Stay on top of your fitness and beauty game with the HerZindagi app, which offers daily updates and tips for a healthier, happier lifestyle. This app is a one-stop destination for all your wellness needs, covering topics like fitness, beauty, and healthy living. Download now to start your journey towards a healthier, happier you!

Redmi Note 14: What We Know So Far

Xiaomi is expected to launch its Redmi Note 14 series of smartphones in the first quarter of 2023. While the company has not yet officially confirmed this, several rumors and leaks have emerged, providing us with some insights into what to expect from the upcoming device.

Expected Features

According to these leaks, the Redmi Note 14 is likely to feature:

Expected Price and Availability

The Redmi Note 14 is expected to be priced between INR 15,000 and INR 20,000 in India. It is likely to be available in several color options, including Black, Blue, and Green.

Top 5 FAQs

1. When will the Redmi Note 14 be released?

The Redmi Note 14 is expected to be released in the first quarter of 2023.

2. What is the expected price of the Redmi Note 14?

The Redmi Note 14 is expected to be priced between INR 15,000 and INR 20,000 in India.

3. What will be the key features of the Redmi Note 14?

The Redmi Note 14 is expected to feature a 6.5-inch AMOLED display, a MediaTek Helio G96 processor, 4GB or 6GB of RAM, a 50MP primary camera, and a large battery with fast charging support.

4. What is the difference between the Redmi Note 14 and the Redmi Note 13?

The Redmi Note 14 is expected to have a larger display, a more powerful processor, and a better camera system than the Redmi Note 13.

5. Which is better, the Redmi Note 14 or the OnePlus Nord 2T?

Both the Redmi Note 14 and the OnePlus Nord 2T are expected to be released in early 2023. It is difficult to say which device is better until we have more information about both devices. However, the OnePlus Nord 2T is expected to have a more powerful processor and a better camera system than the Redmi Note 14.

Vietnam's tuna industry, a significant contributor to the country's seafood exports, is facing multiple challenges, including shortages of raw materials and stringent regulations in key export markets. Enterprises in the industry have expressed concerns over limited supplies of domestic fishing fleets and the impact of new government rules on minimum catch sizes for skipjack tuna. In response, the Vice Chairman of the National Assembly has confirmed the necessity of these regulations for protecting marine resources and meeting sustainable fishing practices. To find a balance between conservation and economic interests, the Agriculture and Environment Ministry is proposing an amendment to the decree, which is expected to be issued by April.

A recent draft decree from the Vietnamese Ministry of Finance has proposed a zero percent first-time registration tax rate for electric cars, in comparison to the 10-12 percent rate for gasoline and diesel cars. This move has resulted in a substantial increase in electric car registrations, with numbers surging nearly 20 times over the past three years. In 2024, VinFast, a Vietnamese car manufacturer, became the top-selling brand in the country after selling over 87,000 electric cars. This growth in the electric car market is expected to continue, as the government continues to prioritize sustainable modes of transportation.

The Indian Space Research Organisation (ISRO) announced the successful completion of the SpaDex Mission's de-docking, marking a significant achievement for the country's space ambitions. The Union Minister of State for Science and Technology and Earth Sciences congratulated ISRO on their success and praised PM Modi's support for the country's space endeavors. The undocking process, which involved precise maneuvers, was completed on January 16 this year, with India now becoming the fourth country in the world to possess space docking technology. This breakthrough mission demonstrates India's technological prowess in spacecraft rendezvous, docking, and undocking, which is crucial for future advancements in space exploration.

A popular video circulating on social media shows individuals in Mumbai struggling to answer the question of what is the official language of Bengaluru. Many mistakenly guessed Hindi or English, while some even suggested Tamil or Sanskrit. The video has sparked a debate among Kannadigas, as many are voicing their frustration over the misrepresentation of Kannada as the official language of the city. This controversy highlights the larger issue of language identity and representation in the business hub of India.

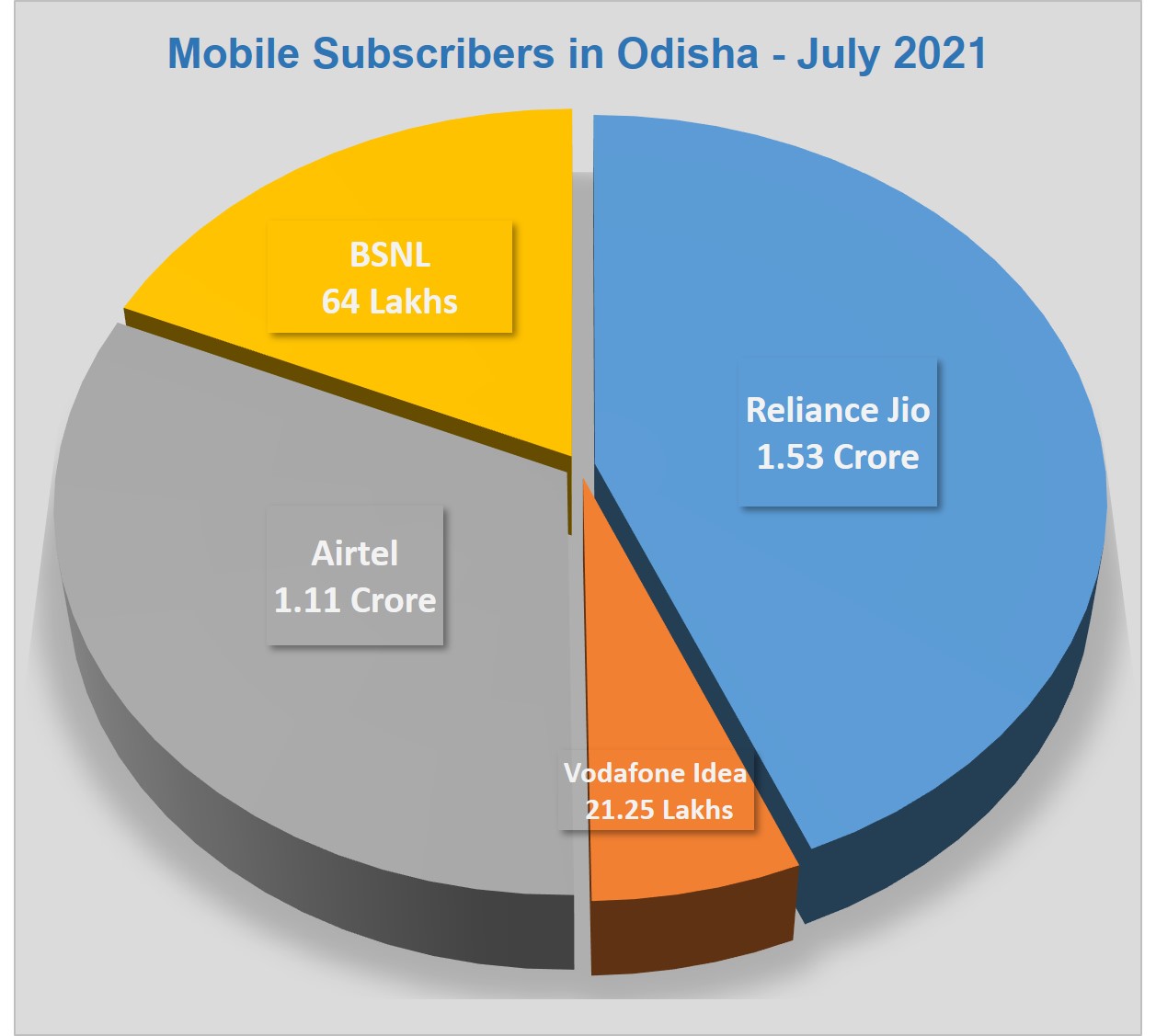

As BSNL continues to lose subscribers due to recent tariff hikes, the state-run telecom operator has launched a new recharge plan to retain its users. Priced at Rs 750 and valid for six months, the plan offers 1GB of daily data, unlimited calling, and 100 SMS per day. This move comes after over 71,000 SIM cards were blocked in Andhra Pradesh and Telangana for being acquired through fraudulent means and used for scams. BSNL's new offering aims to discourage users from switching to other networks by providing a competitive plan exclusively for select customers.

Shares of Bharti Airtel saw a surge after the company entered into a partnership with Elon Musk's SpaceX to offer satellite communication services in India, with a potential target market in remote areas. With Citi and JP Morgan maintaining a Buy rating and setting high stock targets, investors are buzzing about the company's potential for growth in the telecom industry. Despite uncertainties about regulatory approval and pricing, Airtel's new partnership has boosted the stock by 38% in the past year and 137% in the last 3 years, proving to be a lucrative investment.

The latest report from the Telecom Regulatory Authority of India (TRAI) shows that Reliance Jio added 3.9 million wireless subscribers in December 2024, solidifying its position as the dominant player in the Indian telecom market. Meanwhile, Vi and BSNL faced significant subscriber losses, with Vi losing 1.715 million subscribers and BSNL losing 0.322 million subscribers in the same period. In other news, Bharti Airtel has announced a partnership with Elon Musk's SpaceX to offer Starlink's high-speed internet services to customers in India, pending necessary approvals.

Harshil Agrotech Limited, a company with a long history in industrial design and fabrication, has recently changed its focus to the trading and manufacturing of agricultural products. This shift in the company's object clause reflects a growing trend in the market towards agro-based industries. With expert advice and support from IIFL Capital Services, investors can expect better recommendations and improved returns on their investments in Harshil Agrotech. Download the IIFL app to stay updated on the latest developments and make wise investment decisions.

In the fast-paced world of business, feedback is often seen as a reaction to isolated incidents, leading to biases and emotions that can hinder its effectiveness. To truly drive growth, leaders and HR professionals must shift the focus from immediate reactions to observable patterns of behavior. By creating a culture of psychological safety, feedback can become an opportunity for growth rather than a threat to self-esteem. However, this requires a rethinking of how feedback is delivered and received, as well as understanding common emotional responses and how to overcome them.

Telecom giant Bharti Airtel has partnered with SpaceX, owned by Elon Musk, to bring Starlink's high-speed internet to India. This marks a significant milestone for Airtel's commitment to satellite connectivity, with the venture pending regulatory approvals. The collaboration is expected to enhance Airtel's diverse service portfolio, providing reliable and affordable broadband to even the most remote areas in India. This partnership showcases Airtel's dedication to innovation and staying at the forefront of advancements in global connectivity, positioning them as a leading telecom operator globally.