The European Central Bank has made its third interest rate cut since June, lowering its benchmark rate to 3.25% in an effort to combat falling inflation and a weakening economy. The ECB predicts a temporary increase in inflation before it returns to its target rate of 2% next year. However, analysts believe the slowdown in the eurozone may prompt further rate cuts in the future. Other central banks, such as those in the U.S. and U.K., have also seen a decline in inflation as they raised borrowing costs during the coronavirus pandemic.

European Central Bank Cuts Interest Rates amid Economic Concerns

Background

The European Central Bank (ECB) is the central bank of the eurozone, which consists of 19 member states that use the euro as their currency. The ECB is responsible for setting monetary policy for the eurozone, with the primary goal of maintaining price stability.

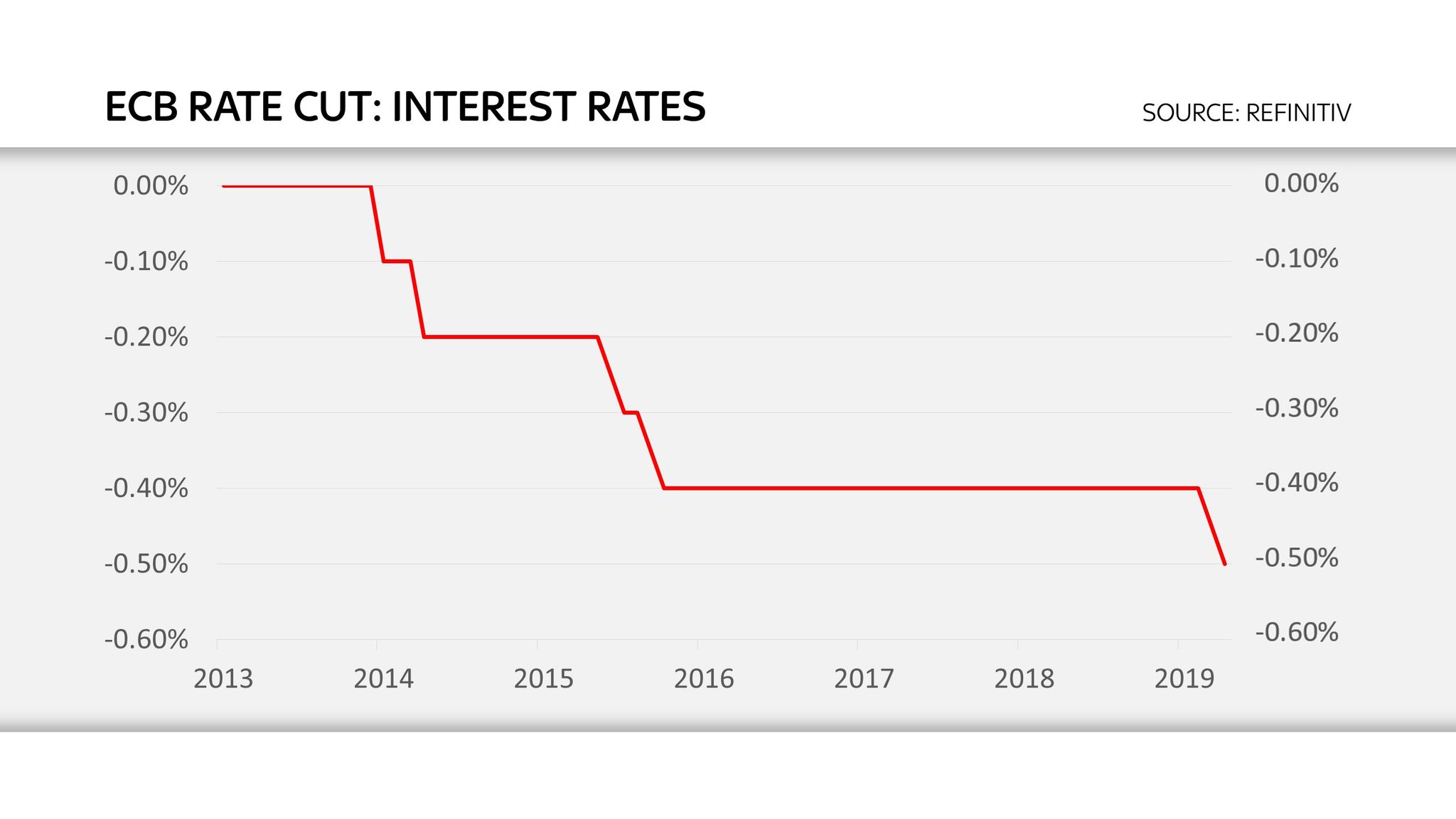

Recent Interest Rate Cuts

In an effort to combat falling inflation and a weakening economy, the ECB has made its third interest rate cut since June 2023. The benchmark rate has been lowered to 3.25%, the lowest level since 2015.

Economic Outlook

The ECB predicts a temporary increase in inflation before it returns to its target rate of 2% next year. However, analysts believe that the slowdown in the eurozone may prompt further rate cuts in the future.

Inflation Trends

Inflation in the eurozone has been falling in recent months, driven by lower energy prices and weaker demand. The ECB believes that inflation will remain below its target for the foreseeable future due to the ongoing economic downturn.

Other Central Bank Actions

Other central banks, such as the Federal Reserve in the United States and the Bank of England in the United Kingdom, have also seen a decline in inflation and have responded with interest rate cuts. This coordinated effort among central banks is aimed at supporting economic growth and preventing a broader downturn.

Top 5 FAQs and Answers

Why is the ECB cutting interest rates? Answer: To combat falling inflation and support economic growth amid a weakening economy.

What is the ECB's inflation target? Answer: 2%.

How many interest rate cuts has the ECB made since June 2023? Answer: Three.

What is the current benchmark interest rate in the eurozone? Answer: 3.25%.

What is the expected impact of the interest rate cuts? Answer: Temporary increase in inflation, followed by a return to the target rate; potential further cuts in the future if the economy continues to weaken.

Delhi-based water and wastewater management provider, Enviro Infra Engineers Ltd., launched its initial public offering on Friday, which was fully subscribed at 2.08 times. As of Monday, the IPO has been subscribed 8.34 times, with a grey market premium of Rs 52 and an estimated listing price of Rs 200 per share. The company aims to raise Rs 650.43 crore through the public issue, with a price band of Rs 140-148 per share and a minimum bid requirement of 101 shares. Enviro Infra had previously raised Rs 195 crore from anchor investors and its IPO will close on November 26, with a fresh issue of Rs 572.46 crore.

In a groundbreaking partnership, Octaviant Financial and Starr Insurance have teamed up with Marsh to offer drug warranty services for pharmaceutical companies. Through their subsidiary, Actuaria Insurance Services LLC, Octaviant will provide comprehensive drug warranties, backed by Starr as the lead underwriter. These warranties are issued directly to end payers, providing them with financial recovery if a patient does not achieve the intended benefits from a high-cost therapy. As pharmaceutical companies continue to develop advanced therapies with high price tags, this partnership offers a solution to address concerns from payers and promote confidence in these innovative treatments.

After changing its name and main object of business, Spright Agro Limited has now ventured into the world of agricultural trading and commodities. With a history of successful textile production and recent operations in the steel industry, the company is expanding its already diverse portfolio. This new move is expected to greatly impact the market, making Spright Agro a force to be reckoned with. Along with their dedicated customer care and support, this move proves that the company is committed to continuously evolving and staying ahead of the game.

The Indian Premier League (IPL) 2025 mega auction kicked off in Saudi Arabia with a bang, as cricketers like Shreyas Iyer, Rishabh Pant, and Arshdeep Singh were sold at record-breaking prices. Rishabh Pant was picked up by Lucknow SuperGiants for a whopping price of ₹27 crore, making him the most expensive player in IPL history. Other notable sales include England's Jos Buttler to Gujarat Titans for ₹15.50 crore and Australia's Mitchell Starc to Delhi Capitals for ₹11.75 crore. With a total of 577 players up for auction and different budgets for each team, it will be an interesting event to follow.

The highly anticipated Glen Sannox ferry has finally been delivered, seven years after it was launched into the Firth of Clyde with much fanfare by Scottish First Minister, Nicola Sturgeon. The project has been plagued by numerous delays, contractual disputes, and cost overruns, ultimately resulting in the nationalisation of the Ferguson Marine shipyard. This delayed delivery has caused frustration for islanders who were hopeful for a new lifeline ferry.

India has become a hub for global cooperation and progress in the business sector with a string of major events and schemes. From hosting the International Cooperative Alliance Assembly to launching the White Revolution 2.0 for the dairy sector, India has been making strides towards economic growth and development. The country also witnessed key agreements and discussions with countries like the US, Japan, and Bhutan, showcasing the strengthening of international relations and cooperation in the field of business. In addition, the Indian government's key schemes, including the Middle Class Schemes and the FCI equity infusion, have received praise and recognition from top leaders like Amit Shah. Stay updated with the latest developments in the Indian business world.

Personal finance expert Martin Lewis has raised concerns over the severe repercussions of missing a single Council Tax payment. In a recent TV segment, Lewis criticized the policy of making individuals pay for an entire year's worth of taxes within three weeks of missing a monthly payment. He also highlighted the impact of this burden on people's financial well-being, the economy, and the healthcare system. While the Local Government Association acknowledged the need for fair collection policies, they also agreed with Lewis that the use of bailiffs should be a last resort.

Vivo has expanded its Y-series in India with the launch of the Vivo Y300, equipped with advanced features and innovative technology. The smartphone offers a high-end Sony IMX882 main camera, along with AI Aura Light and a 2x portrait feature for a superior photography experience. Available in three different colors and two storage variants, the Y300 is priced at Rs 21,999 and Rs 23,999 respectively. It also comes with a high-gloss metal frame, 6.67-inch AMOLED punch-hole display, and a 5000 mAh battery with 80W FlashCharge. With a user-friendly Funtouch OS and IP64 dust and water resistance rating, the Vivo Y300 is the perfect device for tech-savvy individuals.

Tesla CEO Elon Musk praised India for successfully counting 640 million votes in just one day for their Lok Sabha elections. In contrast, California, with a significantly smaller population, is still struggling to tally the results of their presidential election which took place 18 days ago. Musk's post on X highlights the efficiency of India's electoral process and the shortcomings of the US system, which has led to a delay in vote counting in the most populous state.

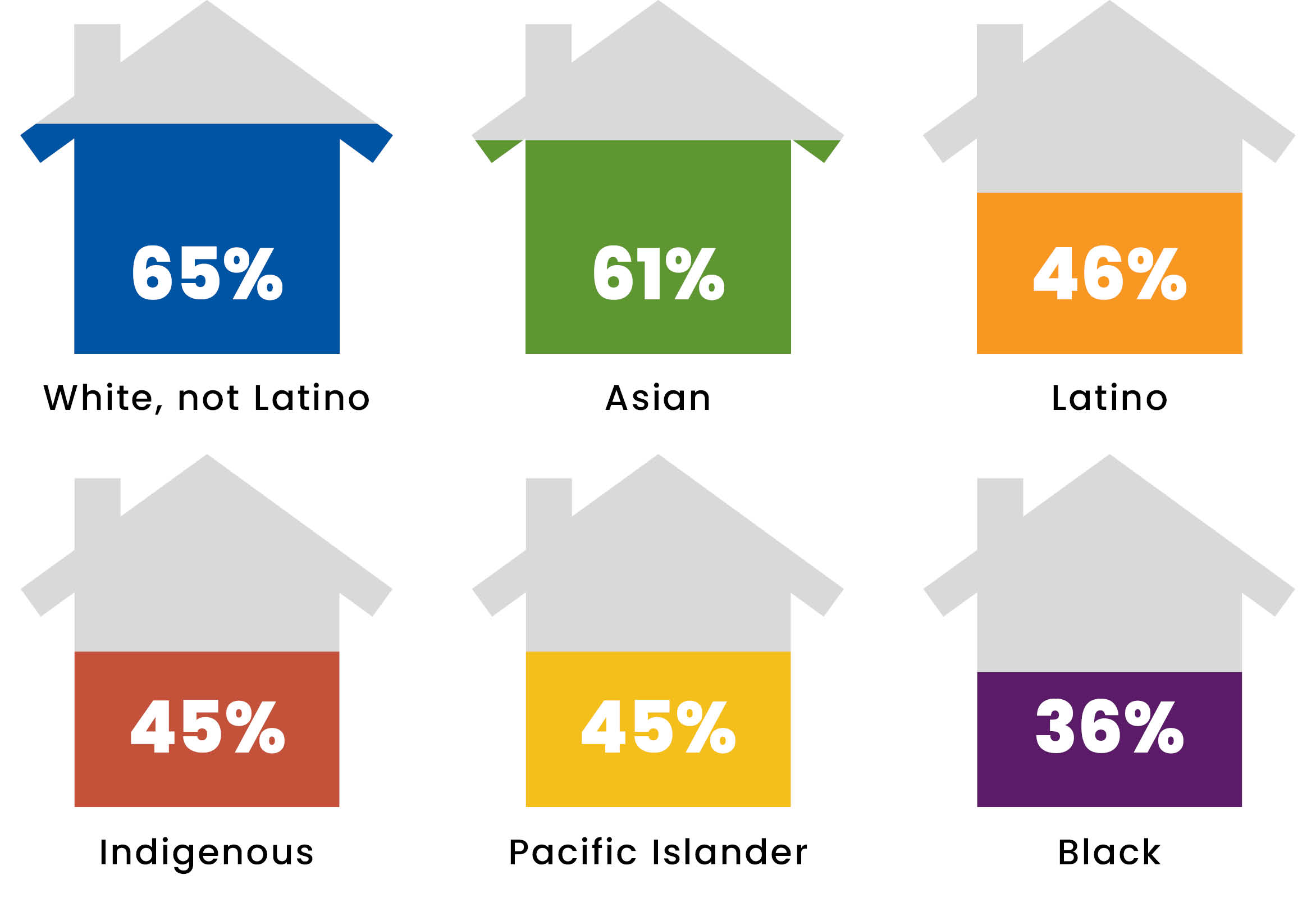

With the median price of a single-family home in California reaching a staggering $868,150 in September, the state's high home prices have created a wealth gap that disproportionately affects communities of color. According to the Legislative Analyst's Office, the cost of buying a mid-tier home has increased by 84% since January 2020, making it unaffordable for the majority of Californians. This poses serious challenges for low-income households and people of color who are already struggling to keep up with the state's high cost of living. As California grapples with mounting economic divides, the need for affordable housing solutions becomes more urgent. Help us address this pressing issue by joining our year-end campaign to raise $50,000 and support local reporting on important issues like this.