company's strong fundamentals have all contributed to the rise in KFin's share prices.

The recent Bihar Investor Summit 2024 saw a number of major announcements in the renewable energy sector, with NHPC pledging to invest Rs 5,500 crore, IOC announcing an investment of Rs 21,000 crore for refinery expansion, and NTPC revealing plans for a nuclear project. The Adani Group also announced a major investment of Rs 20,000 crore in a power plant in the state. With a focus on boosting industrial growth, the summit showcased Bihar's potential for investment in the renewable energy sector, particularly in fields like manufacturing and leather industry. The state has already attracted over 3,800 industry proposals, as confirmed by the Chief Secretary.

The state of Bihar is gearing up for its Investor Summit 2024, which will focus on highlighting the investment potential and growth opportunities in the manufacturing, renewable energy, and leather industries. With major corporations like Adani Group, IOC, Shree Cement, NTPC, and NHPC announcing multi-billion rupee investments in power plants, refineries, and cement plants, the state is set to attract a huge influx of capital and boost its economic development. The summit, scheduled for December 2024, is expected to provide a platform for investors to engage with government officials and business leaders and explore potential partnerships and collaborations. With the aim to transform Bihar into a vibrant industrial hub, the state government is leaving no stone unturned to showcase its strengths and attract investments.

The once-iconic shopping tradition of Black Friday has transformed into a months-long sales bonanza, with the term "doorbusters" used throughout the year and sales starting as early as October. The frenzy and hype surrounding the annual event seem to grow bigger each year, but is Black Friday still as relevant as it used to be? As shoppers hunt for deals and retailers try to keep up with the changing landscape, one thing is clear: Black Friday is no longer just a one-day event.

The highly anticipated $PANDAS token distribution has officially started, with just seven days left until its launch on major exchanges. Early investors can claim their tokens by following a simple process on the Neelsky App and securing their spot for trading. Don't miss out on this opportunity to get in on the hype surrounding $PANDAS before it hits the market on 25th December.

Jason Ruiyi Chin, known as Easlo online, stumbled upon a lucrative opportunity after graduating high school in 2021. He started producing free Notion templates and grew his Twitter audience while studying popular productivity accounts. In fall 2021, he began receiving tips for his templates and decided to turn his internet persona into a business. In just one month, his first paid template brought in over $3,000.

The Indian stock market has been buzzing with excitement as several big names such as Mamata Machinery, Diffusion Engineers, Swiggy, and more have announced their initial public offering (IPO). The latest being Mamata Machinery, whose IPO was fully subscribed within minutes of its launch. The trend continues as companies like Diffusion Engineers report being over-subscribed by over 27 times. It is evident that investors are eager to get their hands on these IPOs, with some even being over-subscribed by up to 76 times. It's a clear indication of the market's confidence in these companies and their potential for growth.

Spright Agro Limited, a prominent player in contract farming and agriculture trading, is set to acquire additional land as part of its growth strategy. Focused on maintaining its position as a leader in the field, this move is expected to boost the company's revenue by 10-15% for the financial year. With a commitment to sustainable farming practices and a drive to empower farmers, Spright Agro Limited is poised to create new opportunities and set new benchmarks in the agricultural industry.

Hansaraam Bhati, a 43-year-old passenger aboard the Mumbai ferry that capsized on Wednesday, remains missing as his family struggles to accept that he may have drowned. Despite his skills as a swimmer and wearing a lifejacket, Bhati’s fate is still unknown as authorities continue to search for him and other missing passengers. The family is also blaming the Indian Navy for the accident, which occurred when a Navy boat hit the ferry carrying passengers from the Gateway of India to Elephanta Island. With the death toll at 13 and possible rising, the investigation into the cause of the collision is ongoing.

The IPO of Mamata Machinery Ltd, a manufacturer of packaging machinery from Gujarat, opened to a stellar reception, with the offering's price band set between Rs 230 and Rs 243 per share. Within the first hour of bidding, the IPO was subscribed over three times, and by the end of the first day, it had received bids for 16.49 times the total shares on offer. Retail investors can apply for a minimum lot size of 61 shares with a minimum investment of Rs 14,823, while small and big non-institutional investors can invest in a minimum lot size of 14 and 68 lots respectively.