After a sharp fall on Monday, domestic markets are expected to open positively as global markets rebound. Despite not facing a major decline like other global markets, Indian stocks have turned cautious according to analysts. They predict that while large-caps will remain stable, small-cap and mid-cap stocks may face pressure. The Gift Nifty at 24,288 is an indication of a 200 point opening, showing strong buying at lower levels.

The Indian Stock Market: A Cautious Rebound

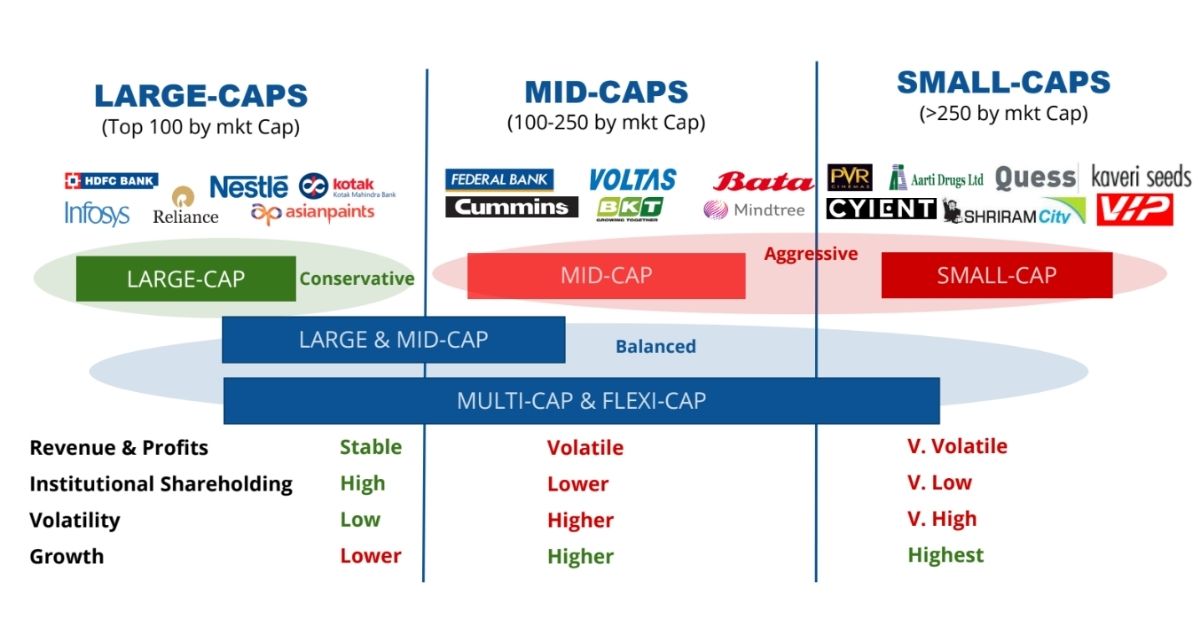

After a sharp fall on Monday, domestic markets are expected to open positively as global markets rebound. Despite not facing a major decline like other global markets, Indian stocks have turned cautious according to analysts. They predict that while large-caps will remain stable, small-cap and mid-cap stocks may face pressure.

Background

The Indian stock market has been on a roller coaster ride in recent months. The benchmark Nifty 50 index has rallied by over 15% since the start of the year, but it has also experienced sharp declines along the way. The most recent decline was triggered by a global sell-off in stocks, which was caused by a combination of factors, including concerns about rising interest rates, the ongoing war in Ukraine, and the COVID-19 pandemic.

Current Situation

Despite the recent decline, the Indian stock market remains relatively stable compared to other global markets. The Nifty 50 index is still trading above its 50-day and 200-day moving averages, which indicates that the overall trend is still positive. However, analysts are cautious and predict that the market may face further headwinds in the short term.

Factors to Watch

There are a number of factors that investors should watch in the coming weeks and months. These include:

Top 5 FAQs

1. What is causing the volatility in the Indian stock market?

The volatility in the Indian stock market is being caused by a combination of factors, including concerns about global economic growth, rising interest rates, the ongoing war in Ukraine, and the COVID-19 pandemic.

2. Will the Indian stock market continue to decline?

Analysts are cautious and predict that the Indian stock market may face further headwinds in the short term. However, the overall trend is still positive, and the Nifty 50 index is still trading above its 50-day and 200-day moving averages.

3. What sectors are most at risk in the current market environment?

Small-cap and mid-cap stocks are most at risk in the current market environment. These stocks are more volatile and have less liquidity than large-cap stocks.

4. What should investors do in the current market environment?

Investors should remain cautious and avoid taking unnecessary risks. They should also focus on investing in quality companies with strong fundamentals.

5. What is the outlook for the Indian stock market in the long term?

The long-term outlook for the Indian stock market is positive. India is one of the fastest growing economies in the world, and its demographics are favorable for continued growth. However, investors should be aware that the market may experience periods of volatility along the way.

In a significant development for India's aviation industry, Hindustan Aeronautics Limited (HAL) has signed an MoU with Russia's PJSC-UAC to manufacture the SJ-100 aircraft domestically. This marks the country's first full passenger aircraft production in over three decades and is seen as a major step towards achieving self-reliance in the civil aviation sector. With an expected demand for over 200 jets in the coming years, this partnership is crucial for strengthening regional connectivity and boosting the domestic manufacturing economy.

The Union Cabinet has approved the Terms of Reference for the 8th Central Pay Commission, which will revise salaries and benefits for central government employees and pensioners. The commission is expected to submit its recommendations in 18 months, following extensive consultations with various stakeholders. The recommendations are expected to be implemented from January 1, 2026.

Swan Defence and Heavy Industries, in collaboration with MDL, is making significant investments and expanding capacities at India's largest shipyard in Pipavav Port. This strategic partnership not only reinforces #AatmanirbharBharat but also opens up opportunities for partnerships and tie-ups in the shipbuilding space. The recent signing of a MoU with Mazagon Dock Shipbuilders to design and construct Landing Platform Docks for the Indian Navy is a testimony to this.

Aviation Daily reports that Air China Cargo, a subsidiary of Air China, will soon be acquiring up to ten Airbus A350Fs as part of its efforts to expand its fleet and improve air transport services. The announcement was made by Chen Chuanren, a renowned aviation correspondent for the Aviation Week Network, who joined the team in 2017. This move by Air China Cargo highlights the growing demand for air transport services in the Asia-Pacific region and is expected to contribute to the company's continued growth and success.

Airbus has officially inaugurated its new final assembly line for the A320-family in Tianjin, marking its 10th production line globally. The line is expected to significantly increase production and help achieve Airbus' target of 75 A320-family jets per month by 2027. The advanced facility will feature the company's latest technologies and processes to ensure high-quality production of aircraft worldwide. Plans for the second line were initially announced in 2023 during a state visit by French prime minister Emmanuel Macron.

Tech billionaire Elon Musk has launched a new encyclopedia, Grokipedia, which aims to surpass Wikipedia's reach and accuracy through the use of AI fact-checking. However, the website has faced criticism for its biased and potentially inaccurate information, with many pointing out that it glorifies Musk and his views. Despite this, some believe that Grokipedia could revolutionize internet searches, thanks to Musk's dominance in the tech industry.

Satyam Rastogi, a renowned expert in the business world, has been serving as a bridge between Indian and overseas companies. His valuable insights and expertise have led to successful collaborations and partnerships between various organizations. With his vast experience and knowledge, Rastogi has become a sought-after resource person in both Indian and international settings.

OMC, a state-owned mining company, is leading the charge in promoting ethical practices and transparency among its employees. As part of the Vigilance Awareness Week, OMC's top officials, including the managing director, administered an integrity pledge to employees at their head office. Employees across OMC's regional offices and mines also participated in the pledge, reaffirming their commitment to honesty and accountability. To mark the occasion, a walkathon was held to raise awareness about the fight against corruption.

Bengaluru's Chief Minister Siddaramaiah recently honored Munawar Zama, CEO and Founder of English House Academy Pvt Ltd., with the prestigious 'Pride of India Award' for his exceptional work in motivating and empowering young people. Zama, who began his career as a pharmacist, has made a significant impact through his Residential Personality Development Workshops and mentoring initiatives, reaching over 3.5 lakh individuals. During the award ceremony, the Chief Minister and other influential leaders praised Zama for instilling values and inspiring purpose among today's youth.

Assam Chief Minister Himanta Biswa Sarma has announced plans to take action against Karnataka IT Minister Priyank Kharge for claiming that the state lacks talent for major industries like a semiconductor unit. Sarma also criticized the Congress party for not speaking against Kharge's statement. Sarma said that a possible case against Kharge for insulting the youth of Assam is being considered by the state government.