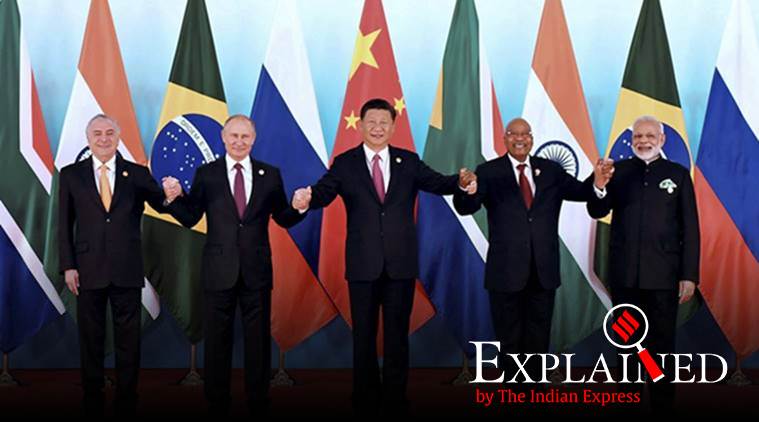

The relationship between developing nations and the US dollar has been turbulent in recent decades, with the decision in 1944 to adopt the dollar as the global trade currency having a lasting impact. Now, with the BRICS bloc musing at a new common currency and countries like Russia and China pushing for de-dollarisation, Trump has taken to social media to threaten against any such moves. While India has denied any plans to move away from the dollar, Trump's remarks have raised eyebrows and added to the already tense relationship between the US and BRICS nations.

The BRICS and the US Dollar: A Shifting Currency Landscape

Background

The establishment of the US dollar as the global reserve currency in 1944 marked a significant turning point in international finance. However, in recent decades, this dominance has faced increasing challenges, particularly from emerging economies.

The BRICS (Brazil, Russia, India, China, and South Africa) has emerged as a powerful grouping of developing nations that have expressed concerns about the volatility and overreliance on the US dollar. These concerns have been fueled by factors such as:

The BRICS' Push for De-Dollarization

In response to these concerns, the BRICS nations have been exploring alternative currency arrangements. In 2015, they announced plans to establish a common reserve currency, the BRICS Contingency Reserve Arrangement (CRA). This arrangement, initially funded with $100 billion, is intended to provide financial assistance to member countries during economic crises and reduce dependence on the US dollar.

Russia and China, in particular, have been vocal advocates for de-dollarization. Russia has been reducing its holdings of US Treasury bonds and promoting alternative payment systems, while China is exploring internationalization of its currency, the renminbi.

Trump's Threat

In a series of tweets in 2018, US President Donald Trump threatened economic retaliation against any country that considered moving away from the US dollar. He warned that countries doing business with Iran, which the US had recently sanctioned, would "have a very big economic problem" if they used currencies other than the dollar.

Trump's remarks were met with criticism from BRICS nations and many analysts. They were seen as an attempt to bully countries into continuing to use the US dollar, despite their concerns about its stability and fairness.

Top 5 FAQs

1. What is the BRICS Contingency Reserve Arrangement (CRA)? The CRA is a currency pool established by the BRICS nations to provide financial assistance to member countries during economic crises and reduce dependence on the US dollar.

2. Why are the BRICS interested in de-dollarization? The BRICS nations are concerned about the volatility and overreliance on the US dollar, as well as the potential for currency manipulation and economic blackmail by the US.

3. What is the impact of Trump's threat against de-dollarization? Trump's threat has raised concerns that the US is willing to use economic coercion to maintain the dominance of the US dollar.

4. Is the US dollar still the global reserve currency? Yes, the US dollar remains the world's dominant reserve currency, accounting for over 60% of global reserves.

5. What are the implications of a potential shift away from the US dollar? A shift away from the US dollar could have significant implications for the global economy, including reduced demand for US exports, increased volatility in currency markets, and potentially higher inflation.

Airbus has officially inaugurated its new final assembly line for the A320-family in Tianjin, marking its 10th production line globally. The line is expected to significantly increase production and help achieve Airbus' target of 75 A320-family jets per month by 2027. The advanced facility will feature the company's latest technologies and processes to ensure high-quality production of aircraft worldwide. Plans for the second line were initially announced in 2023 during a state visit by French prime minister Emmanuel Macron.

Tech billionaire Elon Musk has launched a new encyclopedia, Grokipedia, which aims to surpass Wikipedia's reach and accuracy through the use of AI fact-checking. However, the website has faced criticism for its biased and potentially inaccurate information, with many pointing out that it glorifies Musk and his views. Despite this, some believe that Grokipedia could revolutionize internet searches, thanks to Musk's dominance in the tech industry.

Satyam Rastogi, a renowned expert in the business world, has been serving as a bridge between Indian and overseas companies. His valuable insights and expertise have led to successful collaborations and partnerships between various organizations. With his vast experience and knowledge, Rastogi has become a sought-after resource person in both Indian and international settings.

OMC, a state-owned mining company, is leading the charge in promoting ethical practices and transparency among its employees. As part of the Vigilance Awareness Week, OMC's top officials, including the managing director, administered an integrity pledge to employees at their head office. Employees across OMC's regional offices and mines also participated in the pledge, reaffirming their commitment to honesty and accountability. To mark the occasion, a walkathon was held to raise awareness about the fight against corruption.

Bengaluru's Chief Minister Siddaramaiah recently honored Munawar Zama, CEO and Founder of English House Academy Pvt Ltd., with the prestigious 'Pride of India Award' for his exceptional work in motivating and empowering young people. Zama, who began his career as a pharmacist, has made a significant impact through his Residential Personality Development Workshops and mentoring initiatives, reaching over 3.5 lakh individuals. During the award ceremony, the Chief Minister and other influential leaders praised Zama for instilling values and inspiring purpose among today's youth.

Assam Chief Minister Himanta Biswa Sarma has announced plans to take action against Karnataka IT Minister Priyank Kharge for claiming that the state lacks talent for major industries like a semiconductor unit. Sarma also criticized the Congress party for not speaking against Kharge's statement. Sarma said that a possible case against Kharge for insulting the youth of Assam is being considered by the state government.

A recent social media post declaring that the father's or husband's name will no longer appear on Aadhaar cards has sparked confusion among Indian citizens. However, this claim was proven to be false after investigations showed that no such change has been made by UIDAI. Officials have clarified that while the "Care of" field is now optional, people are still free to include their spouse's or parent's name on the card. This incident highlights the need for fact-checking and research before sharing information on social media.

Power Finance Corporation Ltd. (PFC), a Maharatna CPSE under the Ministry of Power, is observing Vigilance Awareness Week 2025 to reaffirm its commitment to integrity, transparency, and accountability. The week-long observance includes activities such as workshops, slogan writing competitions, and quizzes to raise awareness and encourage employee participation in promoting a culture of vigilance. PFC's dedication to maintaining a transparent and responsible work environment aligned with the theme "Vigilance – Our Shared Responsibility" highlights its focus on promoting ethical conduct and good governance.

As part of Vigilance Awareness Week, the Vijayawada Division of South Central Railway reaffirmed its commitment to integrity and ethical governance through a series of activities. The program included an Integrity Pledge, a vigilance awareness walkathon, and a street play by the Bharat Scouts and Guides. Divisional railway manager Mohit Sonakiya emphasized the importance of transparency and individual responsibility in building a corruption-free society.

According to a report by The Washington Post, the Modi government has allegedly facilitated a plan for state-owned Life Insurance Corporation of India (LIC) to invest around $3.9 billion in companies owned by industrialist Gautam Adani. The move comes at a time when Adani's businesses are facing mounting debt and scrutiny from international banks. Despite acknowledging the risks, government officials pushed for the investment as a means of showing confidence in Adani and promoting economic growth in India.