India's Central Depository Services Ltd. (CDSL) witnessed a sharp decline in its share price, following a notable decline in total income and net profit for the December quarter. Despite opening a significant number of new demat accounts, the company's demat custody also saw a decline from the previous quarter. This marks a significant setback for the company, as it reported a significant drop in its EBITDA and net profit. However, CDSL did achieve a milestone by registering over 14.65 crore demat accounts, making it the first depository to do so.

CDSL's Share Price Decline: Background and Impact

Introduction

Central Depository Services Ltd. (CDSL), India's leading securities depository, has experienced a significant decline in its share price following a weak performance in the December quarter. This article explores the factors behind the decline and its potential impact on the company and investors.

Background

CDSL is India's largest securities depository, with a market share of over 90%. It facilitates the electronic settlement of securities transactions, including stocks, bonds, and mutual funds. The company has experienced strong growth in recent years, driven by an increasing number of demat accounts and the popularity of online trading.

Recent Performance

In its financial results for the December quarter, CDSL reported a notable decline in total income and net profit. The company's total income fell by 16% year-on-year to Rs 240 crore, while net profit declined by 22% to Rs 105 crore.

The decline in income and profit was attributed to a decrease in depository revenue and a rise in expenses. The company's demat custody also saw a decline from the previous quarter, indicating a slowdown in the pace of new account openings.

Impact on Share Price

Following the release of its financial results, CDSL's share price fell sharply on the Bombay Stock Exchange (BSE). The stock has declined by over 15% since the beginning of the year.

The decline in share price reflects investor concerns about the company's slowing growth and profitability. Some analysts have also raised questions about the company's dividend policy, which has been cautious in recent quarters.

Top 5 FAQs about CDSL

1. What are the reasons behind the decline in CDSL's share price?

The decline is attributed to a decrease in total income and net profit, primarily due to a decline in depository revenue and a rise in expenses.

2. How has the company's demat custody performed?

Demat custody witnessed a decline from the previous quarter, indicating a slowdown in the pace of new account openings.

3. What are the market expectations for CDSL's future performance?

Analysts have mixed expectations for CDSL's future performance. Some believe the company will face challenges in maintaining its growth and profitability, while others remain optimistic about its long-term prospects.

4. What is the company's dividend policy?

CDSL has maintained a cautious dividend policy in recent quarters, which has raised concerns among some investors.

5. How does CDSL compare to its competitors?

CDSL dominates the Indian securities depository market with a share of over 90%. Its main competitor is the National Securities Depository Limited (NSDL), which has a smaller market share.

An American Airlines flight headed to Washington D.C. collided with a military helicopter and crashed into the Potomac River, claiming the lives of all 64 passengers and crew members on board. The Ronald Reagan Washington National Airport has suspended operations temporarily while rescue efforts continue, but reports indicate that no survivors have been found yet. Aerial images of the wreckage have surfaced on social media, showing the devastating impact of the collision.

The Federal Reserve has decided to leave interest rates unchanged as Fed Chair Jerome Powell stated that they will wait for more data on inflation and employment before making any further adjustments. This comes as the Trump administration prepares to make decisions on immigration, tariffs, taxes, and other economic areas. Despite some politicians calling for rate cuts, Powell maintains that the current policy stance is appropriate, while also acknowledging that inflation remains elevated. The Fed will continue to monitor economic developments to maintain low unemployment and 2% annual inflation.

In the first monetary policy review of 2025, the US Federal Reserve decided to maintain the key interest rates at 4.25-4.50 per cent, which was in line with market expectations. Fed Chairman Jerome Powell stated that the economy had made significant progress and that indicators suggested continued solid expansion. The US market initially showed a downward trend but later recovered as GDP predictions for 2024 exceeded 2%. The FOMC released a statement stating that risks to achieving employment and inflation goals are balanced, leading to a stable target range for federal funds rate.

As the Union Budget approaches, speculations are rife about possible changes in the taxation structure. According to reports, Finance Minister Nirmala Sitharaman may merge features from both the old and new tax regimes, leaving the new one as the only tax structure with reduced rates and zero concessions. This could result in the abolition of all 80C, 80D, and HRA deductions, including investments such as PPF, life insurance premiums and ELSS. Taxpayers may also be able to claim a deduction of Rs 5,000 for preventive health check-ups under 80D.

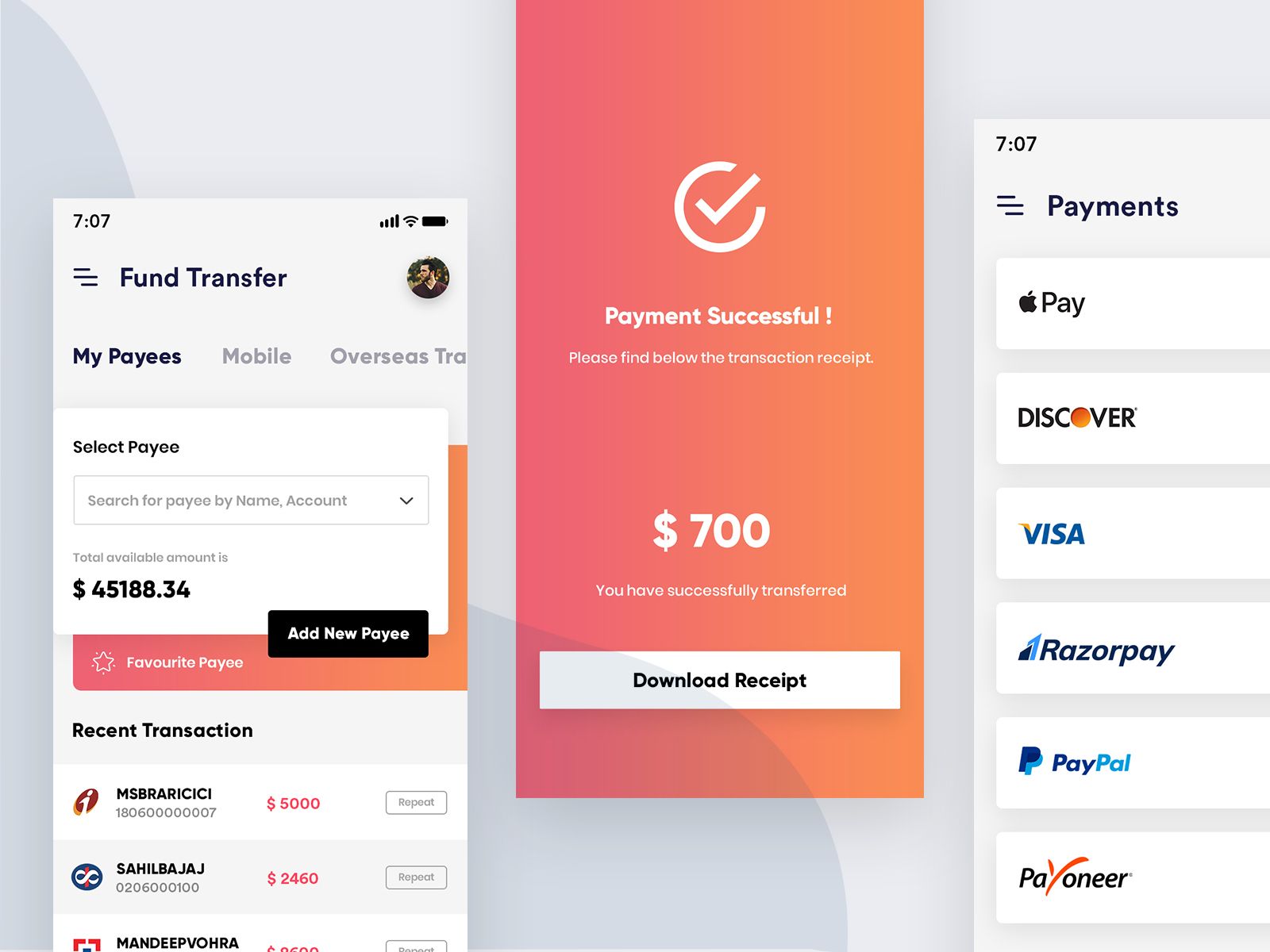

Visa, a leading credit card and digital payments company, announced its partnership with XMoney to launch the XMoney Account, allowing users to transfer funds instantly and securely to their X Wallet via Visa Direct. The feature will also be connected to the user's Visa debit card, enabling easy P2P payments. Additionally, users will have the option to transfer funds directly to their bank accounts. This partnership is another step towards X's goal of becoming an all-in-one app, similar to China's super app model.

With the Union Budget 2025 just around the corner, it's crucial to have a grasp of important budgetary terms. As Finance Minister Nirmala Sitharaman gears up to present the second full budget of Prime Minister Narendra Modi's third term, here's a comprehensive guide to key budgetary concepts. Stay informed and prepared for the unveiling on February 1.

The Digital News Publishers Association has applied to intervene in the copyright suit between Asian News International and OpenAI, over alleged unauthorized use of online news content. Justice Amit Bansal has issued notice on the intervention plea, but has cautioned against expanding the scope of the suit. The Court also criticized the publication of OpenAI's written submission in the media before the hearing. While OpenAI sought time to respond, its counsel has argued that DNPA does not have authorization to file such an application.

Australian brands are still selling children's nightwear made from synthetic fibres that pose fire hazards, despite nine recalls issued by the ACCC. Wool, the only naturally flame-resistant fibre, has been deemed the safest option, but weak laws and labelling requirements in Australia continue to put consumers at risk.

In a conversation with Rob Isbitts, investment expert Matthew Tuttle discusses the selfishness problem on Wall Street and how ETFs have solved it. They also explore the potential for levered and inverse ETFs, the value of active management in finding alpha, and the importance of hedges, edges, asymmetry, and themes in investing. Tune in to learn more about Tuttle's unique perspective on the market.

Anand Mahindra, the esteemed Indian business tycoon, has once again displayed his admiration for India's first armless archer, Sheetal Devi, by gifting her a customized Mahindra Scorpio-N. At only sixteen years old, Sheetal has made history by winning a bronze medal at the Paris Paralympics last year and has continued to impress at various competitions, including the Asian Para Games. Mahindra was struck by her extraordinary skill and determination, and was moved to gift her with a symbol of her identity as an archer. This act of kindness has once again brought attention to Sheetal's inspiring journey and serves as a reminder of the power of resilience and determination.