Emcure Pharmaceuticals has successfully listed on stock exchanges, with a significant 31.45% gain. This reaffirms investor confidence in the company's established brand, diverse product portfolio, and international market reach. However, caution should be exercised as the pharmaceutical industry's regulatory strictness and potential disruptions in the raw material supply chain continue to be monitored.

Emcure Pharmaceuticals Makes a Strong Debut on Stock Exchanges

Emcure Pharmaceuticals, a leading Indian pharmaceutical company, has successfully listed on stock exchanges with a remarkable 31.45% gain above its issue price. This remarkable performance validates investor confidence in the company's solid position in the industry.

Background

Emcure Pharmaceuticals has a long and successful history in the pharmaceutical industry. Established in 1981, the company has built a strong brand and a diverse product portfolio. It has a presence in over 75 countries, making it a notable player in the global market.

Key Factors Driving Stock Market Success

Industry Challenges to Monitor

Despite its strong performance, the pharmaceutical industry faces certain challenges that investors need to consider:

Top 5 FAQs and Answers

Q1: What was the issue price of Emcure Pharmaceuticals' shares? A: Rs. 422

Q2: What is the company's market capitalization? A: Approximately Rs. 18,000 crores

Q3: What is the company's focus on research and development (R&D)? A: Emcure invests heavily in R&D, with a focus on developing novel drugs and improving existing treatments.

Q4: How has the company performed in recent years? A: Emcure has achieved consistent revenue and profit growth in recent years, driven by its diverse product portfolio and international expansion.

Q5: What are the potential risks associated with investing in Emcure Pharmaceuticals? A: Key risks include regulatory changes, competition from generic manufacturers, and potential disruptions to the supply chain.

BTTV, a leading market news channel, introduces a new show called 'Daily Calls' aimed at providing viewers with expert insights and guidance on navigating the market. With access to live sessions featuring experienced analysts, the show aims to assist viewers in making informed investment decisions and building a strong portfolio. Don't miss out on this valuable opportunity to gain clarity and understanding in today's uncertain market.

Adani Group is under scrutiny for alleged violations of disclosure norms concerning a US bribery case and the subsequent cancellation of major deals by Kenya. While the conglomerate has denied any involvement in the case, stock exchanges have sought explanations and experts believe that the Securities and Exchange Board of India (SEBI) may launch an investigation. The allegations, which include a criminal indictment and a civil complaint, could have significant consequences for Adani Group's reputation and access to international markets.

Outlandish, an e-commerce startup, is opening a new brick-and-mortar store in Santa Monica's 3rd Street Promenade, featuring a first floor of branded stalls and a second floor for shopping. The store aims to mix live online selling with in-person retail, as visitors can watch influencers and sellers on livestreams and even join in themselves. The concept taps into the growing trend of live shopping in the US, with TikTok itself actively promoting and hosting events centered around live selling. This move by Outlandish is in line with TikTok's efforts to recreate the success of its Chinese sister app, Douyin, which drives billions in annual product sales.

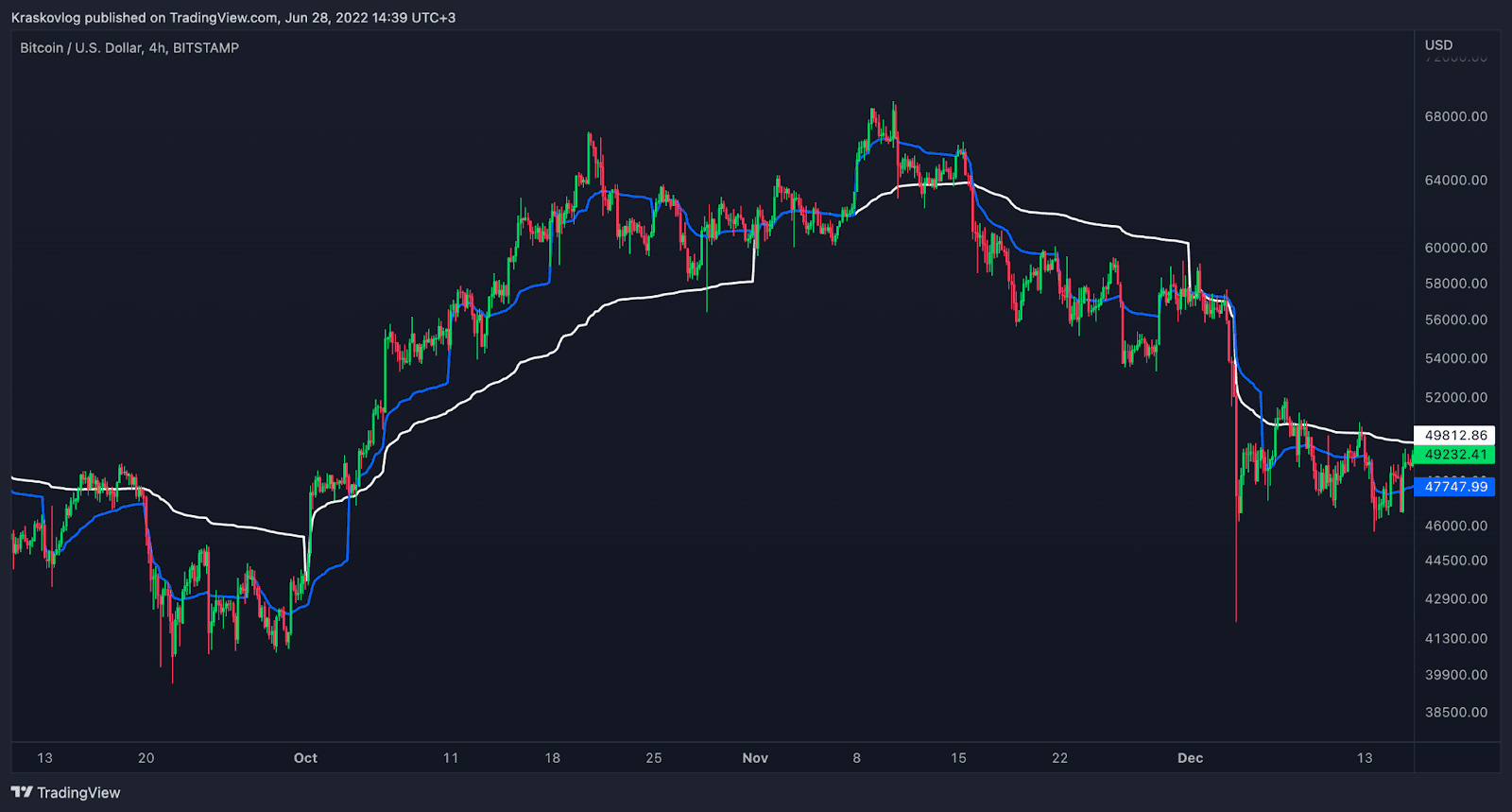

The highly volatile Mad cryptocurrency has seen a massive surge of 67% in the last 24 hours, trading at $0.00006226 as of 02:49 a.m. EST. This sudden spike in price, along with a heavy overbought RSI level of 86, signals a potential correction or pullback in the near future. However, the Mad price has managed to break above both the 50-day and 200-day SMAs, indicating a strong and sustained bullish trend. The ADX value above 60 also confirms the strength of this rally. Stay updated on this exciting development by joining our Telegram channel.

In a note released on Friday, JPMorgan addressed concerns over potential credit risk for Indian banks heavily exposed to the Adani Group, following the recent indictment of its billionaire founder, Gautam Adani, in the US. While the charges have sparked a drop in shares of state-owned banks, JPMorgan analysts have deemed the banks' exposure "manageable," with their assessment showing a low risk of default from the Adani Group. However, global and local banks are expected to take a cautious approach in providing any new funding to the conglomerate, with potential for higher interest rates due to heightened risks.

In a state of the nation address, Kenya's President announced the cancellation of major deals with Indian tycoon Gautam Adani, including an airport expansion project and power transmission lines. This decision was made in light of U.S. bribery and fraud indictments against Adani, who has been charged with securities fraud and conspiracy. The controversial deals had faced backlash from Kenyan protesters and airport workers concerned about potential job losses. Despite claims from Kenya's Energy Minister that no corruption was involved on their part, the country has now severed ties with Adani's conglomerate.

X's new terms of service, which allow the company to use user data and hold users accountable for overusing the platform, are prompting long-time users, including celebrities like Gabrielle Union, to leave the popular microblogging platform. In response, many users are turning to Bluesky, a microblogging startup, with its U.S. mobile app downloads increasing by an estimated 651% since the start of November. Despite X and Meta's larger user bases, Bluesky's growth suggests many users are looking for alternatives to X's new terms.

Zomato’s new “Food Rescue” feature caught the attention of Bengaluru resident Bhanu who offered practical and thoughtful suggestions to CEO Deepinder Goyal. Impressed by his insights, Goyal extended an unexpected job offer to Bhanu, a product manager working for a startup. This positive exchange highlights the importance of hiring talented individuals who offer practical solutions to enhance a company’s operations. Zomato, known for handling over 4,00,000 cancelled orders per month, aims to prevent food wastage with their new feature, which offers discounted meals to customers within a 3km radius of a delivery partner with a cancelled order.

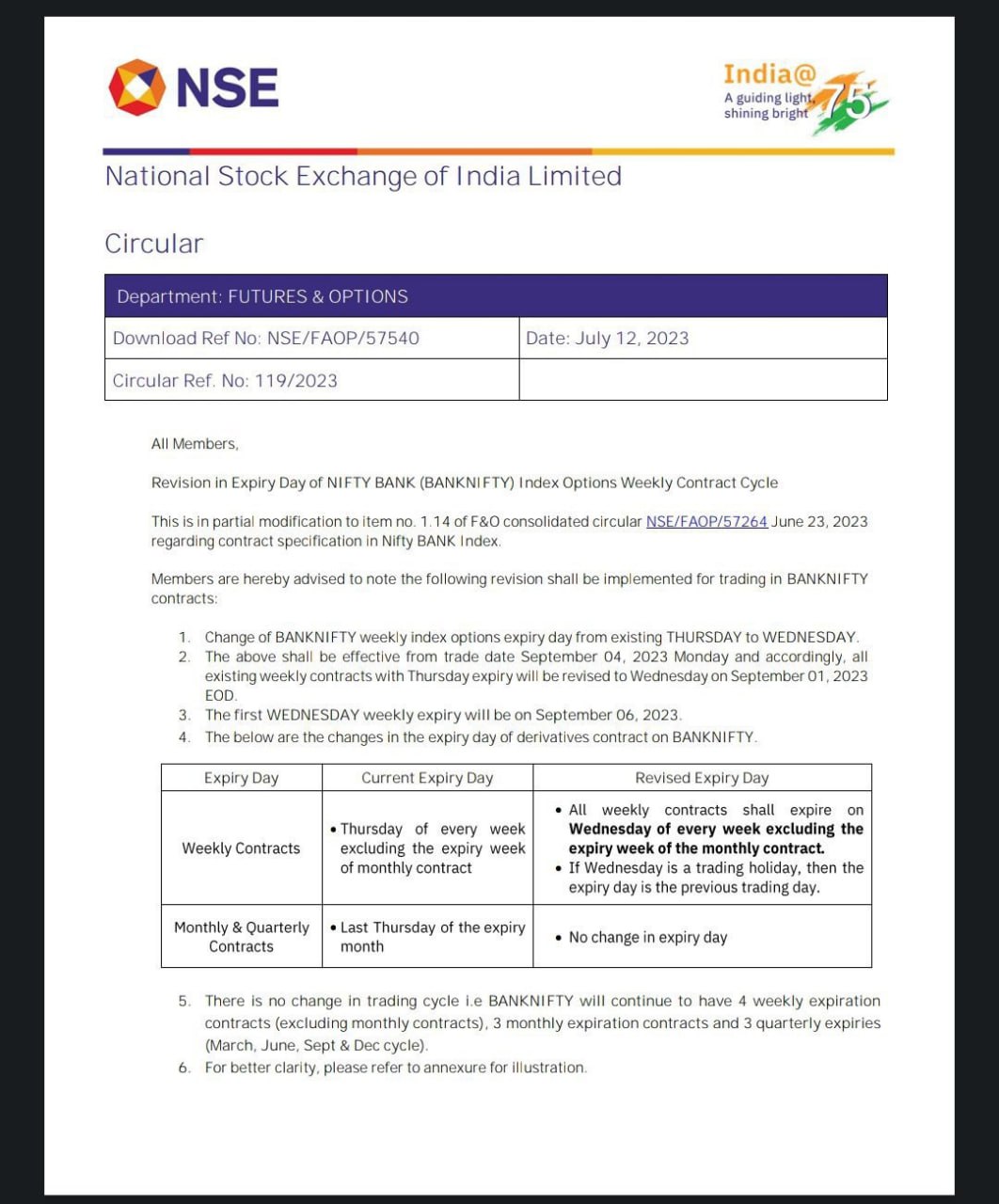

Zerodha co-founder and CEO Nithin Kamath shared a humorous mock obituary for Bank Nifty Weekly contracts on social media. The post, created by one of his old trader friends, announced the "passing" of Bank Nifty Weekly and mentioned its struggles with regulation. The post has since gone viral, with many traders reminiscing about their experiences with this contract.

The Zee Business research team has compiled a list of 20 stocks for investors and traders to track on November 22, 2024. Analysts Kushal Gupta and Ashish Chaturvedi have highlighted their top picks, including buying Orchid Pharma and SJVN shares for immediate profits, and investing in MRF, Radico Khaitan and Afcons Infrastructure for long-term gains. Technical and fundamental picks are also included, making this Traders' Diary a must-read for all stock market enthusiasts.