Choosing a health insurance plan can be confusing, especially with the complex and unfamiliar terms often involved. This has been exacerbated by reports of insurance companies and agents withholding crucial information in order to meet sales targets. As a customer, it's important to understand that health insurance is not just a product being sold, but a crucial protection against financial ruin. This guide provides tips and explains key terms to help you make informed decisions when picking the right policy for your needs.

Choosing a health insurance plan can be a daunting task, especially given the overwhelming number of unfamiliar terms involved. Compounding the confusion, reports of unscrupulous practices by insurance companies and agents withholding crucial information have left consumers wary. It's essential to recognize that health insurance is not merely a commodity but a vital safeguard against financial disaster. This article aims to demystify key terms and provide guidance in selecting the best policy for your needs.

Health insurance has its roots in the early 20th century when employers sought ways to protect their workers from medical expenses. In the 1940s, the introduction of employer-sponsored group plans transformed the industry, leading to widespread health insurance coverage. However, concerns about rising healthcare costs, inadequate coverage, and lack of portability sparked reforms over the decades.

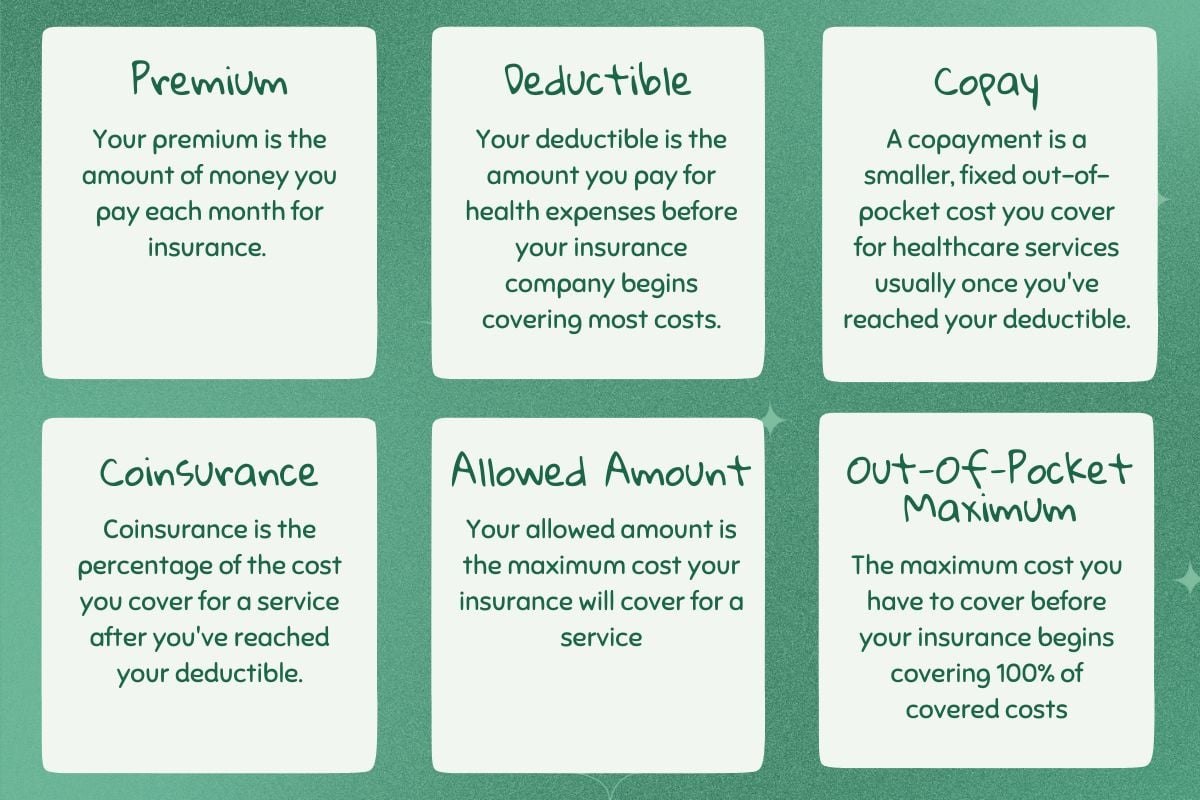

Deductible: The amount you pay out-of-pocket before insurance coverage kicks in.

Premium: The monthly or annual payment you make to maintain your insurance coverage.

Copayment: A fixed amount you must pay for specific medical services, such as doctor's visits or prescription drugs.

Coinsurance: A percentage of the cost of a medical service you are responsible for after meeting your deductible.

Out-of-Pocket Maximum: The maximum amount you pay for covered healthcare expenses before insurance covers the full cost.

1. Why do insurance companies withhold crucial information?

Insurance companies may prioritize sales targets over providing comprehensive information to customers. However, ethical companies prioritize transparency and informed consent.

2. What are some common red flags to watch out for?

3. How can I compare health insurance plans effectively?

Use comparison websites or consult with an insurance broker. Consider factors such as premiums, deductibles, copays, and coverage.

4. What is the Affordable Care Act (ACA)?

Commonly known as Obamacare, the ACA is a healthcare reform law that expanded health insurance coverage to millions of Americans. It also introduced consumer protections and financial assistance programs.

5. Is it possible to get health insurance without an employer?

Yes, individuals can purchase health insurance through the ACA Marketplace or private plans. However, premiums may be higher than employer-sponsored plans.

Choosing a health insurance plan is a crucial decision that requires careful consideration. By understanding the key terms involved and being aware of potential red flags, you can make informed choices that protect your health and financial well-being. Remember, health insurance is not just a product but a vital investment in your future.

The Telangana Southern Power Distribution Company Limited (TGSPDCL) has introduced "Currentolla Praja Baata" in Nalgonda, Medak, Mahabubnagar, Ranga Reddy, and Hyderabad, aimed at enhancing power distribution in the region. Led by CMD Musharraf Faruqui, the initiative will involve over 9,500 employees who will personally visit different areas to interact with consumers and address complaints. This program hopes to minimize power losses, strengthen the network, and improve the quality and reliability of power supply in Telangana.

A new Randstad India report reveals insights about India's youngest workforce cohort and their expectations for their careers. Gen Z prioritizes financial security, flexibility, and a sense of purpose in their job, requiring employers to go beyond just providing a decent salary. With a preference for a combination of a full-time job and a side hustle, Gen Z's mobility is driven by the pursuit of growth, making it crucial for employers to invest in continuous learning and foster inclusive cultures to retain this transformative generation.

According to Randstad India's latest report, young professionals in India are redefining workplace norms by prioritizing factors like pay, flexibility, and personal values. The report also reveals that Gen Z values continuous learning through AI tools and is more concerned about the impact of AI on job security. This calls for businesses to adapt to changing preferences and attract the next generation of talent by offering a mix of technical excellence and personal autonomy. The findings also emphasize the need for inclusive cultures and flexible policies in order to build resilient, future-ready businesses.

With the Gen-Z workforce making up about 27% of India's population, companies are struggling to retain this energetic cohort. A recent report by Randstad highlights the need for a change in mindset from employers towards the Gen-Zs. While they have long-term aspirations, they are also quick to move on to new opportunities if they feel undervalued or underpaid. This poses a challenge for employers who must find ways to keep this ambitious and driven generation engaged and progressing within their organizations.

Union Home Minister and Minister of Cooperation, Amit Shah, congratulated Amul and Indian Farmers Fertiliser Cooperative Limited (IFFCO) for securing the first and second ranks in the global ranking for cooperatives. This achievement is a testament to the boundless potential of cooperatives, which are being transformed into a global model of empowerment and self-reliance by Prime Minister Narendra Modi. The dairy sector, which is the backbone of rural livelihoods in India, has combined farmer-led cooperatives, women's participation and scientific practices to achieve remarkable progress. Additionally, the National Co-operative Exports Limited, set up by the government, has achieved a significant milestone in exporting agricultural commodities.

After purchasing his retirement property in Swansea, David Barlow has been forced to live in a motorhome on his driveway due to persistent damp and mould issues. Despite complaints to his property managers, the issue has not been resolved and Barlow fears for his belongings. The problem is believed to have been caused by faulty insulation installed by British Gas, but the company denies responsibility. This situation has put a hold on Barlow's retirement plans and has left him feeling frustrated and stuck.

US-based private equity firm Tillman Global Holdings (TGH) is reportedly in advanced discussions to invest up to $6 billion in Vodafone Idea Ltd, which could lead to a change in operational control. However, the investment is contingent on the Indian government providing comprehensive relief covering AGR and spectrum payment dues. If the deal goes through, it could dilute existing promoter holdings, including those held by Aditya Birla Group and Vodafone Plc. While the news has boosted investor sentiment, analysts caution that government approval and debt restructuring clarity are key to the execution of the deal.

The Indian real estate market is undergoing a major shift with rising home prices, as apartments priced between Rs 2 crore and Rs 5 crore now dominate sales. This change has been highlighted by a Redditor who expressed concerns over the dwindling chances of middle-class buyers to afford a house. According to a Moneycontrol report, the trend is a result of big developers focusing more on luxury projects, leaving affordable housing in the backseat. As a result, home ownership for the middle-class seems like a distant dream, with even government employees struggling to afford these expensive properties.

Vodafone Idea's share price saw a significant increase of 14% after the Supreme Court provided further clarity on the AGR dues issue. The court clarified that the government can consider providing relief for both additional and reassessed AGR dues, giving some respite to the struggling telecom operator. At the time of writing, Vodafone Idea's share price was trading at Rs 9.51, with a gain of 8.93%. This comes after the court's previous hearing which did not provide a clear ruling on whether the relief applies to only Vodafone Idea's plea or the entire pending AGR amount of nearly Rs 80,000 crore.

After failing to meet Apple's internal sales expectations, the ultra-thin iPhone Air is facing a significant production cut of 80%. The initial prediction of reducing production by one million units has now been deemed insufficient, highlighting deeper concerns about the device's market performance. This setback raises questions about the competitive landscape of high-end smartphones and hints at Apple's next possible move towards a foldable iPhone.