The Virtual Asset Regulatory Authority (VARA) of Dubai has taken action against seven companies operating in the volatile virtual asset industry without acquiring the required approvals. The authority has not disclosed the names of the entities in question but has emphasized its commitment to ensuring transparency and protecting stakeholder interests. This move comes after Dubai gave operational approvals to several crypto firms, highlighting its efforts to establish itself as a hotspot for Web3 activities.

Dubai Enforces Regulations on Cryptocurrency Companies, Highlighting Commitment to Industry Transparency

Dubai's Virtual Asset Regulatory Authority (VARA) has recently taken action against seven cryptocurrency companies operating within its jurisdiction without proper approvals. This move underscores the authority's commitment to regulating the volatile virtual asset industry and fostering stakeholder trust.

Background

Dubai has emerged as a burgeoning hub for cryptocurrency and Web3 activities, attracting numerous firms to its shores. In 2021, the Dubai World Trade Centre launched a dedicated "Crypto Valley," aiming to create a global center for cryptocurrency and blockchain innovation. Several major cryptocurrency exchanges, such as Binance and FTX, have established a presence in Dubai.

However, the rapid expansion of the industry also raised concerns about potential risks and lack of regulation. VARA was established in March 2022 to oversee the virtual asset sector in Dubai and ensure compliance with international standards.

Current Action

The recent enforcement action by VARA targeted siete companies that were operating without obtaining the necessary approvals. The authority did not reveal the identities of the entities involved but stressed its commitment to transparency and protecting stakeholder interests. This move signals a more stringent approach to regulation within the cryptocurrency industry.

Top 5 FAQs

1. Why did VARA take action against the seven companies?

VARA acted against these companies for operating without proper approvals, potentially exposing investors to risks and undermining the integrity of the industry.

2. What does this mean for cryptocurrency companies in Dubai?

Companies operating in Dubai must adhere to VARA's regulations and obtain the necessary approvals to ensure compliance and protect stakeholder interests.

3. How is Dubai regulating the cryptocurrency industry?

VARA has implemented a comprehensive regulatory framework that includes licensing requirements, AML/CFT compliance, and investor protection measures.

4. What are the benefits of VARA's regulation?

VARA's regulation aims to enhance transparency, reduce risks, and build trust in the cryptocurrency industry within Dubai.

5. Is Dubai still a hub for cryptocurrency activities?

Despite the recent enforcement action, Dubai remains committed to fostering a vibrant and regulated cryptocurrency ecosystem. The city continues to attract crypto firms and develop initiatives to support the industry's growth.

Conclusion

Dubai's Virtual Asset Regulatory Authority's recent enforcement action against unauthorized cryptocurrency companies highlights its commitment to regulating the industry and protecting stakeholders. As the cryptocurrency sector evolves, VARA's role will be crucial in ensuring transparency, compliance, and trust within Dubai's burgeoning Web3 landscape.

Adani Group is under scrutiny for alleged violations of disclosure norms concerning a US bribery case and the subsequent cancellation of major deals by Kenya. While the conglomerate has denied any involvement in the case, stock exchanges have sought explanations and experts believe that the Securities and Exchange Board of India (SEBI) may launch an investigation. The allegations, which include a criminal indictment and a civil complaint, could have significant consequences for Adani Group's reputation and access to international markets.

Outlandish, an e-commerce startup, is opening a new brick-and-mortar store in Santa Monica's 3rd Street Promenade, featuring a first floor of branded stalls and a second floor for shopping. The store aims to mix live online selling with in-person retail, as visitors can watch influencers and sellers on livestreams and even join in themselves. The concept taps into the growing trend of live shopping in the US, with TikTok itself actively promoting and hosting events centered around live selling. This move by Outlandish is in line with TikTok's efforts to recreate the success of its Chinese sister app, Douyin, which drives billions in annual product sales.

The highly volatile Mad cryptocurrency has seen a massive surge of 67% in the last 24 hours, trading at $0.00006226 as of 02:49 a.m. EST. This sudden spike in price, along with a heavy overbought RSI level of 86, signals a potential correction or pullback in the near future. However, the Mad price has managed to break above both the 50-day and 200-day SMAs, indicating a strong and sustained bullish trend. The ADX value above 60 also confirms the strength of this rally. Stay updated on this exciting development by joining our Telegram channel.

In a note released on Friday, JPMorgan addressed concerns over potential credit risk for Indian banks heavily exposed to the Adani Group, following the recent indictment of its billionaire founder, Gautam Adani, in the US. While the charges have sparked a drop in shares of state-owned banks, JPMorgan analysts have deemed the banks' exposure "manageable," with their assessment showing a low risk of default from the Adani Group. However, global and local banks are expected to take a cautious approach in providing any new funding to the conglomerate, with potential for higher interest rates due to heightened risks.

In a state of the nation address, Kenya's President announced the cancellation of major deals with Indian tycoon Gautam Adani, including an airport expansion project and power transmission lines. This decision was made in light of U.S. bribery and fraud indictments against Adani, who has been charged with securities fraud and conspiracy. The controversial deals had faced backlash from Kenyan protesters and airport workers concerned about potential job losses. Despite claims from Kenya's Energy Minister that no corruption was involved on their part, the country has now severed ties with Adani's conglomerate.

X's new terms of service, which allow the company to use user data and hold users accountable for overusing the platform, are prompting long-time users, including celebrities like Gabrielle Union, to leave the popular microblogging platform. In response, many users are turning to Bluesky, a microblogging startup, with its U.S. mobile app downloads increasing by an estimated 651% since the start of November. Despite X and Meta's larger user bases, Bluesky's growth suggests many users are looking for alternatives to X's new terms.

Zomato’s new “Food Rescue” feature caught the attention of Bengaluru resident Bhanu who offered practical and thoughtful suggestions to CEO Deepinder Goyal. Impressed by his insights, Goyal extended an unexpected job offer to Bhanu, a product manager working for a startup. This positive exchange highlights the importance of hiring talented individuals who offer practical solutions to enhance a company’s operations. Zomato, known for handling over 4,00,000 cancelled orders per month, aims to prevent food wastage with their new feature, which offers discounted meals to customers within a 3km radius of a delivery partner with a cancelled order.

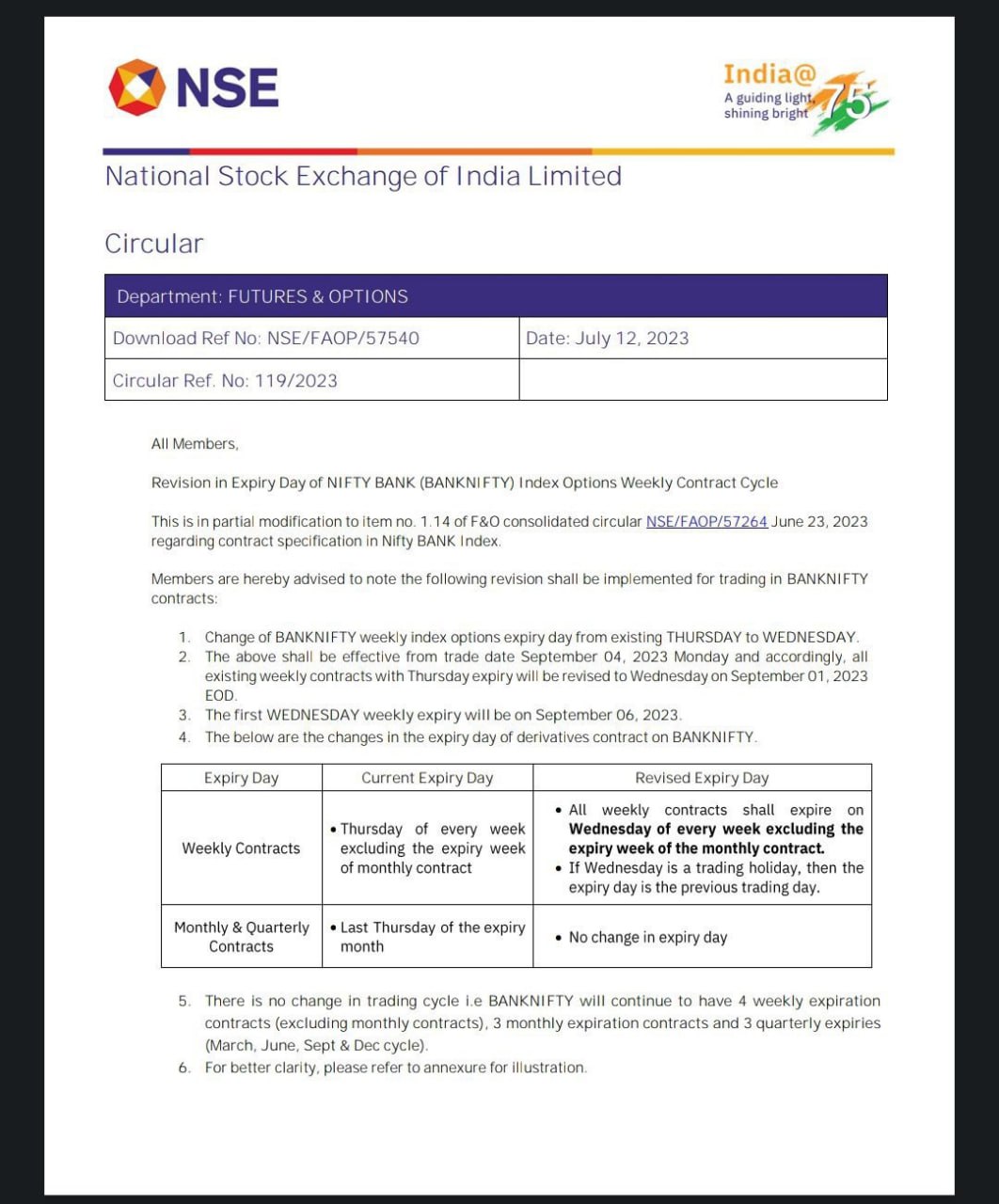

Zerodha co-founder and CEO Nithin Kamath shared a humorous mock obituary for Bank Nifty Weekly contracts on social media. The post, created by one of his old trader friends, announced the "passing" of Bank Nifty Weekly and mentioned its struggles with regulation. The post has since gone viral, with many traders reminiscing about their experiences with this contract.

The Zee Business research team has compiled a list of 20 stocks for investors and traders to track on November 22, 2024. Analysts Kushal Gupta and Ashish Chaturvedi have highlighted their top picks, including buying Orchid Pharma and SJVN shares for immediate profits, and investing in MRF, Radico Khaitan and Afcons Infrastructure for long-term gains. Technical and fundamental picks are also included, making this Traders' Diary a must-read for all stock market enthusiasts.

Billionaire Elon Musk has confirmed that X, formerly known as Twitter, has become the number-one news app on Apple's AppStore in India. Musk acquired X for a whopping $44 billion in October 2022. This news comes after user 'DogeDesigner' shared a post about X's success on the AppStore. Stay updated on the latest Business news, stock market updates, and financial tips through Zee Business's Twitter, Facebook, and YouTube channels.