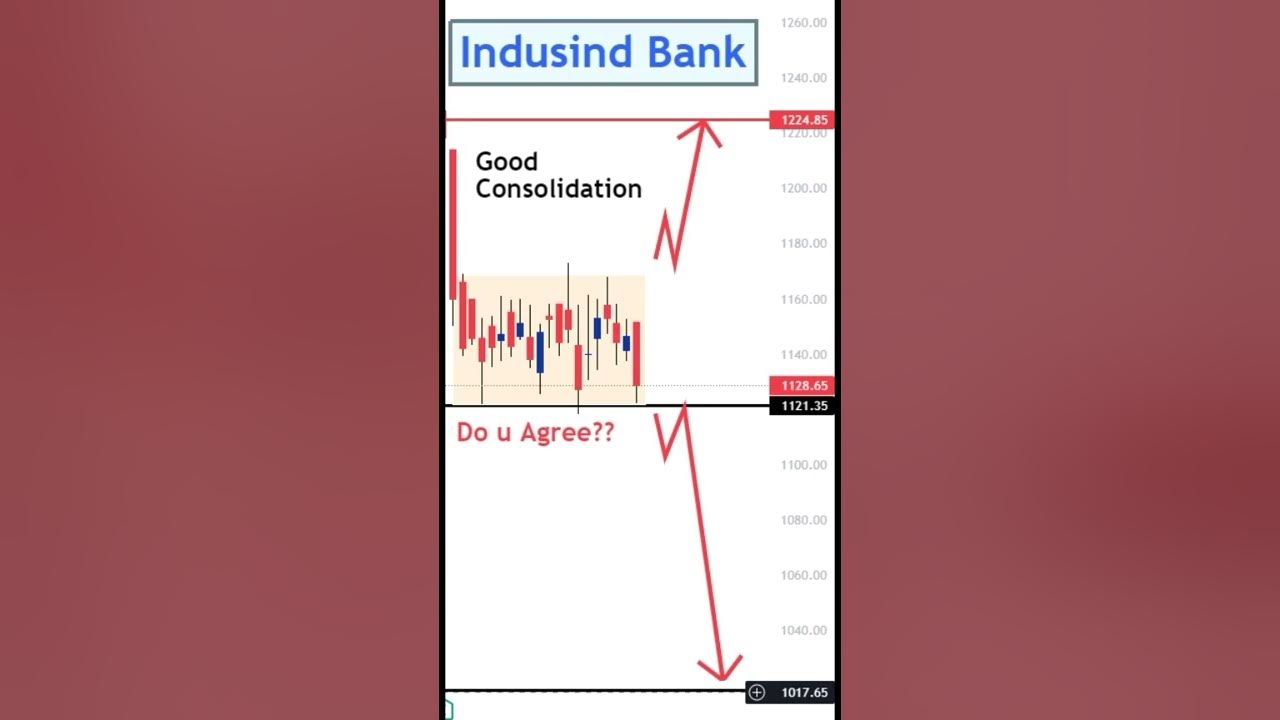

IndusInd Bank's stock plummeted 15% after the lender reported a significant drop in net profits for the second quarter due to stress in the microfinance sector and increased provisions for bad loans. The bank's management highlighted the growing strain on microfinance loans, which make up 9% of their loan book, particularly in tier-2 and tier-3 cities. With the overall gross non-performing asset ratio also on the rise, investors are cautious about the bank's future performance.

IndusInd Bank's Stock Plunge: A Deep Dive into the Challenges and Outlook

IndusInd Bank, one of India's leading private sector banks, has recently faced a significant decline in its stock price, following a sharp drop in net profits for the second quarter of the fiscal year 2023. This article provides a comprehensive background and analysis of the factors behind the stock plunge and addresses common concerns and FAQs related to the bank's performance and future prospects.

Background

IndusInd Bank has consistently delivered strong financial performance over the years, with robust asset quality and a diversified loan portfolio. However, the bank has been facing increasing pressures from the microfinance sector and has also been making higher provisions for bad loans.

Stress in the Microfinance Sector

Microfinance loans account for approximately 9% of IndusInd Bank's loan book. The bank's management has highlighted that the microfinance sector, which typically caters to low-income and vulnerable populations, has been experiencing growing stress. This is particularly evident in tier-2 and tier-3 cities, where the bank has a significant presence. The rising defaults and delinquent loans in the microfinance segment have impacted IndusInd Bank's asset quality and profitability.

Increased Provisions for Bad Loans

In addition to the challenges in the microfinance sector, IndusInd Bank has also been increasing its provisions for non-performing assets (NPAs). This is a reflection of the bank's conservative approach to risk management, as it anticipates potential loan losses in the future. The higher provisioning levels have put pressure on the bank's earnings and have contributed to the decline in net profits.

Stock Plunge

The combination of stress in the microfinance sector and increased provisioning for bad loans has led to a significant drop in IndusInd Bank's profitability. This, in turn, has triggered a sharp sell-off in the bank's stock, with the share price plummeting by approximately 15% in the wake of the second-quarter results announcement.

Outlook

IndusInd Bank's management remains committed to addressing the challenges and improving the bank's performance. The bank is taking steps to strengthen its microfinance operations and is also working to enhance its risk management practices. However, the recovery in the microfinance sector and the overall macroeconomic environment will play a key role in determining the bank's ability to regain its previous trajectory of growth.

FAQs

1. What are the main reasons for the decline in IndusInd Bank's stock price? A: The stock plunge is primarily due to a significant drop in net profits, caused by stress in the microfinance sector and increased provisioning for bad loans.

2. How significant is the exposure to microfinance loans in IndusInd Bank's loan book? A: Microfinance loans account for approximately 9% of IndusInd Bank's loan book, with a concentration in tier-2 and tier-3 cities.

3. Is the increase in provisioning for NPAs a positive sign? A: While provisioning for NPAs can impact earnings in the short term, it is a prudent risk management measure that enhances the bank's long-term resilience by setting aside funds to cover potential loan losses.

4. What is the management's response to the challenges? A: IndusInd Bank's management is working to strengthen microfinance operations, enhance risk management, and explore new growth opportunities.

5. What are the expectations for IndusInd Bank's future performance? A: The recovery in the microfinance sector, the macroeconomic environment, and the bank's ability to execute its strategy will influence its future performance.

The Indian Space Research Organisation (ISRO) announced the successful completion of the SpaDex Mission's de-docking, marking a significant achievement for the country's space ambitions. The Union Minister of State for Science and Technology and Earth Sciences congratulated ISRO on their success and praised PM Modi's support for the country's space endeavors. The undocking process, which involved precise maneuvers, was completed on January 16 this year, with India now becoming the fourth country in the world to possess space docking technology. This breakthrough mission demonstrates India's technological prowess in spacecraft rendezvous, docking, and undocking, which is crucial for future advancements in space exploration.

A popular video circulating on social media shows individuals in Mumbai struggling to answer the question of what is the official language of Bengaluru. Many mistakenly guessed Hindi or English, while some even suggested Tamil or Sanskrit. The video has sparked a debate among Kannadigas, as many are voicing their frustration over the misrepresentation of Kannada as the official language of the city. This controversy highlights the larger issue of language identity and representation in the business hub of India.

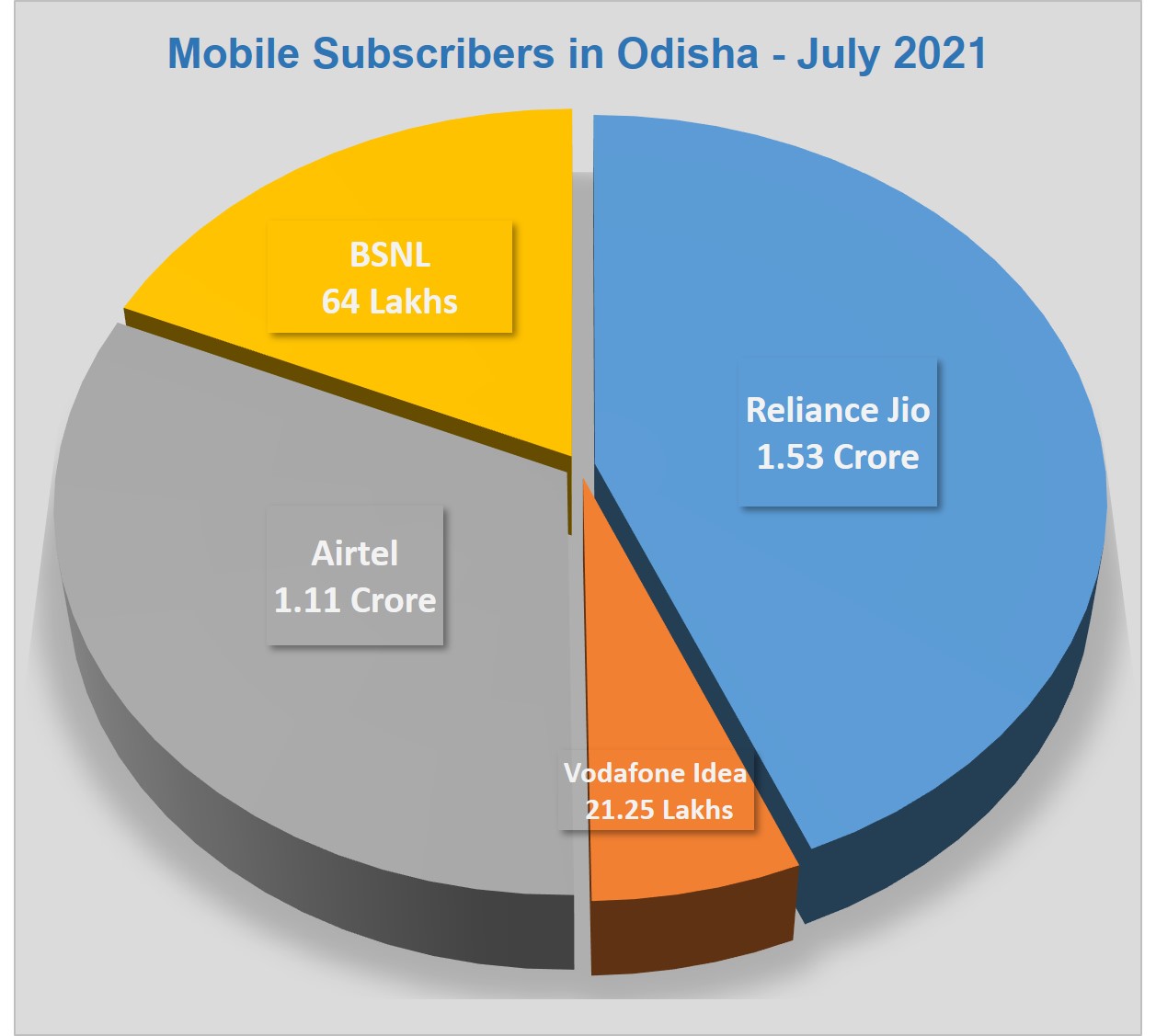

As BSNL continues to lose subscribers due to recent tariff hikes, the state-run telecom operator has launched a new recharge plan to retain its users. Priced at Rs 750 and valid for six months, the plan offers 1GB of daily data, unlimited calling, and 100 SMS per day. This move comes after over 71,000 SIM cards were blocked in Andhra Pradesh and Telangana for being acquired through fraudulent means and used for scams. BSNL's new offering aims to discourage users from switching to other networks by providing a competitive plan exclusively for select customers.

Shares of Bharti Airtel saw a surge after the company entered into a partnership with Elon Musk's SpaceX to offer satellite communication services in India, with a potential target market in remote areas. With Citi and JP Morgan maintaining a Buy rating and setting high stock targets, investors are buzzing about the company's potential for growth in the telecom industry. Despite uncertainties about regulatory approval and pricing, Airtel's new partnership has boosted the stock by 38% in the past year and 137% in the last 3 years, proving to be a lucrative investment.

The latest report from the Telecom Regulatory Authority of India (TRAI) shows that Reliance Jio added 3.9 million wireless subscribers in December 2024, solidifying its position as the dominant player in the Indian telecom market. Meanwhile, Vi and BSNL faced significant subscriber losses, with Vi losing 1.715 million subscribers and BSNL losing 0.322 million subscribers in the same period. In other news, Bharti Airtel has announced a partnership with Elon Musk's SpaceX to offer Starlink's high-speed internet services to customers in India, pending necessary approvals.

Harshil Agrotech Limited, a company with a long history in industrial design and fabrication, has recently changed its focus to the trading and manufacturing of agricultural products. This shift in the company's object clause reflects a growing trend in the market towards agro-based industries. With expert advice and support from IIFL Capital Services, investors can expect better recommendations and improved returns on their investments in Harshil Agrotech. Download the IIFL app to stay updated on the latest developments and make wise investment decisions.

In the fast-paced world of business, feedback is often seen as a reaction to isolated incidents, leading to biases and emotions that can hinder its effectiveness. To truly drive growth, leaders and HR professionals must shift the focus from immediate reactions to observable patterns of behavior. By creating a culture of psychological safety, feedback can become an opportunity for growth rather than a threat to self-esteem. However, this requires a rethinking of how feedback is delivered and received, as well as understanding common emotional responses and how to overcome them.

Telecom giant Bharti Airtel has partnered with SpaceX, owned by Elon Musk, to bring Starlink's high-speed internet to India. This marks a significant milestone for Airtel's commitment to satellite connectivity, with the venture pending regulatory approvals. The collaboration is expected to enhance Airtel's diverse service portfolio, providing reliable and affordable broadband to even the most remote areas in India. This partnership showcases Airtel's dedication to innovation and staying at the forefront of advancements in global connectivity, positioning them as a leading telecom operator globally.

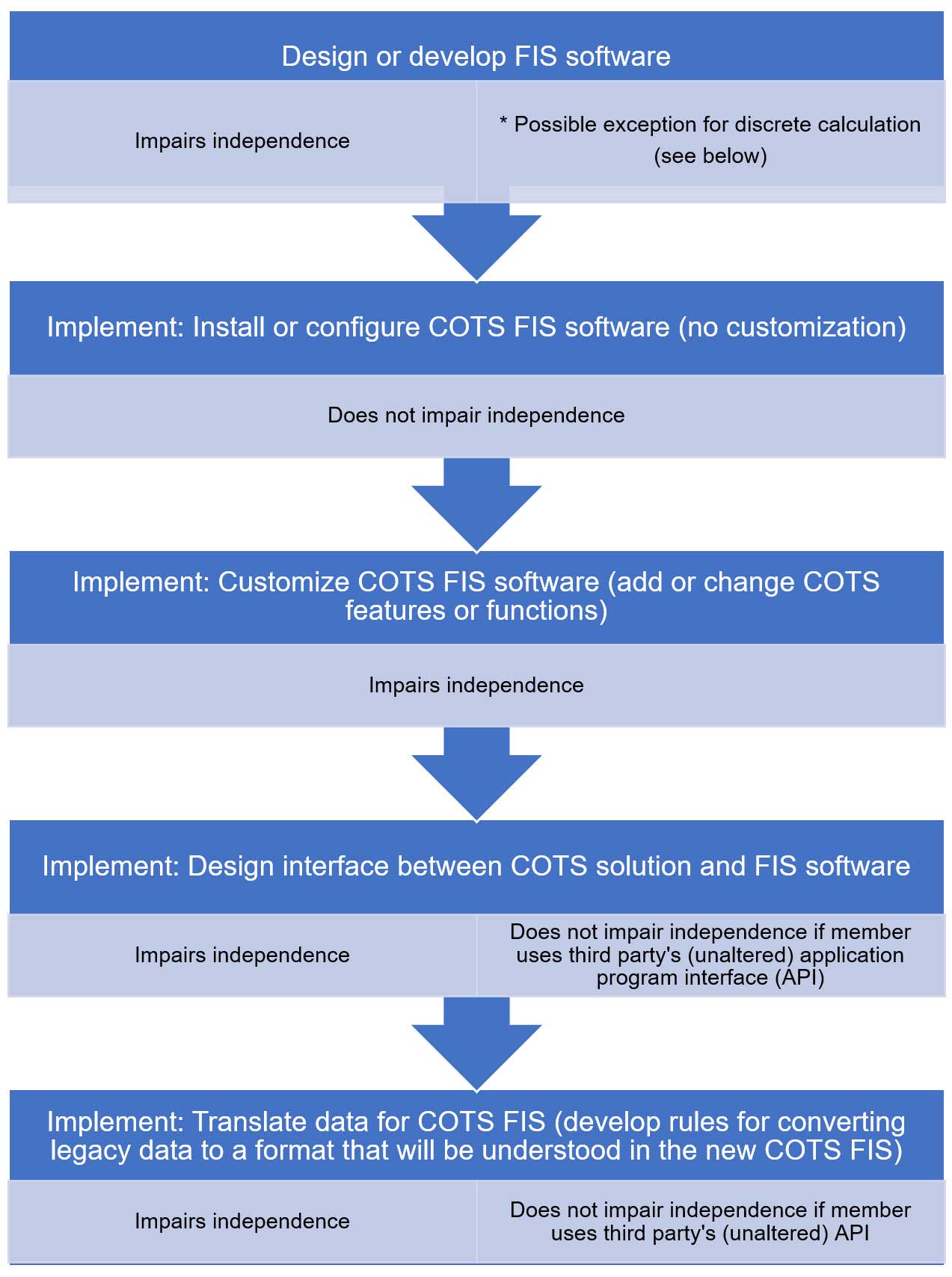

The AICPA Professional Ethics Executive Committee (PEEC) has released a discussion memorandum featuring preliminary conclusions about potential revisions to independence rules related to alternative practice structures. The memorandum aims to address the increasing prevalence of private-equity investment in accounting firms and stimulate feedback from the public. PEEC plans to use this feedback to create an exposure draft that includes a new interpretation of the independence rules, with a focus on issues surrounding auditor independence and private-equity-related entities. This initiative reflects the PEEC's commitment to protecting the public interest and ensuring the integrity of the attest function in the face of evolving industry practices.

Harshil Agrotech, a leading company in the agricultural industry, recently held a board meeting to discuss investment strategies and provide expert advice to customers. By signing up and agreeing to receive communication through Whatsapp, investors can now receive better recommendations and make more informed and successful investments. Additionally, IIFL has a dedicated customer care number for various investment services such as gold, NCD, NBFC, insurance, and NPS, making it easier for customers to get in touch with their team for any queries or concerns.