The odds of XRP ETF approval in the US have increased to 70% on Polymarket, thanks to the token's surge in price and growing enthusiasm for cryptocurrency under the incoming Trump administration. The token's rise has brought it close to its all-time high of $3.84, set seven years ago. With the launch of Bitcoin and Ethereum ETFs, investors and influencers are now speculating on the potential approval of an XRP ETF. Will the rally continue and will the ETF be approved? The odds seem to be in its favor.

XRP ETF Approval Odds Rise Amid Price Surge and Regulatory Optimism

Recently, speculation has intensified around the potential approval of a XRP exchange-traded fund (ETF) in the United States. According to the prediction market Polymarket, the odds of such an approval have risen to 70%. This optimism stems from several factors.

Background:

XRP is the native digital asset of the Ripple network, a blockchain-based cross-border payment platform. The Ripple network has garnered significant attention in the financial sector due to its fast and cost-effective transactions.

Price Surge and Regulatory Enthusiasm:

In recent weeks, XRP's price has surged significantly, reaching close to its all-time high set seven years ago. This price increase has generated renewed interest in XRP and cryptocurrencies as a whole.

Additionally, the incoming Biden administration has expressed a more positive stance towards cryptocurrency regulation compared to the previous Trump administration. This shift has raised hopes that the regulatory environment for cryptocurrencies will become more favorable.

Influence of Bitcoin and Ethereum ETFs:

The recent approval of Bitcoin and Ethereum ETFs has further fueled speculation about the potential for an XRP ETF. Investors and influencers are anticipating that the precedent set by these ETF approvals will pave the way for XRP to follow suit.

Top 5 FAQs and Answers:

An ETF (exchange-traded fund) is an investment fund that tracks the performance of an underlying asset, such as a stock, commodity, or index. ETFs trade on stock exchanges like individual stocks.

An XRP ETF would provide investors with a regulated and convenient way to invest in XRP without the need to purchase and store the digital asset directly. This could increase demand for XRP and support its price.

The SEC has not announced a specific timeline for its decision on an XRP ETF. However, analysts anticipate that the decision could come within the next few months.

As with any investment, there are risks associated with investing in an XRP ETF. These risks include regulatory changes, price volatility, and the SEC potentially rejecting an XRP ETF application.

The Biden administration's more positive stance towards cryptocurrency regulation has increased optimism among investors and analysts regarding the likelihood of an XRP ETF approval. However, it is important to note that the SEC remains the independent agency responsible for approving ETFs.

The first day of India's most prestigious motor show, the Auto Expo 2025, saw major car manufacturers like BMW, Hyundai, Isuzu, and Kia introduce and showcase their latest electric models. BMW launched its first locally assembled electric vehicle, Hyundai revealed prices for its mass-market EV, Isuzu displayed an electric version of its pickup truck, and Kia debuted its facelifted EV6 with autonomous features and an impressive 650km range. The event is a reflection of the growing shift towards electric vehicles in the Indian market.

At a joint meeting of various authorities, Chief Secretary Atal Dulloo revealed that the All India Institute of Medical Sciences (AIIMS) Awantipora is expected to be completed and functional by November of this year. He emphasized on expediting the work after the winter season and ensuring adequate water supply to the hospital. The Executive Director of AIIMS, Dr Sachidananda Mohanty, provided an update on the progress and stated that with an expected completion of 61% of the blocks, the institute is on track to meet the November deadline. The Chief Secretary also assured his support for any pending issues that the AIIMS team may have.

A Messari analyst predicts that XRP will overtake Ethereum as the leading altcoin within the month following Trump's inauguration, citing the "Trump effect" and the potential launch of an XRP ETF. The analyst points to several metrics that suggest Ethereum is currently overvalued, including a historical peak in open interest and a significant drop from its all-time high. This news could have investors reconsidering their investment strategies as the competitive landscape in the cryptocurrency market shifts.

The cryptocurrency market is abuzz with XRP's record-breaking surge, pushing its market cap past Disney's. With analysts predicting a possible $10 price by 2025, XRP's future looks promising. The token's success can be attributed to a combination of factors, including positive regulatory developments and Ripple's growing influence, led by CEO Brad Garlinghouse. As XRP continues to gain traction among institutional investors, it is poised to make a significant impact in the business world and beyond.

Family Express, a convenience store chain based in Indiana, has launched a new and improved loyalty program for its customers. The program incorporates advanced technology, such as a personalized mobile app and artificial intelligence, to create a one-to-one experience for customers. This approach not only boosts sales and customer loyalty, but also sets the brand apart from the competition in the ever-growing loyalty market. Other convenience store operators are advised to continually update and enhance their loyalty programs to meet changing customer expectations or risk losing business to the competition.

The Indian auto industry witnessed a significant event with the inauguration of the Bharat Mobility Global Expo 2025 by Prime Minister Narendra Modi. The first day of the expo saw the unveiling of several new car models from both Indian and international brands, including the Maruti e Vitara, Toyota Urban Cruiser BEV concept, Hyundai Creta Electric, and Tata Sierra EV, Bandipur, and Stealth Editions. These models come with advanced features and impressive ranges, aiming to capture the growing demand for electric vehicles in the Indian market.

The Indian auto industry has been buzzing with news of major developments from two giants, Tata Motors and Eicher. Tata Motors' subsidiaries have partnered with Saraswat Bank for electric fleet financing and have seen a 1% increase in global wholesales in the third quarter of fiscal year 2025, while also urging government incentives for electric fleets. Meanwhile, Eicher has launched their new electric Pro X range for small commercial vehicles and has formed a partnership with TIVOLT Electric Vehicles and Tata Power for EV charging infrastructure. Lohia Auto has also announced their entry into the EV market with their brand 'Youdha.'

As Republic Day approaches, Indian e-commerce platforms Flipkart and Amazon launch their annual sales with attractive discounts. One of the most sought-after deals during this sale is the 14% discount on the iPhone 14 series, with the 128GB model now available for just Rs 50,999, down from its original price of Rs 59,900. This sale also includes additional bank and exchange offers, making the iPhone 14 an even more affordable option for buyers. While Flipkart offers discounts of up to Rs 10,000 on the iPhone 16 and iPhone 16 Plus, Amazon may still have competitive deals with its specific bank offers or gift cards.

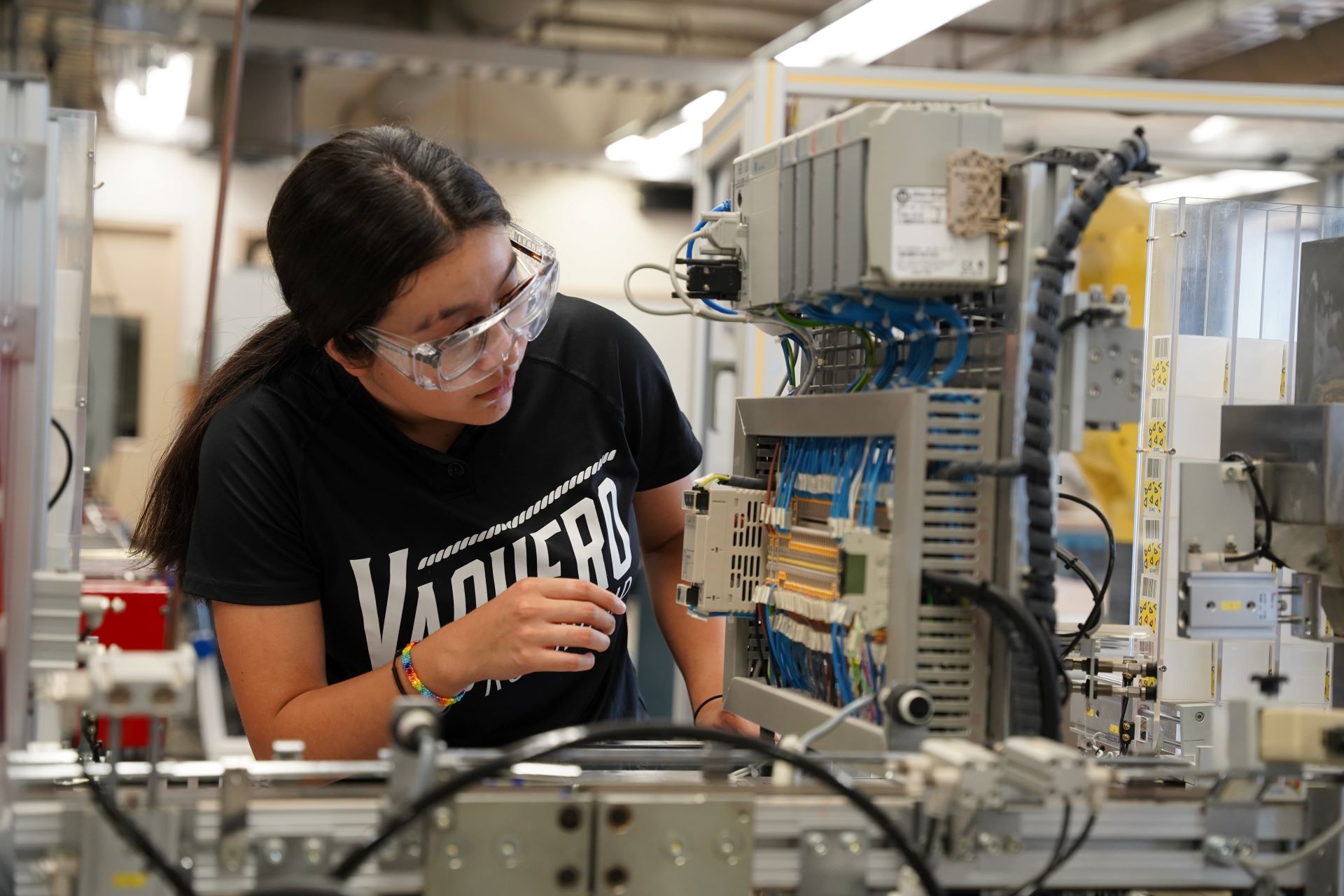

Alexa McCulley, an industrial engineer at MARSHALLTOWN Company, tackles daily challenges and problem-solving opportunities in her role at the company's production plant. McCulley's passion for industrial engineering began early in high school and has led her to excel in optimizing production processes and ensuring quality control. Her diverse responsibilities include creating a safe work environment and continuously seeking ways to improve efficiency. With her dedication and expertise, McCulley is a vital part of the company's success.