The Indian banking sector is facing a significant challenge as the growth of deposits has slowed down compared to credit, creating a widening gap between the two. This has raised concerns for the government and the Reserve Bank of India, who have urged banks to focus on innovative strategies to attract more deposits. One of the main reasons for this divergence is the increasing trend of Indian households investing their savings in capital markets, resulting in a lower inflow of savings into banks. As a result, banks are looking for ways to address this issue and mitigate the risk of asset-liability mismatch.

The Widening Gap Between Deposits and Credit in India's Banking Sector

Background:

The Indian banking industry has been a key driver of economic growth in the country, playing a crucial role in mobilizing savings and providing credit to businesses and consumers. However, in recent years, the sector has faced a growing challenge as the growth of deposits has slowed down while credit growth has continued at a strong pace.

This divergence has created a widening gap between deposits and credit, raising concerns about the stability and soundness of the financial system. It has also put pressure on banks to find innovative ways to attract more deposits.

Reasons for the Divergence:

Several factors have contributed to the slowdown in deposit growth, including:

Consequences of the Divergence:

The widening gap between deposits and credit poses several risks to the banking sector, including:

Government and RBI Response:

Recognizing the significance of the issue, the Indian government and the Reserve Bank of India (RBI) have taken several steps to encourage deposit growth and address the divergence. These include:

FAQs:

1. What is the asset-liability mismatch risk faced by banks?

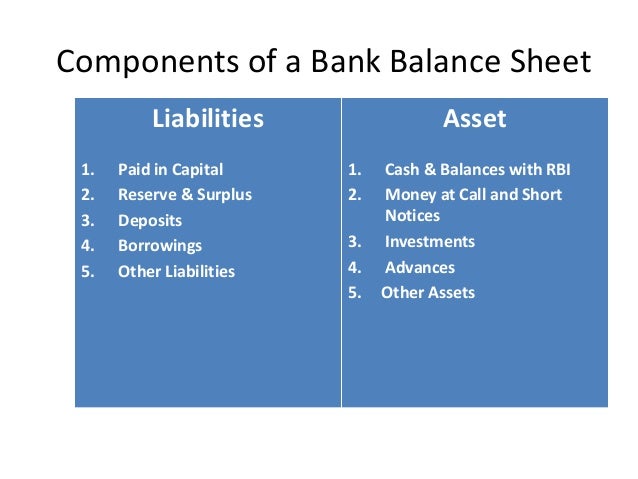

Answer: Asset-liability mismatch occurs when banks have a significant portion of short-term deposits but provide long-term loans. This can create a liquidity risk if depositors withdraw their funds before the loans mature.

2. Why are Indian households investing more in capital markets?

Answer: Higher returns, lower interest rates, and increased financial literacy have led Indian households to invest more in stocks and bonds, reducing the flow of savings into banks.

3. What are the consequences of a prolonged asset-liability mismatch?

Answer: Prolonged asset-liability mismatch can weaken banks' balance sheets, increase the risk of liquidity problems, and contribute to systemic financial instability.

4. What is the government doing to address the widening gap between deposits and credit?

Answer: The government is implementing measures to lower interest rates, promote financial inclusion, and encourage deposit growth through innovative deposit schemes.

5. What is the role of the RBI in addressing the deposit growth slowdown?

Answer: The RBI plays a crucial role in regulating the banking sector and setting monetary policy. It has lowered interest rates to make bank deposits more attractive and has urged banks to adopt innovative strategies to attract more deposits.

Amazon and Flipkart have launched their highly anticipated annual festival sales, offering huge discounts for their customers. The sales, which include up to 10% discounts for SBI and HDFC bank cardholders, are set to begin today for paid subscribers and tomorrow for regular customers. With deals on popular smartphones such as the Google Pixel 8 and Samsung Galaxy S23, this is a sale not to be missed.

The Indian government has launched the e-Shram portal to provide welfare benefits to unorganised workers working in various sectors. Workers between the age of 16 and 59 can register on the portal and receive a unique 12-digit e-Shram card, which will allow them to access social security schemes across the country. The registration can be done through CSCs, labour facilitation centres, or State Seva Kendras, and workers will receive their card with a UAN number after successful registration. This move aims to improve the lives of workers in the unorganised sector and provide them with much-needed support.

A new report has revealed that healthcare workers in the UK are among the most dissatisfied and stressed workers in the country. According to the study, over one-third of shift workers in doctors' offices and medical clinics reported being unhappy or stressed in their jobs. This highlights the pressing issue of healthcare workers nearing their breaking point due to high levels of stress and dissatisfaction.

In light of US President Donald Trump's declaration to charge an additional 10% tariff on countries perceived to support BRICS' "anti-American policies," Malaysia's Investment, Trade, and Industry Ministry has reaffirmed the country's commitment to its independent foreign and economic policy. This comes after Trump's threat that nations backing the BRICS bloc would face a tariff increase. The ministry clarified that Malaysia's engagement in any multilateral platform is guided by national interest and not ideological alignment. The US, one of Malaysia's key economic partners, has given countries until August 1 to reach a trade agreement to avoid the tariff implementation, with Trump stating that letters would be sent to countries if no deal is reached by July 9.

With the launch of no-fee crypto cards in partnership with Mastercard and support for national QR payments, Bitget Wallet is disrupting the crypto space and empowering users with seamless and cost-effective transactions. Additionally, the platform has secured a digital asset license in Georgia and joined India's I4C Sahyog Portal to support digital asset law enforcement, solidifying its position as a leader in the industry. As Bitget Wallet continues to expand its offerings, including a diverse range of entertainment options like casino games and sports betting, it is revolutionizing the way people interact with cryptocurrencies.

The government-owned bottled water company Hilly Aqua in Kerala is taking steps to reduce plastic bottle usage by installing water ATMs in crowded places like tourist destinations and medical colleges. The initial rollout is expected in popular spots like Munnar and Thekkady, and the company plans to expand to more locations in the future. A QR code will be scanned and a payment made to dispense water from the machine, making it more affordable than bottled water. This initiative not only benefits the environment but also creates a new opportunity for the company.

The ongoing conflict between US President Donald Trump and tech billionaire Elon Musk escalated on Sunday as Trump publicly criticized Musk's new political party initiative, calling it unnecessary and confusing. Musk, who was once a close ally of Trump's, announced the formation of the America Party on Saturday, vowing to oppose lawmakers who supported the president's spending bill that could harm his Tesla business. Trump warned against the disruption and chaos that third parties can bring, suggesting this feud may be driven by changes in the spending bill that affect Musk's interests.

In a surprising move, the Indian government has reportedly blocked the official X (formerly Twitter) account of international news agency Reuters in India, citing a legal request. While the page is still accessible outside of India, there has been no official explanation as to why it has been restricted within Indian territory. This development is the latest in a series of actions taken by the Indian government to regulate online content, leading to concerns over free speech and media freedom. Reuters has yet to issue a statement, and more details are expected to emerge as the story develops.

The Rochester City School District in New York is seeking input from the public on their electronic device policy before the state's restrictions on smartphones in schools take effect. The district has released a survey and will hold a meeting to discuss the policy, which was prompted by legislation signed by Governor Kathy Hochul. All schools in the state must have a plan in place for implementing the policy by August 1st.

The Maharashtra State Road Transport Corporation (MSRTC) launched a campaign on June 16, providing "Bus Pass Direct to School" for students. Through this initiative, 5,21,354 students have been able to benefit from subsidized transportation within just 15 days. In addition, girls up to Class 12 are receiving free bus passes under the "Punyashlok Ahilyabai Holkar Yojana." This new method of distribution has saved valuable time for students and parents who previously had to visit long queues at bus pass centres. However, Minister Pratap Sarnaik has also issued a strict directive to ensure regular operation of school buses in rural and tribal areas, emphasizing the importance of uninterrupted transportation for students' access to education.