Shares of IT giants Infosys and Wipro experienced declines on Wall Street influenced by Accenture's revised revenue projection for 2024, reflecting the cautious economic outlook. The consulting firm's share price tumbled over 9% following its updated forecast, anticipating subdued demand for its services due to economic headwinds. This development highlights the broader challenges faced by the IT and consulting sector, with businesses tightening budgets and limiting spending on additional services. Indian IT majors such as TCS and Infosys have previously reported subdued results, in line with this trend of reduced industry spending. Accenture's third-quarter revenue forecast fell below market estimates and new bookings experienced a decline, contributing to the negative sentiment.

Accenture's Revised Revenue Projection Impact on Tech Sector

In recent developments, shares of IT giants Infosys and Wipro have witnessed a decline on Wall Street, partially attributed to Accenture's revised revenue projection for 2024. This cautious outlook reflects the broader economic headwinds faced by the IT and consulting sector.

Background

Accenture, a global consulting and technology services company, recently revised its revenue forecast for 2024. The company anticipates that subdued demand for its services will impact its growth prospects in the coming years. This update sent a shockwave through the IT industry, as Accenture is often seen as a bellwether for the sector's performance.

Accenture's Revised Forecast

Accenture's third-quarter revenue forecast fell short of market estimates, indicating a slowdown in growth. The company also reported a decline in new bookings, a key indicator of future revenue. This negative outlook led to a sharp drop in Accenture's share price, which has cascaded into a sell-off in other IT stocks.

Impact on IT Sector

Accenture's revised forecast has heightened concerns about the health of the IT sector. With businesses tightening budgets and limiting spending on additional services, IT companies are facing a challenging operating environment. Indian IT majors such as TCS and Infosys have also reported subdued results, reflecting the industry-wide trend of reduced spending.

Top 5 FAQs on Accenture and IT Sector Outlook

Q: Why has Accenture revised its revenue forecast? A: Accenture anticipates subdued demand for its services due to economic headwinds, including uncertainties in the technology sector and geopolitical tensions.

Q: How does Accenture's forecast impact the IT sector? A: Accenture's revised outlook raises concerns about the overall health of the IT industry, as it suggests a slowdown in spending on consulting and technology services.

Q: What are the implications for Indian IT companies? A: Indian IT majors such as TCS and Infosys have previously reported subdued results, indicating that they are also facing challenges in the current economic environment.

Q: What is the market sentiment towards Accenture and the IT sector? A: The negative outlook has led to a sell-off in Accenture shares and a broader decline in the IT sector, reflecting cautious sentiment among investors.

Q: What are the prospects for the IT sector in the coming year? A: The sector's outlook remains uncertain, with economic headwinds and cautious spending expected to continue to weigh on growth. However, long-term prospects remain strong, driven by digital transformation and emerging technologies.

In an effort to support first-time home buyers, Norway's finance ministry has announced a reduction in the equity requirement for purchasing a dwelling. The new requirement will be lowered from 15% to 10%, allowing more individuals to enter the housing market. While this may increase overall housing demand, regulations on banks' flexibility in assessing customers' serviceability and rules on installment payments for mortgages and consumer loans will remain unchanged. This decision aims to make home ownership more accessible for young and inexperienced buyers, potentially stimulating the housing market and boosting economic growth.

Feedback Sports has just released their latest product, the Reflex Fixed Torque Bit Driver. This compact T-shaped driver comes with a preset 5Nm torque limiter and four bits, making it perfect for on-the-go bike adjustments. In addition, three torque limiting bit extensions can be purchased separately to accommodate for different torque needs. This tool is a game changer for cyclists, providing a compact and easy solution for mid-ride repairs.

After pausing its investment plans in India earlier this year, Tesla has resumed its efforts to establish a presence in the country. The company is reportedly in discussions with DLF, India's largest property developer, to secure showroom and operational spaces in the Delhi-NCR region. The move comes amidst the Indian government's efforts to attract global automakers and grow the country's nascent EV market. If successful, Tesla's entry into India could have a significant impact on the growth of the EV market in the country.

WhatsApp, the popular messaging app, has launched the Bharat Yatra initiative to empower small businesses across India with digital tools and skills. The mobile bus tour, starting in Delhi-NCR and covering major cities nationwide, will offer hands-on training to help SMBs leverage the WhatsApp Business app for growth. This initiative is part of WhatsApp's commitment to support India's small business ecosystem, and aims to familiarise businesses with the latest updates and features on the platform, such as Meta Verified and custom messaging for appointments and sales. The hands-on training will guide businesses in using these tools effectively to boost sales and streamline operations.

The IPO of Sai Life Sciences, a pharma company offering its services globally, has opened for bidding and has received a mixed set of reviews from investors. While SBI Securities recommends subscribing for long-term investment, Swastika Investmart has a cautious rating due to the high valuation and limited direct benefits to the company. Nirmal Bang Securities also recommends subscribing for long-term, citing the company's strong financial performance and potential for improvement in operating margins.

The pilot of an Air India flight travelling from Chennai to Singapore noticed a possible fuel leak during pre-flight checks, resulting in a prompt response from engineers and airport authorities. The issue was quickly resolved, allowing the flight to depart safely. However, this was not the only incident at Chennai Airport on Wednesday as multiple flights were cancelled, causing inconvenience for passengers.

In the fast-paced world of cryptocurrency, Beldex (BDX) has recently experienced a -0.36% price drop in just 24 hours, resulting in a current market rank of #203. Despite its all-time high of $0.450785 in 2018, the current price of Beldex is $0.077194, with a fully diluted valuation of $766,267,861. These frequent fluctuations highlight the volatile nature of the cryptocurrency market and emphasize the need for constant updates and analysis to stay informed. With a circulating supply of $6,911,904,481, it's important for investors to stay on top of Beldex's performance.

RushLane, India's leading auto news website, brings you the latest updates on the 2023 Toyota Camry launch in India. Priced at Rs 48 lakh (Ex-sh), the new Camry boasts a new and improved design, updated interiors with advanced features and safety equipment. It also has a 2.5L petrol-hybrid powertrain with a total system output of 230 hp. Join RushLane's Facebook Groups and Whatsapp/Telegram channels to stay updated on the latest automotive news.

Shares of financial technology company One Mobikwik Systems were in high demand on the first day of its initial public offering, with bids for over double the number of shares available. This success bodes well for the company's future growth and potential to disrupt the financial industry. Stay updated on all the latest business news, stock market updates, and personal finance tips from Zee Business.

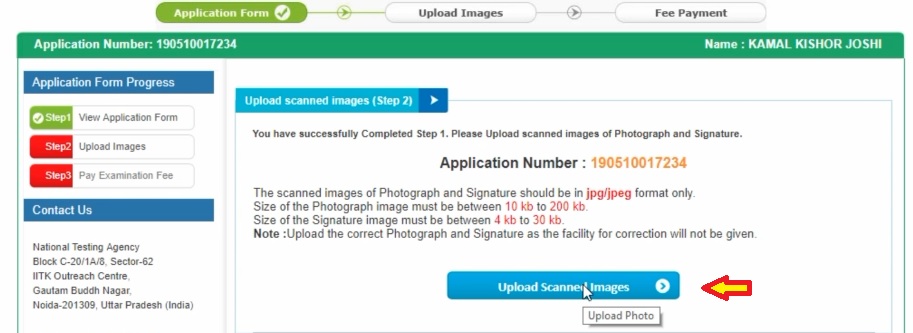

Today is the deadline for registrations of the UGC-NET December 2024 exam but aspirants are facing technical issues with the website, leading to unsuccessful attempts. Some have been trying to register since November 26, but have not been able to complete the process due to issues like the website freezing, redirecting to the homepage, and not receiving the email OTP. Aspirants are urging for an extension of the deadline and question the utilization of the exam fees for maintenance and smooth conducting of the exam.