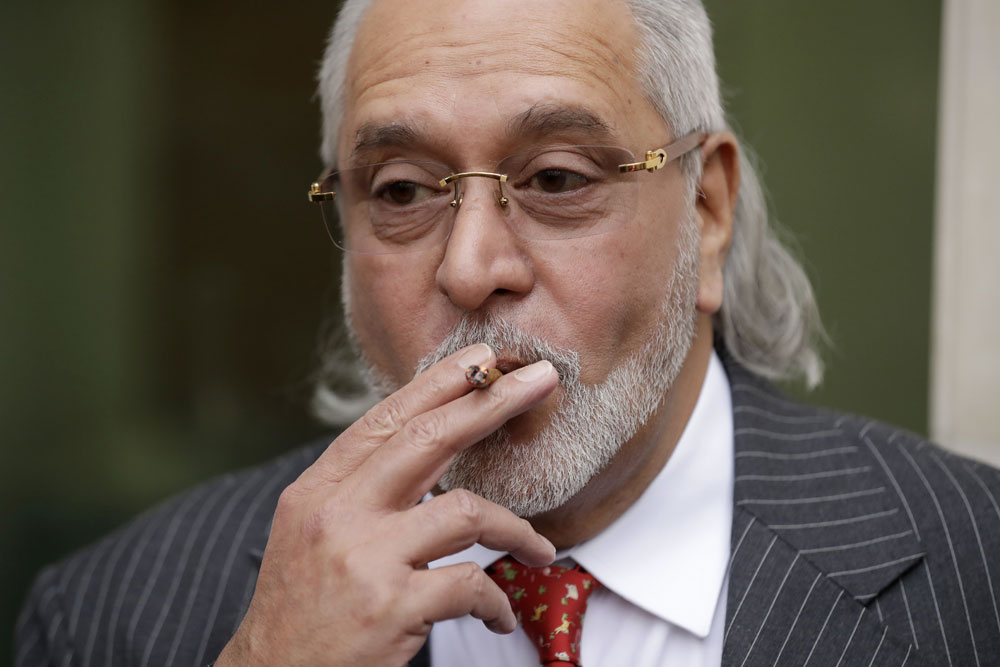

The business tycoon, Vijay Mallya, known as the 'King of Good Times', is finally facing the consequences of his actions. After losing an appeal in the UK Supreme Court against his extradition to India, all legal processes have now been completed for his return. The CBI and ED are already working on the extradition process and it is expected to be completed within the next 28 days. Mallya faces charges of fraud and money laundering worth Rs 9,000 crore and is accused of defrauding at least 17 Indian banks.

Vijay Mallya's Extradition to India: A Long-Awaited Resolution

Vijay Mallya, the flamboyant business tycoon and former owner of Kingfisher Airlines, is finally set to face the consequences of his alleged financial crimes. After a protracted legal battle, the UK Supreme Court has cleared the way for his extradition to India.

Background

Mallya is accused of defrauding Indian banks of over Rs 9,000 crore (approximately $1.2 billion) through his insolvent airline, Kingfisher Airlines. The Central Bureau of Investigation (CBI) and Enforcement Directorate (ED) have been pursuing his extradition since 2016.

Extradition Process

With the legal roadblocks cleared, the extradition process is expected to be completed within the next 28 days. The Indian government has appointed a team of officers to coordinate the extradition and ensure a smooth handover.

Charges and Allegations

Mallya faces charges of fraud, money laundering, and diversion of funds. The alleged financial irregularities led to the collapse of Kingfisher Airlines, leaving creditors, including banks and employees, with massive unpaid debts.

Top 5 FAQs and Answers

Links for Further Information

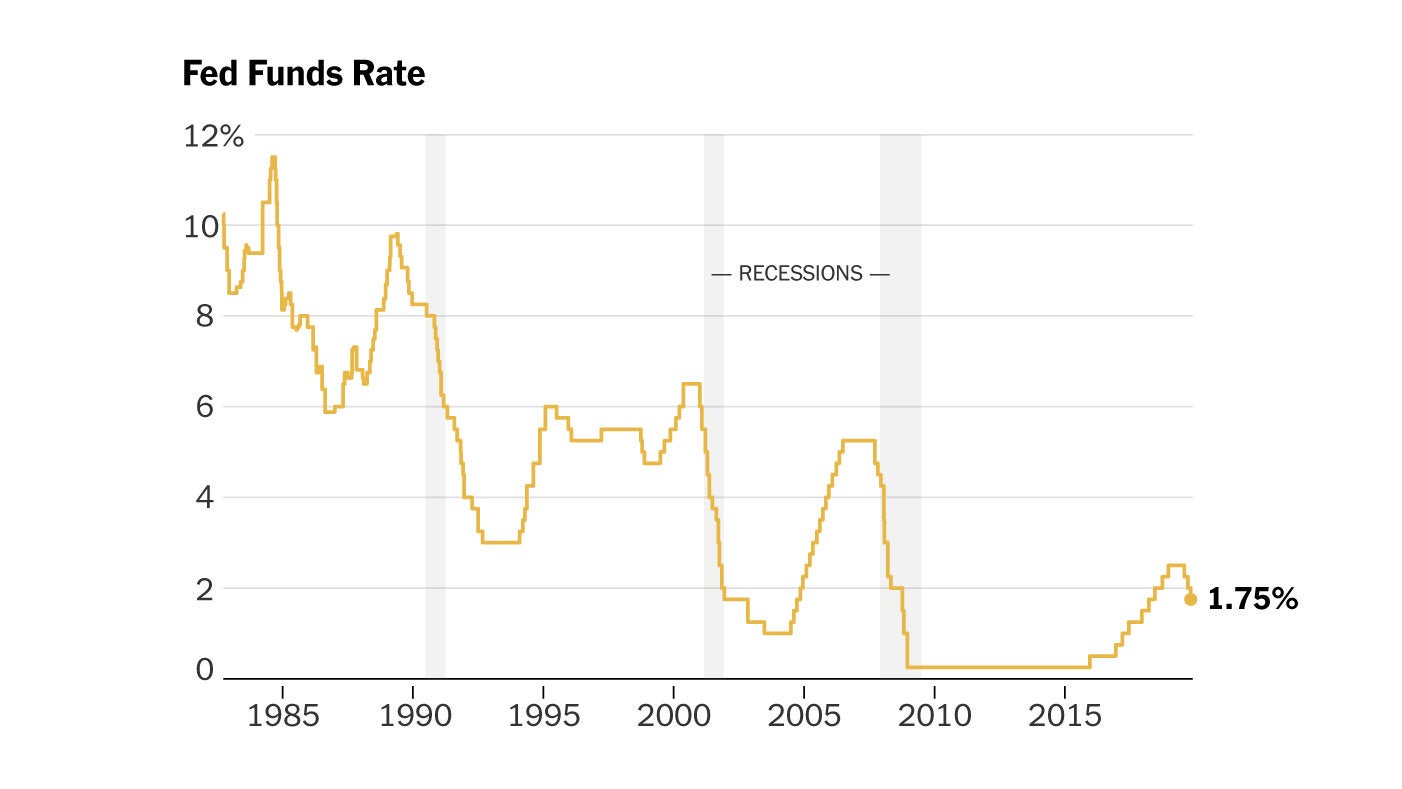

The US Federal Reserve announced a decision to cut key interest rates by 25 basis points, marking the third rate cut in three months. This move comes as the Fed attempts to keep the US economy strong and maintain a low unemployment rate. Despite the slight dip in US markets after the announcement, the Fed remains hopeful about the economy and has forecasted an increase in inflation for 2025.

On its debut in the stock market, Vishal Mega Mart's shares saw a premium of up to 43.5%, following strong demand for its IPO. With a stellar listing, experts predict the stock to see further gains in the long run, advising investors to hold onto it for potential 100% gains in the next 2-3 years. Prior to its listing, the company had raised Rs 2,400 crore from anchor investors, adding to the positive sentiment surrounding the stock. Keep an eye on all the latest stock market updates and news on Zeebiz.com.

The Federal Reserve has cut the federal funds rate by 0.25% and released the latest FOMC forecasts, showing expectations for fewer and slower interest rate cuts through 2027. Despite a solid labor market, the Fed has the flexibility to cut rates gradually given moderate inflation. The dot plot of median Fed member forecasts reveals a modest increase in interest rate projections for 2025, 2026, and 2027, with real GDP growth remaining positive and unemployment expected to improve slightly.

During the December meeting, Federal Reserve Chairman Jerome Powell announced a cut to the federal funds rate range and discussed the potential impact of tariffs on inflation in a post-meeting press conference. He emphasized that there are still many unknown factors regarding the scale and duration of tariffs and that it is premature to draw any conclusions. Powell also mentioned the need to consider both inflation and the labor market when making policy decisions, especially in light of potential changes.

Finance Minister Nirmala Sitharaman announced that properties worth Rs 22,280 crore have been restored to pay off the debts of wanted individuals such as Vijay Mallya, Mehul Choksi, and Nirav Modi. This includes Rs 1,052 crore from Modi and Rs 2,565 crore from Choksi. The Finance Minister's statement comes after questions were raised about the Enforcement Directorate's low conviction rate in cases under the Prevention of Money Laundering Act. Congress leader Randeep Surjewala has accused the ruling party of using agencies like the ED to target opposition leaders.

As the Indian stock market continues to rally, a number of companies are taking advantage by launching their Initial Public Offerings (IPOs). Among them are Mamata Machinery, who has opened its IPO with a price band of Rs 230-243. Other companies such as Transrail Lighting, Concord Enviro, ACME Solar, Mobikwik, Niva Bupa, Senores Pharma, Sterlite Power, and Zinka Logistics have also announced their IPOs with various price bands. These IPOs are expected to bring in a significant amount of capital, with some companies like ACME Solar raising Rs 2,900 crore through their IPO. Investors are eagerly watching these developments and expecting a positive outcome.

MobiKwik, a digital payment platform, made a remarkable stock market debut on Wednesday with a premium of 58.51% over its issue price. The company's growing adoption of digital payments and recent shift to profitability has boosted market confidence. However, analysts suggest investors should book profits given the high listing gains, while those holding should set a stop loss at Rs 400. MobiKwik has capitalized on the fintech sector's significant growth and offers flagship products such as MobiKwik ZIP, providing flexibility and easy repayment options for consumers.

Cleartrip, a leading online travel booking portal, has recently undergone a major app makeover to enhance user experience. Along with introducing new features such as in-app cancellations and automated rescheduling, Cleartrip also offers exciting discounts and offers to its users. With a focus on customer satisfaction, Cleartrip promises smooth and easy travel bookings for popular destinations like New York, Canada, Cape Town, and Maldives, and also offers train and bus bookings. Their "Similar offers from Other Stores" segment helps users find the best deals from other similar stores.

Karnataka, one of India's top innovation hubs, has launched a new policy specifically aimed at attracting and supporting global capability centers (GCCs) in the state. With a focus on AI, talent development, and creating a favorable business environment, the policy aims to establish 500 new GCCs by 2029, creating hundreds of thousands of jobs. The state also plans to expand GCC operations beyond the capital city of Bengaluru by building three new innovation districts in other cities. This ambitious initiative solidifies Karnataka's position as a leader in India's innovation ecosystem and is expected to have a significant impact on the state's economy.

The highly anticipated listing of Vishal Mega Mart IPO is finally happening on Wednesday, after the IPO received overwhelming demand and was oversubscribed 28.75 times. The current grey market premium for the unlisted shares reflects strong investor sentiment, but experts warn that GMP is not always a reliable indicator of listing performance. Investors who have applied for the IPO can now check their allotment status online through various portals.