The stock market witnessed a massive plunge, causing investors to lose a whopping Rs. 9.28 Lakh Crore. ICICI Bank saw a 2% rise in stock after reporting strong Q3 earnings, but it wasn't enough to stem the overall market trend. ICICI Pru Life, UltraTech Cement, MCX, Wipro, and Dr. Reddy's were among the companies that saw stock prices plummet after disappointing earnings reports. LIC MF, Aditya Birla, and Bank of India added to their investment portfolio by buying shares of Manorama, while HDFC Life saw a 12% surge in stock after announcing strong Q3 earnings.

Aditya Birla Sun Life Insurance: Market Movement and Investment Trends

Background

Aditya Birla Sun Life Insurance (ABSLI) is a joint venture between the Aditya Birla Group and Sun Life Financial, providing a range of life insurance and investment products in India. The company has a strong presence in the market, with a diverse portfolio of products and a wide distribution network.

Current Market Trend

In recent times, the Indian stock market has experienced a significant decline, with investors losing a staggering Rs. 9.28 Lakh Crore. This has been attributed to factors such as geopolitical tensions, rising interest rates, and concerns over global economic growth.

ABSLI's Performance

While the overall market trend has been negative, ABSLI has managed to perform relatively well. The company has reported strong financial performance in the past few quarters, supported by its growing customer base and innovative product offerings.

Investment Trends

Despite the market volatility, some investors are continuing to add to their portfolio by investing in companies with strong fundamentals. In recent months, LIC MF, Aditya Birla, and Bank of India have increased their shareholdings in Manorama Industries. Additionally, HDFC Life has seen a significant surge in stock prices after announcing robust Q3 earnings.

Top 5FAQs

Q1: What is the current market capitalization of ABSLI? A1: As of March 2023, the market capitalization of ABSLI is approximately Rs. 1.15 Lakh Crore.

Q2: How has ABSLI performed in recent quarters? A2: ABSLI has reported strong financial performance, with steady growth in both its insurance and investment businesses.

Q3: What are some of the key factors driving ABSLI's growth? A3: ABSLI's growth is primarily driven by its extensive distribution network, innovative products, and focus on customer service.

Q4: Is it a good time to invest in ABSLI? A4: While the overall market conditions are challenging, ABSLI's strong fundamentals and positive outlook make it a potential investment opportunity for long-term investors.

Q5: What is the future outlook for the Indian life insurance industry? A5: The Indian life insurance industry is expected to continue growing in the coming years, driven by factors such as rising disposable income, increasing awareness of financial planning, and government initiatives promoting insurance penetration.

In the first monetary policy review of 2025, the US Federal Reserve decided to maintain the key interest rates at 4.25-4.50 per cent, which was in line with market expectations. Fed Chairman Jerome Powell stated that the economy had made significant progress and that indicators suggested continued solid expansion. The US market initially showed a downward trend but later recovered as GDP predictions for 2024 exceeded 2%. The FOMC released a statement stating that risks to achieving employment and inflation goals are balanced, leading to a stable target range for federal funds rate.

As the Union Budget approaches, speculations are rife about possible changes in the taxation structure. According to reports, Finance Minister Nirmala Sitharaman may merge features from both the old and new tax regimes, leaving the new one as the only tax structure with reduced rates and zero concessions. This could result in the abolition of all 80C, 80D, and HRA deductions, including investments such as PPF, life insurance premiums and ELSS. Taxpayers may also be able to claim a deduction of Rs 5,000 for preventive health check-ups under 80D.

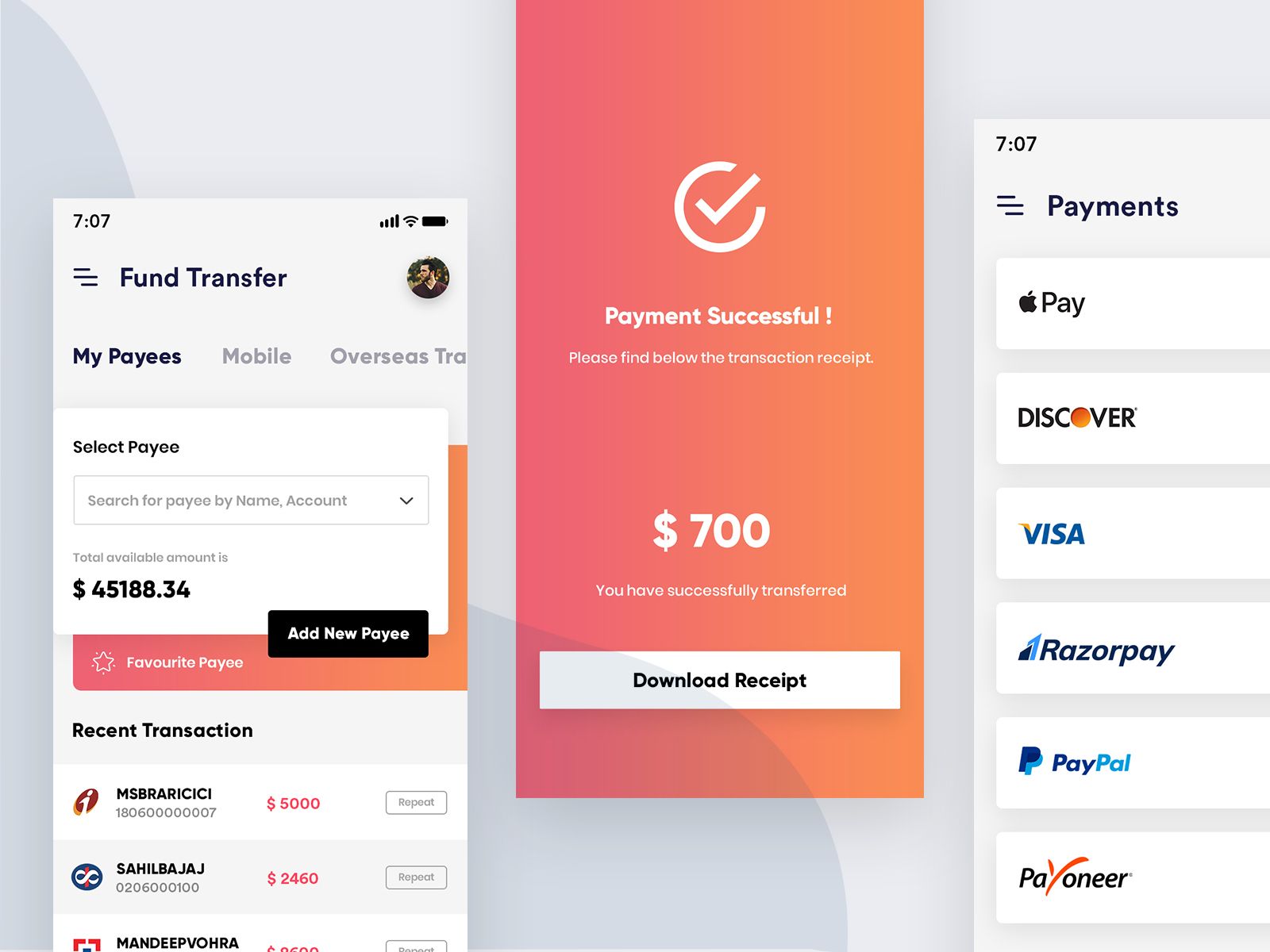

Visa, a leading credit card and digital payments company, announced its partnership with XMoney to launch the XMoney Account, allowing users to transfer funds instantly and securely to their X Wallet via Visa Direct. The feature will also be connected to the user's Visa debit card, enabling easy P2P payments. Additionally, users will have the option to transfer funds directly to their bank accounts. This partnership is another step towards X's goal of becoming an all-in-one app, similar to China's super app model.

With the Union Budget 2025 just around the corner, it's crucial to have a grasp of important budgetary terms. As Finance Minister Nirmala Sitharaman gears up to present the second full budget of Prime Minister Narendra Modi's third term, here's a comprehensive guide to key budgetary concepts. Stay informed and prepared for the unveiling on February 1.

The Digital News Publishers Association has applied to intervene in the copyright suit between Asian News International and OpenAI, over alleged unauthorized use of online news content. Justice Amit Bansal has issued notice on the intervention plea, but has cautioned against expanding the scope of the suit. The Court also criticized the publication of OpenAI's written submission in the media before the hearing. While OpenAI sought time to respond, its counsel has argued that DNPA does not have authorization to file such an application.

Australian brands are still selling children's nightwear made from synthetic fibres that pose fire hazards, despite nine recalls issued by the ACCC. Wool, the only naturally flame-resistant fibre, has been deemed the safest option, but weak laws and labelling requirements in Australia continue to put consumers at risk.

In a conversation with Rob Isbitts, investment expert Matthew Tuttle discusses the selfishness problem on Wall Street and how ETFs have solved it. They also explore the potential for levered and inverse ETFs, the value of active management in finding alpha, and the importance of hedges, edges, asymmetry, and themes in investing. Tune in to learn more about Tuttle's unique perspective on the market.

Anand Mahindra, the esteemed Indian business tycoon, has once again displayed his admiration for India's first armless archer, Sheetal Devi, by gifting her a customized Mahindra Scorpio-N. At only sixteen years old, Sheetal has made history by winning a bronze medal at the Paris Paralympics last year and has continued to impress at various competitions, including the Asian Para Games. Mahindra was struck by her extraordinary skill and determination, and was moved to gift her with a symbol of her identity as an archer. This act of kindness has once again brought attention to Sheetal's inspiring journey and serves as a reminder of the power of resilience and determination.

Yorkshire and former England captain Michael Vaughan have openly criticized the decision to select Adil Rashid for the first Test against India, despite the spinner's absence from red-ball domestic cricket this season. Rashid has responded to their comments by stating he is not affected by their opinions. While Vaughan has called the situation "ridiculous", Chief Executive Mark Arthur of Yorkshire has expressed disappointment with England's choice, emphasizing that it diminishes the value of the county game. Rashid's desire to focus on white-ball cricket and his selection by Ed Smith based on exceptional circumstances is behind the decision, but it has caused significant tension within the English cricket community.

After 25 years of being wrongfully imprisoned in Louisiana, a 62-year-old African American man was finally released on Tuesday. Wilbert Jones was sentenced to life in prison without parole in 1973 for kidnapping and aggravated rape. However, new evidence surfaced that showed Jones' innocence, leading to his release. The case has raised questions about the justice system and the impact of wrongful convictions on individuals and their families.